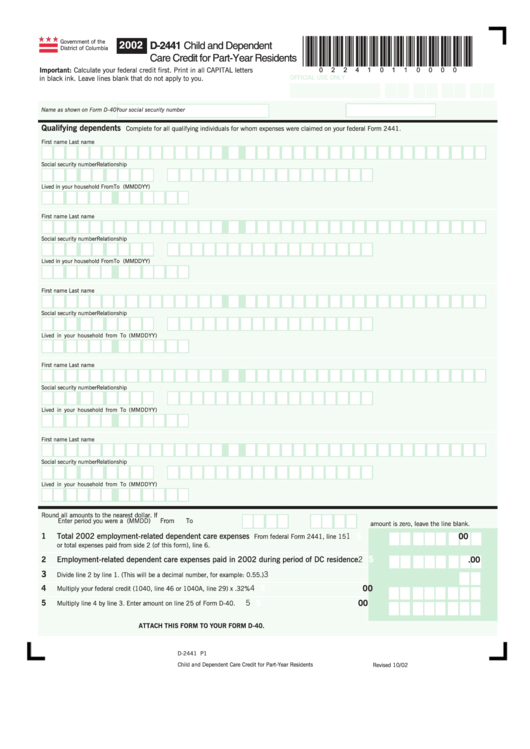

Form D-2441 - Child And Dependent Care Credit For Part-Year Residents - Government Of The District Of Columbia - 2002

ADVERTISEMENT

*022410110000*

Government of the

2002

D-2441 Child and Dependent

District of Columbia

Care Credit for Part-Year Residents

Important: Calculate your federal credit first. Print in all CAPITAL letters

OFFICIAL USE ONLY

in black ink. Leave lines blank that do not apply to you.

Name as shown on Form D-40

Your social security number

Qualifying dependents

Complete for all qualifying individuals for whom expenses were claimed on your federal Form 2441.

First name

Last name

M.I.

Social security number

Relationship

Lived in your household From

To (MMDDYY)

First name

Last name

M.I.

Social security number

Relationship

Lived in your household From

To (MMDDYY)

First name

Last name

M.I.

Social security number

Relationship

Lived in your household from To (MMDDYY)

First name

Last name

M.I.

Social security number

Relationship

Lived in your household from To (MMDDYY)

First name

Last name

M.I.

Social security number

Relationship

Lived in your household from To (MMDDYY)

D.C. credit

Round all amounts to the nearest dollar. If

Enter period you were a D.C. resident in 2002. (MMDD)

From

To

amount is zero, leave the line blank.

1

Total 2002 employment-related dependent care expenses

1

$

.00

From federal Form 2441, line 15

or total expenses paid from side 2 (of this form), line 6.

$

2

Employment-related dependent care expenses paid in 2002 during period of DC residence

2

.00

3

3

Divide line 2 by line 1. (This will be a decimal number, for example: 0.55.)

4

D.C. dependent care credit

4

$

.00

Multiply your federal credit (1040, line 46 or 1040A, line 29) x .32%

5

D.C. part-year dependent care credit

5

$

.00

Multiply line 4 by line 3. Enter amount on line 25 of Form D-40.

ATTACH THIS FORM TO YOUR FORM D-40.

D-2441 P1

Child and Dependent Care Credit for Part-Year Residents

Revised 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2