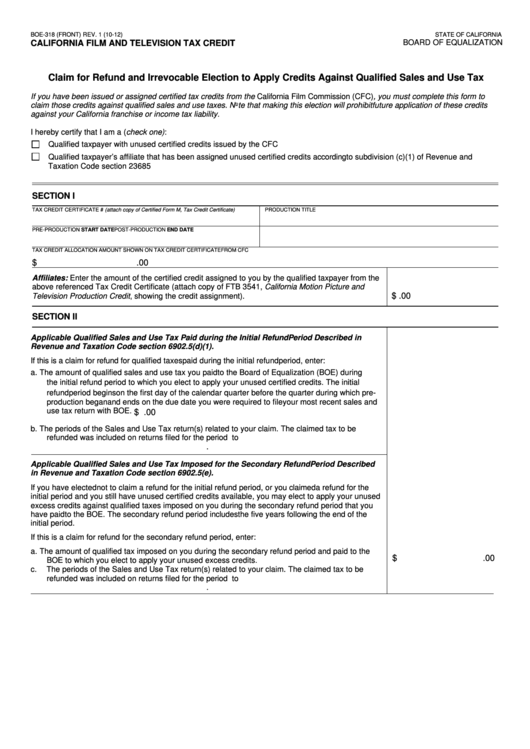

BOE-318 (FRONT) REV. 1 (10-12)

STATE OF CALIFORNIA

CALIFORNIA FILM AND TELEVISION TAX CREDIT

BOARD OF EQUALIZATION

Claim for Refund and Irrevocable Election to Apply Credits Against Qualified Sales and Use Tax

If you have been issued or assigned certified tax credits from the California Film Commission (CFC), you must complete this form to

claim those credits against qualified sales and use taxes. Note that making this election will prohibit future application of these credits

against your California franchise or income tax liability.

I hereby certify that I am a (check one):

Qualified taxpayer with unused certified credits issued by the CFC

Qualified taxpayer’s affiliate that has been assigned unused certified credits according to subdivision (c)(1) of Revenue and

Taxation Code section 23685

SECTION I

TAX CREDIT CERTIFICATE # (attach copy of Certified Form M, Tax Credit Certificate)

PRODUCTION TITLE

PRE-PRODUCTION START DATE

POST-PRODUCTION END DATE

TAX CREDIT ALLOCATION AMOUNT SHOWN ON TAX CREDIT CERTIFICATE FROM CFC

$

.00

Affiliates: Enter the amount of the certified credit assigned to you by the qualified taxpayer from the

above referenced Tax Credit Certificate (attach copy of FTB 3541, California Motion Picture and

$

.00

Television Production Credit, showing the credit assignment).

SECTION II

Applicable Qualified Sales and Use Tax Paid during the Initial Refund Period Described in

Revenue and Taxation Code section 6902.5(d)(1).

If this is a claim for refund for qualified taxes paid during the initial refund period, enter:

a.

The amount of qualified sales and use tax you paid to the Board of Equalization (BOE) during

the initial refund period to which you elect to apply your unused certified credits. The initial

refund period begins on the first day of the calendar quarter before the quarter during which pre-

production began and ends on the due date you were required to file your most recent sales and

use tax return with BOE.

$

.00

b.

The periods of the Sales and Use Tax return(s) related to your claim. The claimed tax to be

refunded was included on returns filed for the period

to

.

Applicable Qualified Sales and Use Tax Imposed for the Secondary Refund Period Described

in Revenue and Taxation Code section 6902.5(e).

If you have elected not to claim a refund for the initial refund period, or you claimed a refund for the

initial period and you still have unused certified credits available, you may elect to apply your unused

excess credits against qualified taxes imposed on you during the secondary refund period that you

have paid to the BOE. The secondary refund period includes the five years following the end of the

initial period.

If this is a claim for refund for the secondary refund period, enter:

a.

The amount of qualified tax imposed on you during the secondary refund period and paid to the

$

.00

BOE to which you elect to apply your unused excess credits.

c.

The periods of the Sales and Use Tax return(s) related to your claim. The claimed tax to be

refunded was included on returns filed for the period

to

.

1

1 2

2