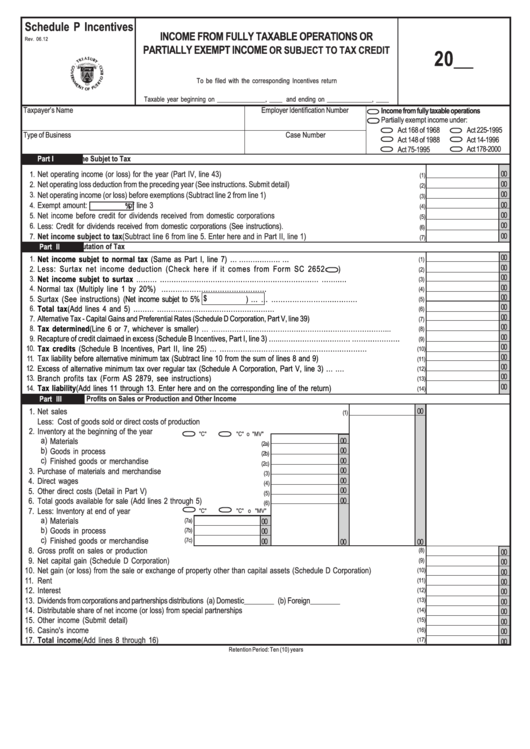

Schedule P Incentives - Income From Fully Taxable Operations Form

ADVERTISEMENT

Schedule P Incentives

INCOME FROM FULLY TAXABLE OPERATIONS OR

Rev. 06.12

PARTIALLY EXEMPT INCOME

OR SUBJECT TO TAX CREDIT

20__

To be filed with the corresponding Incentives return

Taxable year beginning on _______________, ____ and ending on ______________, ____

Taxpayer’s Name

Employer Identification Number

Income from fully taxable operations

Partially exempt income under:

Act 225-1995

Act 168 of 1968

Type of Business

Case Number

Act 148 of 1988

Act 14-1996

Act 75-1995

Act 178-2000

Part I

Net Income Subjet to Tax

1.

Net operating income (or loss) for the year (Part IV, line 43) .........................................................................................................

00

(1)

00

2.

Net operating loss deduction from the preceding year (See instructions. Submit detail) .....................................................................

(2)

00

3.

Net operating income (or loss) before exemptions (Subtract line 2 from line 1) .................................................................................

(3)

Exempt amount:

of line 3 .......................................................................................................................................

00

4.

%

(4)

Net income before credit for dividends received from domestic corporations ..........................................................................

00

5.

(5)

Less: Credit for dividends received from domestic corporations (See instructions). ...........................................................................

00

6.

(6)

00

7.

Net income subject to tax (Subtract line 6 from line 5. Enter here and in Part II, line 1) .........................................................

(7)

Part II

I

Computation of Tax

00

1.

Net income subjet to normal tax (Same as Part I, line 7) …................………………......…...............................................

(1)

00

2.

Less: Surtax net income deduction (Check here if it comes from Form SC 2652

) ..............................

(2)

00

3.

Net income subjet to surtax ..............................………....……………………………………………………………......…….….

(3)

00

4.

Normal tax (Multiply line 1 by 20%) ......................………………………………………...................................................

(4)

00

$

5.

Surtax (See instructions) (Net income subjet to 5%

) ….......…...............……………………..…….….

(5)

00

6.

Total tax (Add lines 4 and 5) ……….............……………………………………………............................................................

(6)

00

7.

Alternative Tax - Capital Gains and Preferential Rates (Schedule D Corporation, Part V, line 39) .......................................................

(7)

00

8.

Tax determined (Line 6 or 7, whichever is smaller) …...............………………………………………………….………………...

(8)

00

9.

Recapture of credit claimaed in excess (Schedule B Incentives, Part I, line 3) …...…………………………...........…………………

(9)

00

10.

Tax credits (Schedule B Incentives, Part II, line 25) …..............…………………………………………….…………..............

(10)

00

11.

Tax liability before alternative minimum tax (Subtract line 10 from the sum of lines 8 and 9) ...................................................

(11)

00

12.

Excess of alternative minimum tax over regular tax (Schedule A Corporation, Part V, line 3) …...................................…......

(12)

00

13.

Branch profits tax (Form AS 2879, see instructions) ................................................................................................

(13)

00

14.

Tax liability (Add lines 11 through 13. Enter here and on the corresponding line of the return) ...........................................

(14)

Gross Profits on Sales or Production and Other Income

Part III

I

1.

Net sales ...........................................................................................................................................

00

(1)

Less: Cost of goods sold or direct costs of production

2.

Inventory at the beginning of the year

"C"

"C" o "MV"

a)

Materials ............................................................................................

00

(2a)

b)

Goods in process ..............................................................................

00

(2b)

c)

Finished goods or merchandise ........................................................

00

(2c)

3.

Purchase of materials and merchandise ...................................................

00

(3)

4.

Direct wages ............................................................................................

00

(4)

5.

Other direct costs (Detail in Part V) ...........................................................

00

(5)

6.

Total goods available for sale (Add lines 2 through 5) ..............................

00

(6)

7.

Less: Inventory at end of year

"C"

"C" o "MV"

a)

Materials ..................................................

(7a)

00

b)

Goods in process .....................................

(7b)

00

c)

Finished goods or merchandise ...............

(7c)

00

00

00

8.

Gross profit on sales or production ............................................................................................................................................

(8)

00

9.

Net capital gain (Schedule D Corporation) ................................................................................................................................

(9)

00

10.

Net gain (or loss) from the sale or exchange of property other than capital assets (Schedule D Corporation) ........................

(10)

00

11.

Rent ..........................................................................................................................................................................................

(11)

00

12.

Interest .......................................................................................................................................................................................

(12)

00

13.

Dividends from corporations and partnerships distributions (a) Domestic________ (b) Foreign________ ...........................................

(13)

00

14.

Distributable share of net income (or loss) from special partnerships .............................................................................................

(14)

00

15.

Other income (Submit detail) ......................................................................................................................................................

(15)

00

16.

Casino's income ........................................................................................................................................................................

(16)

00

17.

Total income (Add lines 8 through 16) ....................................................................................................................................

(17)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2