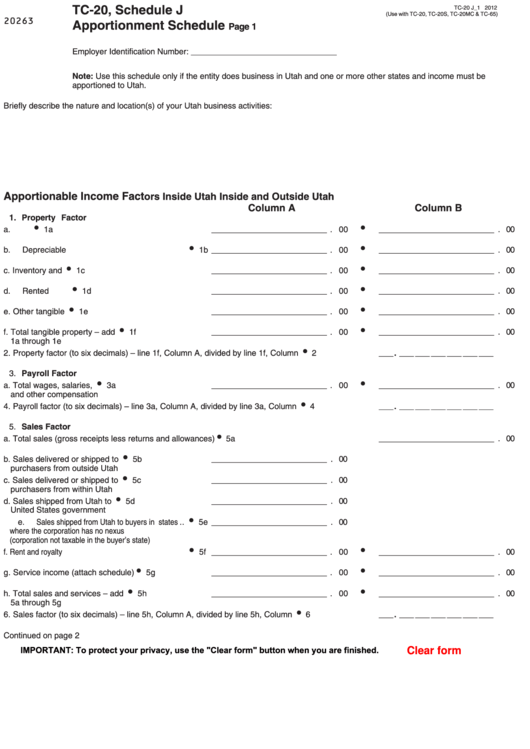

TC-20, Schedule J

TC-20 J_1 2012

(Use with TC-20, TC-20S, TC-20MC & TC-65)

20263

Apportionment Schedule

Page 1

Employer Identification Number: _ _ ___________ __ __ __

Note: Use this schedule only if the entity does business in Utah and one or more other states and income must be

apportioned to Utah.

Briefly describe the nature and location(s) of your Utah business activities:

Apportionable Income Fact

ors

Inside Utah

Inside and Outside Utah

Column A

Column B

1. Property Factor

a. Land ........................................................

1a ___________ __ __ . 00

_ __ __ __ _ _ _ _ _ _ _ _ . 00

b. Depreciable assets..................................

1b __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

c. Inventory and supplies ............................

1c __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

d. Rented property......................................

1d __________ __ __ _ . 00

__ __ __ __ __ _ _ _ _ _ . 00

e. Other tangible property ...........................

1e __________ __ __ _ . 00

__ __ __ __ __ _ _ _ _ _ . 00

f.

Total tangible property – add lines ..........

1f __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

1a through 1e

2. Property factor (to six decimals) – line 1f, Column A, divided by line 1f, Column B...............

2 __ . __ __ __ __ __ __

3. Payroll Factor

a. Total wages, salaries, commissions ........

3a __________ __ __ _ . 00

_ __ __ __ __ _ _ _ _ _ _ . 00

and other compensation

4. Payroll factor (to six decimals) – line 3a, Column A, divided by line 3a, Column B ...............

4 __ . __ __ __ __ __ __

5. Sales Factor

a. Total sales (gross receipts less returns and allowances) .................................................

5a _ ___ __ __ _ _ _ _ _ _ _ . 00

b. Sales delivered or shipped to Utah .........

5b __________ __ __ _ . 00

purchasers from outside Utah

c. Sales delivered or shipped to Utah .........

5c __________ __ __ _ . 00

purchasers from within Utah

d. Sales shipped from Utah to the...............

5d __________ __ __ _ . 00

United States government

e. Sales shipped from Utah to buyers in states ..

5e ___________ __ __ . 00

where the corporation has no nexus

(corporation not taxable in the buyer’s state)

f.

Rent and royalty income...................................

5f ___________ __ __ . 00

_ __ __ __ _ _ _ _ _ _ _ _ . 00

g. Service income (attach schedule)...........

5g __________ __ __ _ . 00

_ ___ __ __ _ _ _ _ _ _ _ . 00

h. Total sales and services – add lines .......

5h __________ __ __ _ . 00

__ __ __ __ _ _ _ _ _ _ _ . 00

5a through 5g

6. Sales factor (to six decimals) – line 5h, Column A, divided by line 5h, Column B .................

6 __ . __ __ __ __ __ __

Continued on page 2

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2