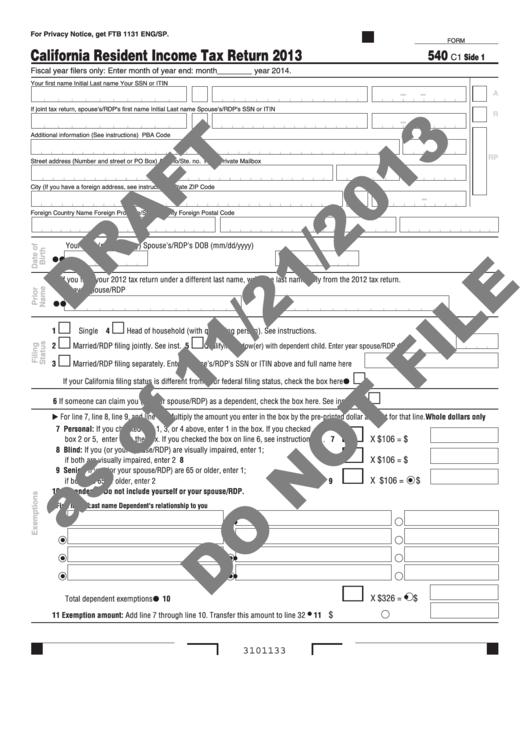

Form 540 C1 Draft - California Resident Income Tax Return - 2013

ADVERTISEMENT

For Privacy Notice, get FTB 1131 ENG/SP.

FORM

California Resident Income Tax Return 2013

540

C1 Side 1

Fiscal year filers only: Enter month of year end: month________ year 2014.

Your first name

Initial Last name

Your SSN or ITIN

A

If joint tax return, spouse's/RDP's first name

Initial Last name

Spouse's/RDP's SSN or ITIN

R

Additional information (See instructions)

PBA Code

RP

Street address (Number and street or PO Box)

Apt. no/Ste. no.

PMB/Private Mailbox

City (If you have a foreign address, see instructions)

State

ZIP Code

Foreign Country Name

Foreign Province/State/County

Foreign Postal Code

Your DOB (mm/dd/yyyy)

Spouse's/RDP's DOB (mm/dd/yyyy)

If you filed your 2012 tax return under a different last name, write the last name only from the 2012 tax return.

Taxpayer

Spouse/RDP

m

m

1

Single

4

Head of household (with qualifying person). See instructions.

m

m

2

Married/RDP filing jointly. See inst.

5

Qualifying widow(er) with dependent child. Enter year spouse/RDP died

m

3

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here

m

If your California filing status is different from your federal filing status, check the box here . . . . . . . . . .

m

6 If someone can claim you (or your spouse/RDP) as a dependent, check the box here. See inst.. . . . . . . .

6

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line.

Whole dollars only

m

7 Personal: If you checked box 1, 3, or 4 above, enter 1 in the box. If you checked

X $106 =

$

box 2 or 5, enter 2, in the box. If you checked the box on line 6, see instructions. . . . 7

m

8 Blind: If you (or your spouse/RDP) are visually impaired, enter 1;

X $106 =

$

if both are visually impaired, enter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

m

9 Senior: If you (or your spouse/RDP) are 65 or older, enter 1;

X $106 = $

if both are 65 or older, enter 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Dependents: Do not include yourself or your spouse/RDP.

First name

Last name

Dependent's relationship to you

m

X $326 = $

Total dependent exemptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

$

11 Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 . . . . . . . . . . . . . . . . . . .

11

3101133

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5