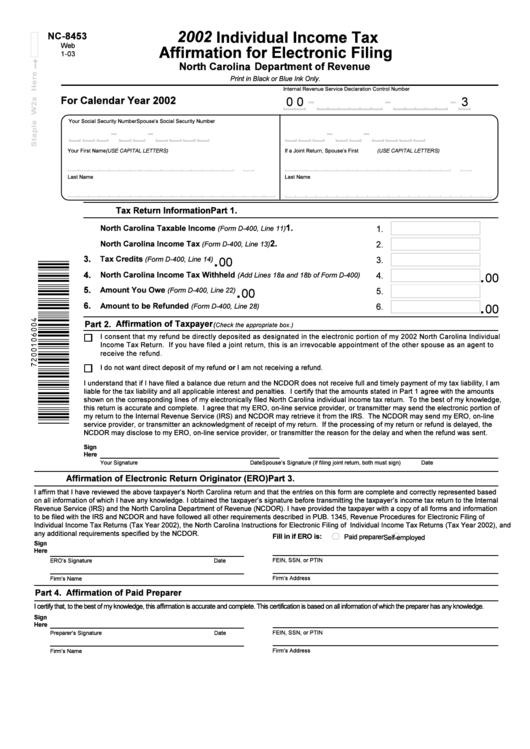

Form Nc-8453 - Individual Income Tax Affirmation For Electronic Filing - 2002

ADVERTISEMENT

2002 Individual Income Tax

NC-8453

Web

Affirmation for Electronic Filing

1-03

Department of Revenue

Print in Black or Blue Ink Only.

Internal Revenue Service Declaration Control Number

For Calendar Year 2002

3

0 0

Your Social Security Number

Spouse’s Social Security Number

Your First Name (USE CAPITAL LETTERS)

M.I.

If a Joint Return, Spouse’s First Name

(USE CAPITAL LETTERS)

M.I.

Last Name

Last Name

Part 1.

Tax Return Information

.

1.

North Carolina Taxable Income

1.

00

(Form D-400, Line 11)

.

2.

North Carolina Income Tax

2.

00

(Form D-400, Line 13)

.

3.

Tax Credits

3.

(Form D-400, Line 14)

00

.

4.

North Carolina Income Tax Withheld

4.

(Add Lines 18a and 18b of Form D-400)

00

.

5.

Amount You Owe

5.

(Form D-400, Line 22)

00

.

6.

Amount to be Refunded

6.

(Form D-400, Line 28)

00

Affirmation of Taxpayer

Part 2.

(

Check the appropriate box.)

I consent that my refund be directly deposited as designated in the electronic portion of my 2002 North Carolina Individual

Income Tax Return. If you have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to

receive the refund.

I do not want direct deposit of my refund or I am not receiving a refund.

I understand that if I have filed a balance due return and the NCDOR does not receive full and timely payment of my tax liability, I am

liable for the tax liability and all applicable interest and penalties. I certify that the amounts stated in Part 1 agree with the amounts

shown on the corresponding lines of my electronically filed North Carolina individual income tax return. To the best of my knowledge,

this return is accurate and complete. I agree that my ERO, on-line service provider, or transmitter may send the electronic portion of

my return to the Internal Revenue Service (IRS) and NCDOR may retrieve it from the IRS. The NCDOR may send my ERO, on-line

service provider, or transmitter an acknowledgment of receipt of my return. If the processing of my return or refund is delayed, the

NCDOR may disclose to my ERO, on-line service provider, or transmitter the reason for the delay and when the refund was sent.

Sign

Here

Your Signature

Date

Spouse’s Signature (if filing joint return, both must sign)

Date

Part 3.

Affirmation of Electronic Return Originator (ERO)

I affirm that I have reviewed the above taxpayer’s North Carolina return and that the entries on this form are complete and correctly represented based

on all information of which I have any knowledge. I obtained the taxpayer’s signature before transmitting the taxpayer’s income tax return to the Internal

Revenue Service (IRS) and the North Carolina Department of Revenue (NCDOR). I have provided the taxpayer with a copy of all forms and information

to be filed with the IRS and NCDOR and have followed all other requirements described in PUB. 1345, Revenue Procedures for Electronic Filing of

Individual Income Tax Returns (Tax Year 2002), the North Carolina Instructions for Electronic Filing of Individual Income Tax Returns (Tax Year 2002), and

any additional requirements specified by the NCDOR.

Fill in if ERO is:

Paid preparer

Self-employed

Sign

Here

FEIN, SSN, or PTIN

ERO’s Signature

Date

Firm’s Address

Firm’s Name

Part 4.

Affirmation of Paid Preparer

I certify that, to the best of my knowledge, this affirmation is accurate and complete. This certification is based on all information of which the preparer has any knowledge.

Sign

Here

FEIN, SSN, or PTIN

Preparer’s Signature

Date

Firm’s Address

Firm’s Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1