Instructions On Completion Of Form Ssa-7011-F4

ADVERTISEMENT

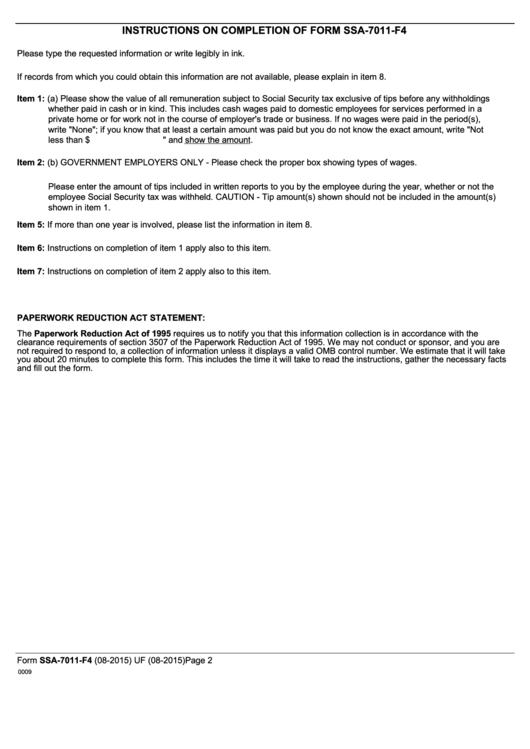

INSTRUCTIONS ON COMPLETION OF FORM SSA-7011-F4

Please type the requested information or write legibly in ink.

If records from which you could obtain this information are not available, please explain in item 8.

Item 1: (a) Please show the value of all remuneration subject to Social Security tax exclusive of tips before any withholdings

whether paid in cash or in kind. This includes cash wages paid to domestic employees for services performed in a

private home or for work not in the course of employer's trade or business. If no wages were paid in the period(s),

write "None"; if you know that at least a certain amount was paid but you do not know the exact amount, write "Not

less than $

" and show the amount.

Item 2: (b) GOVERNMENT EMPLOYERS ONLY - Please check the proper box showing types of wages.

Please enter the amount of tips included in written reports to you by the employee during the year, whether or not the

employee Social Security tax was withheld. CAUTION - Tip amount(s) shown should not be included in the amount(s)

shown in item 1.

Item 5: If more than one year is involved, please list the information in item 8.

Item 6: Instructions on completion of item 1 apply also to this item.

Item 7: Instructions on completion of item 2 apply also to this item.

PAPERWORK REDUCTION ACT STATEMENT:

The Paperwork Reduction Act of 1995 requires us to notify you that this information collection is in accordance with the

clearance requirements of section 3507 of the Paperwork Reduction Act of 1995. We may not conduct or sponsor, and you are

not required to respond to, a collection of information unless it displays a valid OMB control number. We estimate that it will take

you about 20 minutes to complete this form. This includes the time it will take to read the instructions, gather the necessary facts

and fill out the form.

Form SSA-7011-F4 (08-2015) UF (08-2015)

Page 2

0009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1