Form De 8721 - Work Opportunity Tax Credit (Wotc) - Information Sheet

ADVERTISEMENT

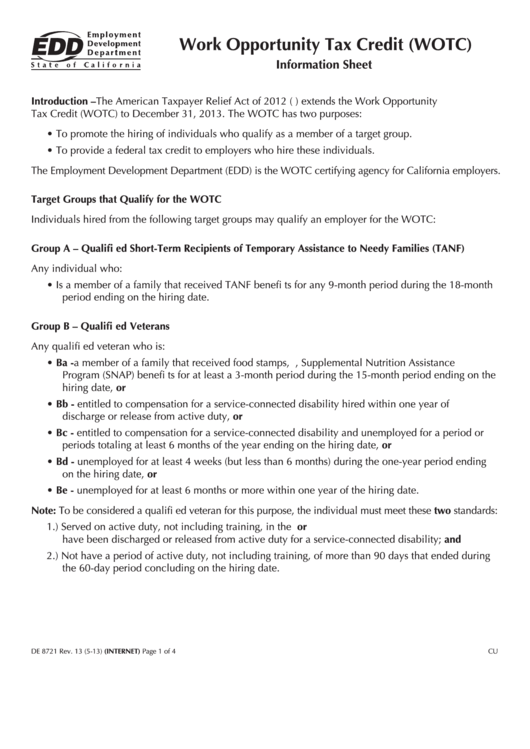

Work Opportunity Tax Credit (WOTC)

Information Sheet

Introduction – The American Taxpayer Relief Act of 2012 (P.L. 112-240) extends the Work Opportunity

Tax Credit (WOTC) to December 31, 2013. The WOTC has two purposes:

• To promote the hiring of individuals who qualify as a member of a target group.

• To provide a federal tax credit to employers who hire these individuals.

The Employment Development Department (EDD) is the WOTC certifying agency for California employers.

Target Groups that Qualify for the WOTC

Individuals hired from the following target groups may qualify an employer for the WOTC:

Group A – Qualifi ed Short-Term Recipients of Temporary Assistance to Needy Families (TANF)

Any individual who:

• Is a member of a family that received TANF benefi ts for any 9-month period during the 18-month

period ending on the hiring date.

Group B – Qualifi ed Veterans

Any qualifi ed veteran who is:

• Ba - a member of a family that received food stamps, i.e., Supplemental Nutrition Assistance

Program (SNAP) benefi ts for at least a 3-month period during the 15-month period ending on the

hiring date, or

• Bb - entitled to compensation for a service-connected disability hired within one year of

discharge or release from active duty, or

• Bc - entitled to compensation for a service-connected disability and unemployed for a period or

periods totaling at least 6 months of the year ending on the hiring date, or

• Bd - unemployed for at least 4 weeks (but less than 6 months) during the one-year period ending

on the hiring date, or

• Be - unemployed for at least 6 months or more within one year of the hiring date.

Note: To be considered a qualifi ed veteran for this purpose, the individual must meet these two standards:

1.) Served on active duty, not including training, in the U.S. Armed Forces for more than 180 days or

have been discharged or released from active duty for a service-connected disability; and

2.) Not have a period of active duty, not including training, of more than 90 days that ended during

the 60-day period concluding on the hiring date.

DE 8721 Rev. 13 (5-13) (INTERNET)

Page 1 of 4

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4