2008 Individual Extension Request Form

ADVERTISEMENT

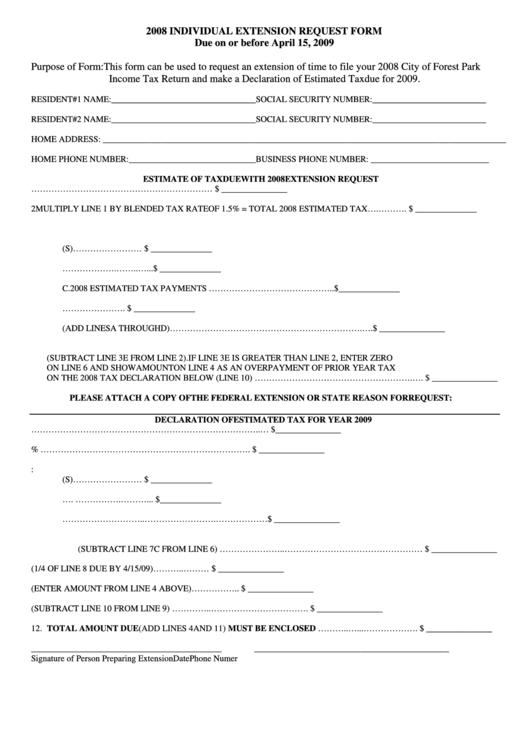

2008 INDIVIDUAL EXTENSION REQUEST FORM

Due on or before April 15, 2009

Purpose of Form: This form can be used to request an extension of time to file your 2008 City of Forest Park

Income Tax Return and make a Declaration of Estimated Tax due for 2009.

RESIDENT #1 NAME: _________________________________ SOCIAL SECURITY NUMBER:__________________________

RESIDENT #2 NAME: _________________________________ SOCIAL SECURITY NUMBER:__________________________

HOME ADDRESS: ___________________________________________________________________________________________

HOME PHONE NUMBER: _____________________________ BUSINESS PHONE NUMBER: ___________________________

ESTIMATE OF TAX DUE WITH 2008 EXTENSION REQUEST

1.

TOTAL ESTIMATED FOREST PARK 2008 INCOME……………………………………………………… $ _______________

2

MULTIPLY LINE 1 BY BLENDED TAX RATE OF 1.5% = TOTAL 2008 ESTIMATED TAX….………. $ ______________

3.

ESTIMATED TAX PAYMENTS AND CREDITS

A. FOREST PARK TAX WITHHELD BY EMPLOYER(S)…………………… $ ______________

B. ESTIMATED CREDIT FOR OTHER CITY TAX ……………….……..…... $ ______________

C. 2008 ESTIMATED TAX PAYMENTS …………………………………….. $ ______________

D. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR …………………. $ ______________

E. TOTAL (ADD LINES A THROUGH D)………………………………………………………….…. $ _______________

4.

TOTAL ESTIMATED TAX DUE AND PAYABLE WITH THIS EXTENSION REQUEST

(SUBTRACT LINE 3E FROM LINE 2). IF LINE 3E IS GREATER THAN LINE 2, ENTER ZERO

ON LINE 6 AND SHOW AMOUNT ON LINE 4 AS AN OVERPAYMENT OF PRIOR YEAR TAX

ON THE 2008 TAX DECLARATION BELOW (LINE 10) ……………………………………………….…. $ _______________

PLEASE ATTACH A COPY OF THE FEDERAL EXTENSION OR STATE REASON FOR REQUEST:

DECLARATION OF ESTIMATED TAX FOR YEAR 2009

5.

TOTAL ESTIMATED 2009 INCOME ……………………………………………………………………..… $ _______________

6.

MULTIPLY LINE 5 BY TAX RATE OF 1.5% ………………………………………………………………. $ _______________

7.

ESTIMATED PAYMENTS AND CREDITS:

A. FOREST PARK TAX WITHHELD BY EMPLOYER(S)…………………… $ ______________

B. ESTIMATED CREDIT FOR OTHER CITY TAX …. …………….………... $ ______________

C. TOTAL 2009 ESTIMATED CREDITS ………………………..…………………….……………… $ _______________

8.

TOTAL ESTIMATED TAX DUE AND PAYABLE TO FOREST PARK DURING 2009

(SUBTRACT LINE 7C FROM LINE 6) …………………..………………………………………… $ _______________

9.

AMOUNT TO BE PAID WITH THIS DECLARATION (1/4 OF LINE 8 DUE BY 4/15/09)………..……… $ _______________

10. TAX DUE OR OVERPAYMENT FROM 2008 (ENTER AMOUNT FROM LINE 4 ABOVE)…………….. $ _______________

11. AMOUNT DUE FOR 2009 (SUBTRACT LINE 10 FROM LINE 9) …………..……………………………. $ _______________

12. TOTAL AMOUNT DUE (ADD LINES 4 AND 11) MUST BE ENCLOSED ………..…...………………. $ _______________

___________________________________________

_____________

_______________________________

Signature of Person Preparing Extension

Date

Phone Numer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1