Instructions For Form 8892 - Individual Income Tax Return

ADVERTISEMENT

2

Form 8892 (1-2005)

Page

General Instructions

8892 to send in your tax payment. If you

Next Day 12:00 pm, DHL Next Day 3:00

do not pay the gift tax by the original

pm, and DHL 2nd Day Service.

Purpose of Form

● Federal Express (FedEx): FedEx

due date of the return (generally, April

15), you will be charged interest and

Priority Overnight, FedEx Standard

Use Form 8892 for the following

may be charged penalties.

Overnight, FedEx 2Day, FedEx

purposes:

These same rules apply if you file

International Priority, and FedEx

● To make a payment of gift tax when

International First.

Form 2350, Application for Extension of

you are applying for an extension of time

● United Parcel Service (UPS): UPS

Time To File U.S. Income Tax Return,

to file Form 709 (including payment of

rather than Form 4868.

Next Day Air, UPS Next Day Air Saver,

any generation-skipping transfer (GST)

You can use the table at the bottom

UPS 2nd Day Air, UPS 2nd Day Air

tax from Form 709), and

of this page to determine whether to file

A.M., UPS Worldwide Express Plus, and

● To request an extension of time to file

Form 8892.

UPS Worldwide Express.

Form 709, when you are not applying for

The private delivery service can tell

When To File

an extension of time to file Form 1040.

you how to get written proof of the

Paying tax. If you are filing Form 8892

mailing date.

Form 8892 cannot be used for

to pay gift tax, file by the due date for

joint filings and can only be

How To Complete the Form

Form 709. Generally, this is April 15. See

filed by an individual taxpayer.

the Instructions for Form 709 for

If both you and your spouse

If you are applying for an extension of

CAUTION

exceptions. If the due date falls on a

need to file Form 8892, use separate

time to file your income and gift tax

Saturday, Sunday, or legal holiday, you

forms and mail the forms in separate

returns by using Form 4868 and need to

can file the return on the next business

envelopes.

make a payment of gift tax, complete

day.

Parts I and II only and sign the form.

Who Must File

If you are filing Form 8892 to request

Extensions of time to file. File Form

Extending the time to file Form 709.

an extension of time to file your gift tax

8892 by the regular due date (or the

Previously, certain Form 709 extensions

return, complete Parts I and III, sign the

extended due date if a previous

were requested by letter. Form 8892

form, and complete the Return Label in

extension was granted) of Form 709.

replaces the use of a letter. You must

the Notice to Applicant. If you are

However, to avoid a possible late filing

use Form 8892 to request an extension

making a payment along with the

penalty in case your request for an

of time to file Form 709 in either of the

extension request, also complete Part II.

extension is not granted, you should file

following situations:

Form 8892 early enough to allow the IRS

Filing Form 709

● You are not applying for an extension

to consider your application and reply

You may file Form 709 any time before

before the Form 709 regular or extended

of time to file your individual income tax

the extension expires. But remember,

due date.

return (Form 1040), or

Form 8892 does not extend the time to

● You have already obtained a 4-month

Unless the donor has died, do not file

pay taxes. If you do not pay the amount

this form before January 1 of the year

extension on Form 4868, Application for

due by the original due date, you will

following the year of the gift tax return. The

Automatic Extension of Time To File

owe interest. You may also be charged

form cannot be processed before then.

U.S. Individual Income Tax Return, and

penalties.

need an additional extension only for

Where To File

Interest. You will owe interest on any

Form 709. In this case, use Form 8892

If you live in the United States, file Form

tax not paid by the original due date of

to request an additional extension for

8892 at the following address:

your return even if you had a good

Form 709. (But, if you obtain an

reason for not paying on time. The

Internal Revenue Service Center

additional Form 1040 extension with

Cincinnati, OH 45999

interest runs until you pay the tax.

Form 2688, Application for Additional

Extension of Time To File U.S. Individual

If you live in a foreign country, U.S.

Penalties. The late payment penalty is

Income Tax Return, that will also give

possession, or have an APO or FPO

usually

1

⁄

of 1% of any tax not paid by

2

you an additional extension for Form 709

address, file Form 8892 at the following

the regular due date. It is charged for

and you do not need to use Form 8892.)

address:

each month or part of a month the tax is

unpaid. The maximum penalty is 25%.

Paying gift tax. An extension of time to

Internal Revenue Service Center

file your Form 709 does not extend the

You might not owe the penalty if you

Philadelphia, PA 19255

time to pay the gift tax.

had reasonable cause for paying late.

Private delivery services. You can use

Attach a statement to your Form 709,

If you file Form 4868 by the regular

certain private delivery services

not Form 8892, explaining the reason.

due date of your income tax return, you

designated by the IRS to meet the

will automatically be given a 4-month

“timely mailing as timely filing/paying”

Late filing penalty. A penalty is usually

extension of time to file your Form 709.

rule for tax returns and payments. These

charged if your return is filed after the

You do not need to do anything else to

private delivery services include only the

due date (including extensions). It is

receive the extension of time to file your

following.

usually 5% of the tax not paid by the

Form 709.

● DHL Express (DHL): DHL Same Day

original due date for each month or part

However, if you also expect to owe

of a month your return is late. The

Service, DHL Next Day 10:30 am, DHL

gift and/or GST tax, you must use Form

maximum penalty is 25%. You might not

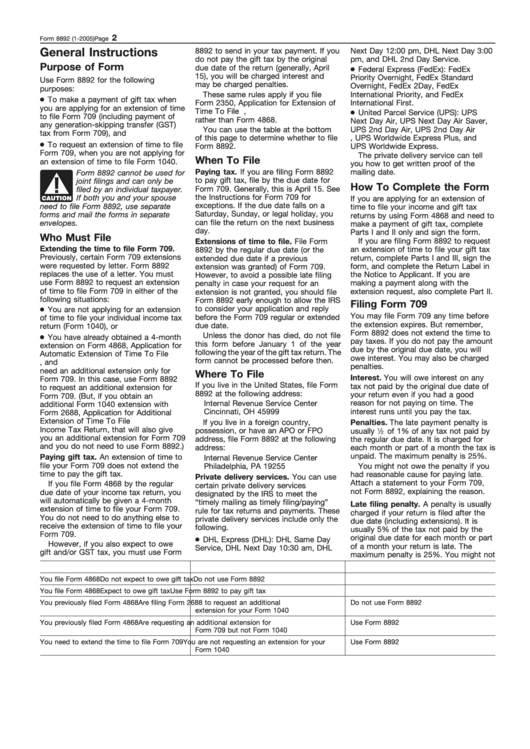

IF...

AND...

THEN...

You file Form 4868

Do not expect to owe gift tax

Do not use Form 8892

You file Form 4868

Expect to owe gift tax

Use Form 8892 to pay gift tax

You previously filed Form 4868

Are filing Form 2688 to request an additional

Do not use Form 8892

extension for your Form 1040

You previously filed Form 4868

Are requesting an additional extension for

Use Form 8892

Form 709 but not Form 1040

You need to extend the time to file Form 709

You are not requesting an extension for your

Use Form 8892

Form 1040

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2