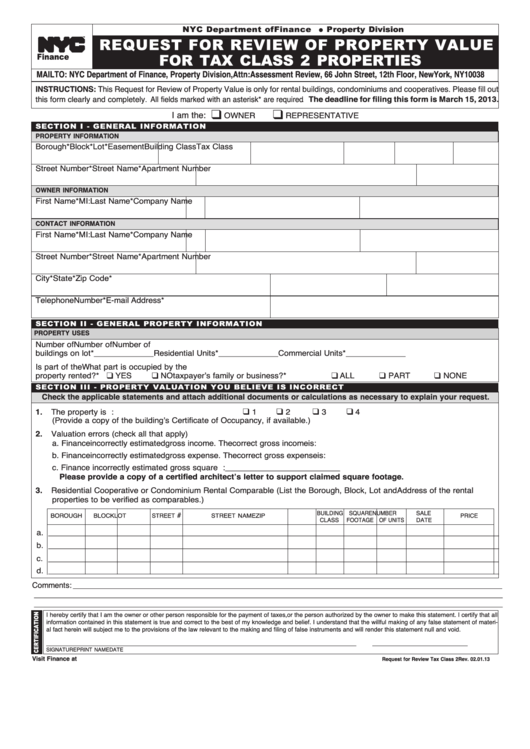

Form Request For Review Of Property Value For Tax Class 2 Properties

ADVERTISEMENT

NYC Department of Finance

Property Division

REQUEST FOR REVIEW OF PROPERTY VALUE

G

TM

FOR TAX CLASS 2 PROPERTIES

Finance

MAIL TO: NYC Department of Finance, Property Division, Attn: Assessment Review, 66 John Street, 12th Floor, New York, NY 10038

INSTRUCTIONS: This Request for Review of Property Value is only for rental buildings, condominiums and cooperatives. Please fill out

this form clearly and completely. All fields marked with an asterisk* are required. The deadline for filing this form is March 15, 2013.

I am the:

K

K

OWNER

REPRESENTATIVE

SECTION I - GENERAL INFORMATION

PROPERTY INFORMATION

Borough*

Block*

Lot*

Easement

Building Class Tax Class

Street Number*

Street Name*

Apartment Number

OWNER INFORMATION

First Name*

MI:

Last Name*

Company Name

CONTACT INFORMATION

First Name*

MI:

Last Name*

Company Name

Street Number*

Street Name*

Apartment Number

City*

State*

Zip Code*

Telephone Number*

E-mail Address*

SECTION II - GENERAL PROPERTY INFORMATION

PROPERTY USES

Number of

Number of

Number of

buildings on lot*_____________

Residential Units*_____________

Commercial Units*_____________

Is part of the

What part is occupied by the

property rented?*

YES

NO

taxpayerʼs family or business?*

ALL

PART

NONE

K

K

K

K

K

SECTION III - PROPERTY VALUATION YOU BELIEVE IS INCORRECT

Check the applicable statements and attach additional documents or calculations as necessary to explain your request.

1.

The property is misclassified. The correct class is:

1

2

3

4

K

K

K

K

(Provide a copy of the buildingʼs Certificate of Occupancy, if available.)

2.

Valuation errors (check all that apply)

a. Finance incorrectly estimated gross income. The correct gross income is:

............ _________________________

b. Finance incorrectly estimated gross expense. The correct gross expense is: ............ _________________________

c. Finance incorrectly estimated gross square footage. The correct square footage is: _________________________

Please provide a copy of a certified architectʼs letter to support claimed square footage.

3.

Residential Cooperative or Condominium Rental Comparable (List the Borough, Block, Lot and Address of the rental

properties to be verified as comparables.)

#

BUILDING SQUARE

NUMBER

SALE

BOROUGH

BLOCK

LOT

STREET

STREET NAME

ZIP

PRICE

CLASS

FOOTAGE OF UNITS

DATE

a. __________________________________________________________________________________________________

b. __________________________________________________________________________________________________

c. __________________________________________________________________________________________________

d. __________________________________________________________________________________________________

Comments: __________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

I hereby certify that I am the owner or other person responsible for the payment of taxes,or the person authorized by the owner to make this statement. I certify that all

information contained in this statement is true and correct to the best of my knowledge and belief. I understand that the willful making of any false statement of materi-

al fact herein will subject me to the provisions of the law relevant to the making and filing of false instruments and will render this statement null and void.

______________________________________________

_____________________________________________

____________________________

SIGNATURE

PRINT NAME

DATE

Visit Finance at nyc.gov/finance

Request for Review Tax Class 2

Rev. 02.01.13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2