Instructions For Form Cst-240 - West Virginia Claim For Refund Or Credit Of Consumers Sales And Services Tax

ADVERTISEMENT

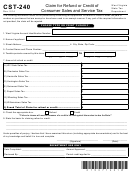

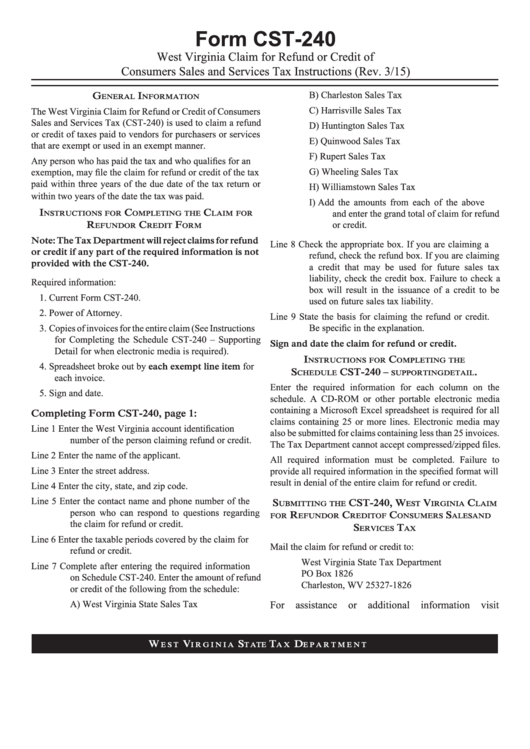

Form CST-240

West Virginia Claim for Refund or Credit of

Consumers Sales and Services Tax Instructions (Rev. 3/15)

B)

Charleston Sales Tax

G

I

eneral

nformatIon

C)

Harrisville Sales Tax

The West Virginia Claim for Refund or Credit of Consumers

Sales and Services Tax (CST-240) is used to claim a refund

D)

Huntington Sales Tax

or credit of taxes paid to vendors for purchasers or services

E)

Quinwood Sales Tax

that are exempt or used in an exempt manner.

F)

Rupert Sales Tax

Any person who has paid the tax and who qualifies for an

G)

Wheeling Sales Tax

exemption, may file the claim for refund or credit of the tax

paid within three years of the due date of the tax return or

H)

Williamstown Sales Tax

within two years of the date the tax was paid.

I)

Add the amounts from each of the above

I

c

c

and enter the grand total of claim for refund

nstructIons for

ompletInG the

laIm for

r

c

f

or credit.

efund or

redIt

orm

Note: The Tax Department will reject claims for refund

Line 8

Check the appropriate box. If you are claiming a

or credit if any part of the required information is not

refund, check the refund box. If you are claiming

provided with the CST-240.

a credit that may be used for future sales tax

liability, check the credit box. Failure to check a

Required information:

box will result in the issuance of a credit to be

1. Current Form CST-240.

used on future sales tax liability.

2. Power of Attorney.

Line 9

State the basis for claiming the refund or credit.

Be specific in the explanation.

3. Copies of invoices for the entire claim (See Instructions

for Completing the Schedule CST-240 – Supporting

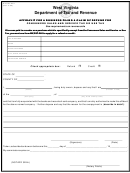

Sign and date the claim for refund or credit.

Detail for when electronic media is required).

I

c

nstructIons for

ompletInG the

4. Spreadsheet broke out by each exempt line item for

s

cst-240 –

.

chedule

supportInG detaIl

each invoice.

Enter the required information for each column on the

5. Sign and date.

schedule. A CD-ROM or other portable electronic media

containing a Microsoft Excel spreadsheet is required for all

Completing Form CST-240, page 1:

claims containing 25 or more lines. Electronic media may

Line 1

Enter the West Virginia account identification

also be submitted for claims containing less than 25 invoices.

number of the person claiming refund or credit.

The Tax Department cannot accept compressed/zipped files.

Line 2

Enter the name of the applicant.

All required information must be completed. Failure to

Line 3

Enter the street address.

provide all required information in the specified format will

result in denial of the entire claim for refund or credit.

Line 4

Enter the city, state, and zip code.

Line 5

Enter the contact name and phone number of the

s

cst-240, W

V

c

ubmIttInG the

est

IrGInIa

laIm

person who can respond to questions regarding

r

c

c

s

for

efund or

redIt of

onsumers

ales and

the claim for refund or credit.

s

t

erVIces

ax

Line 6

Enter the taxable periods covered by the claim for

Mail the claim for refund or credit to:

refund or credit.

West Virginia State Tax Department

Line 7

Complete after entering the required information

PO Box 1826

on Schedule CST-240. Enter the amount of refund

Charleston, WV 25327-1826

or credit of the following from the schedule:

A)

West Virginia State Sales Tax

For

assistance

or

additional

information

visit

W

V

s

t

d

e s t

I r G I n I a

t a t e

a x

e p a r t m e n t

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1