Form Tc-106 - Selection Of Reporting Basis For Motor Fuel Gallons - Utah State Tax Commission

ADVERTISEMENT

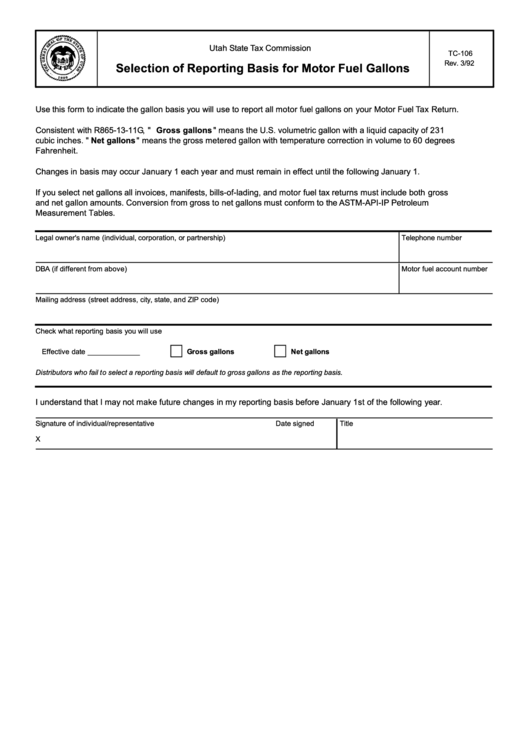

Utah State Tax Commission

TC-106

Rev. 3/92

Selection of Reporting Basis for Motor Fuel Gallons

Use this form to indicate the gallon basis you will use to report all motor fuel gallons on your Motor Fuel Tax Return.

Consistent with R865-13-11G, " Gross gallons " means the U.S. volumetric gallon with a liquid capacity of 231

cubic inches. " Net gallons " means the gross metered gallon with temperature correction in volume to 60 degrees

Fahrenheit.

Changes in basis may occur January 1 each year and must remain in effect until the following January 1.

If you select net gallons all invoices, manifests, bills-of-lading, and motor fuel tax returns must include both gross

and net gallon amounts. Conversion from gross to net gallons must conform to the ASTM-API-IP Petroleum

Measurement Tables.

Legal owner's name (individual, corporation, or partnership)

Telephone number

DBA (if different from above)

Motor fuel account number

Mailing address (street address, city, state, and ZIP code)

Check what reporting basis you will use

Effective date _____________

Gross gallons

Net gallons

Distributors who fail to select a reporting basis will default to gross gallons as the reporting basis.

I understand that I may not make future changes in my reporting basis before January 1st of the following year.

Signature of individual/representative

Date signed

Title

X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1