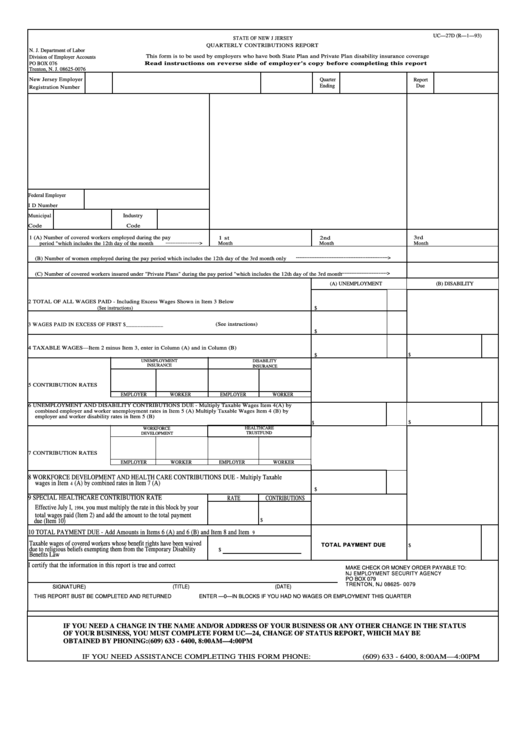

Form Uc-27d - Quarterly Contributions Report- State Of New Jersey

ADVERTISEMENT

UC—27D (R—1—93)

STATE OF NEW J JERSEY

QUARTERLY CONTRIBUTIONS REPORT

N. J. Department of Labor

This form is to be used by employers who have both State Plan and Private Plan disability insurance coverage

Division of Employer Accounts

PO BOX 076

Read instructions on reverse side of employer's copy before completing this report

Trenton, N. J. 08625-0076

New Jersey Employer

Quarter

Report

Ending

Due

Registration Number

Federal Employer

I D Number

Municipal

Industry

Code

Code

1 (A) Number of covered workers employed during the pay

1 st

2nd

3rd

-------------------->

period "which includes the 12th day of the month

Month

Month

Month

------------------------------------------------------>

(B) Number of women employed during the pay period which includes the 12th day of the 3rd month only

--------------------------->

(C) Number of covered workers insured under "Private Plans" during the pay period "which includes the 12th day of the 3rd month

(A) UNEMPLOYMENT

(B) DISABILITY

2 TOTAL OF ALL WAGES PAID - Including Excess Wages Shown in Item 3 Below

(See instructions)

$

(See instructions)

3 WAGES PAID IN EXCESS OF FIRST $_____________

$

4 TAXABLE WAGES—Item 2 minus Item 3, enter in Column (A) and in Column (B)

$

$

UNEMPLOYMENT

DISABILITY

INSURANCE

INSURANCE

5 CONTRIBUTION RATES

EMPLOYER

WORKER

EMPLOYER

WORKER

6 UNEMPLOYMENT AND DISABILITY CONTRIBUTIONS DUE - Multiply Taxable Wages Item 4(A) by

combined employer and worker unemployment rates in Item 5 (A) Multiply Taxable Wages Item 4 (B) by

employer and worker disability rates in Item 5 (B)

$

$

HEALTHCARE

WORKFORCE

TRUSTFUND

DEVELOPMENT

7 CONTRIBUTION RATES

EMPLOYER

WORKER

EMPLOYER

WORKER

8 WORKFORCE DEVELOPMENT AND HEALTH CARE CONTRIBUTIONS DUE - Multiply Taxable

wages in Item

(A) by combined rates in Item 7 (A)

4

$

9 SPECIAL HEALTHCARE CONTRIBUTION RATE

RATE

CONTRIBUTIONS

Effective July I,

you must multiply the rate in this block by your

1994,

total wages paid (Item 2) and add the amount to the total payment

$

due (Item 10)

10 TOTAL PAYMENT DUE - Add Amounts in Items 6 (A) and 6 (B) and Item 8 and Item

9

Taxable wages of covered workers whose benefit rights have been waived

TOTAL PAYMENT DUE

$

due to religious beliefs exempting them from the Temporary Disability

$

Benefits Law

I certify that the information in this report is true and correct

MAKE CHECK OR MONEY ORDER PAYABLE TO:

NJ EMPLOYMENT SECURITY AGENCY

PO BOX 079

TRENTON, NJ 08625- 0079

(TITLE)

(DATE)

SIGNATURE)

THIS REPORT BUST BE COMPLETED AND RETURNED

ENTER —0—IN BLOCKS IF YOU HAD NO WAGES OR EMPLOYMENT THIS QUARTER

IF YOU NEED A CHANGE IN THE NAME AND/OR ADDRESS OF YOUR BUSINESS OR ANY OTHER CHANGE IN THE STATUS

OF YOUR BUSINESS, YOU MUST COMPLETE FORM UC—24, CHANGE OF STATUS REPORT, WHICH MAY BE

OBTAINED BY PHONING:(609) 633 - 6400, 8:00AM—4:00PM

IF YOU NEED ASSISTANCE COMPLETING THIS FORM PHONE:

(609) 633 - 6400, 8:00AM—4:00PM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1