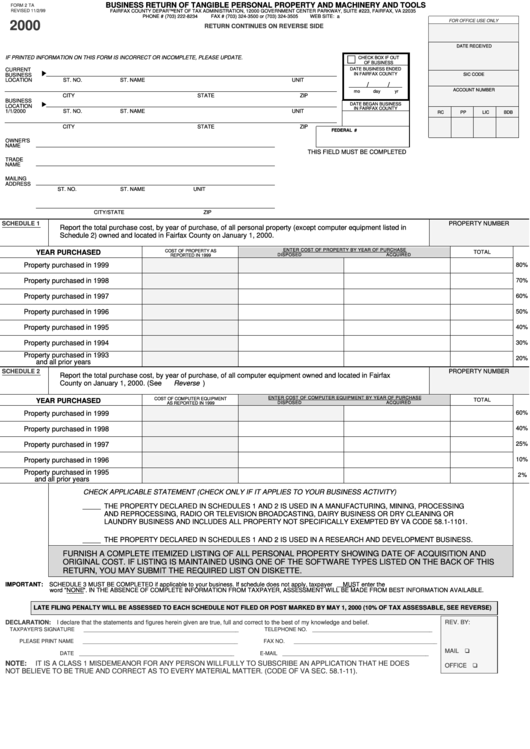

Form 2 Ta - Business Return Of Tangible Personal Property And Machinery And Tools - State Of Virginia

ADVERTISEMENT

BUSINESS RETURN OF TANGIBLE PERSONAL PROPERTY AND MACHINERY AND TOOLS

FORM 2 TA

REVISED 11/2/99

FAIRFAX COUNTY DEPARTMENT OF TAX ADMINISTRATION, 12000 GOVERNMENT CENTER PARKWAY, SUITE #223, FAIRFAX, VA 22035

PHONE # (703) 222-8234

FAX # (703) 324-3500 or (703) 324-3505

WEB SITE:

FOR OFFICE USE ONLY

2000

RETURN CONTINUES ON REVERSE SIDE

DATE RECEIVED

IF PRINTED INFORMATION ON THIS FORM IS INCORRECT OR INCOMPLETE, PLEASE UPDATE.

CHECK BOX IF OUT

□

OF BUSINESS

CURRENT

DATE BUSINESS ENDED

IN FAIRFAX COUNTY

BUSINESS

SIC CODE

LOCATION

ST. NO.

ST. NAME

UNIT

ACCOUNT NUMBER

mo

day

yr

CITY

STATE

ZIP

BUSINESS

DATE BEGAN BUSINESS

LOCATION

IN FAIRFAX COUNTY

1/1/2000

ST. NO.

ST. NAME

UNIT

RC

PP

LIC

BDB

CITY

STATE

ZIP

FEDERAL I.D./EMPLOYER ID #

OWNER'S

NAME

THIS FIELD MUST BE COMPLETED

TRADE

NAME

MAILING

ADDRESS

ST. NO.

ST. NAME

UNIT

CITY/STATE

ZIP

SCHEDULE 1

PROPERTY NUMBER

Report the total purchase cost, by year of purchase, of all personal property (except computer equipment listed in

Schedule 2) owned and located in Fairfax County on January 1, 2000.

ENTER COST OF PROPERTY BY YEAR OF PURCHASE

COST OF PROPERTY AS

YEAR PURCHASED

TOTAL

DISPOSED

ACQUIRED

REPORTED IN 1999

Property purchased in 1999

80%

Property purchased in 1998

70%

Property purchased in 1997

60%

Property purchased in 1996

50%

Property purchased in 1995

40%

Property purchased in 1994

30%

Property purchased in 1993

20%

and all prior years

SCHEDULE 2

PROPERTY NUMBER

Report the total purchase cost, by year of purchase, of all computer equipment owned and located in Fairfax

County on January 1, 2000. (See Reverse)

ENTER COST OF COMPUTER EQUIPMENT BY YEAR OF PURCHASE

COST OF COMPUTER EQUIPMENT

YEAR PURCHASED

TOTAL

AS REPORTED IN 1999

DISPOSED

ACQUIRED

Property purchased in 1999

60%

Property purchased in 1998

40%

Property purchased in 1997

25%

10%

Property purchased in 1996

Property purchased in 1995

2%

and all prior years

CHECK APPLICABLE STATEMENT (CHECK ONLY IF IT APPLIES TO YOUR BUSINESS ACTIVITY)

THE PROPERTY DECLARED IN SCHEDULES 1 AND 2 IS USED IN A MANUFACTURING, MINING, PROCESSING

AND REPROCESSING, RADIO OR TELEVISION BROADCASTING, DAIRY BUSINESS OR DRY CLEANING OR

LAUNDRY BUSINESS AND INCLUDES ALL PROPERTY NOT SPECIFICALLY EXEMPTED BY VA CODE 58.1-1101.

THE PROPERTY DECLARED IN SCHEDULES 1 AND 2 IS USED IN A RESEARCH AND DEVELOPMENT BUSINESS.

FURNISH A COMPLETE ITEMIZED LISTING OF ALL PERSONAL PROPERTY SHOWING DATE OF ACQUISITION AND

ORIGINAL COST. IF LISTING IS MAINTAINED USING ONE OF THE SOFTWARE TYPES LISTED ON THE BACK OF THIS

RETURN, YOU MAY SUBMIT THE REQUIRED LIST ON DISKETTE.

IMPORTANT: SCHEDULE 3 MUST BE COMPLETED if applicable to your business. If schedule does not apply, taxpayer MUST enter the

word "NONE". IN THE ABSENCE OF COMPLETE INFORMATION FROM TAXPAYER, ASSESSMENT WILL BE MADE FROM BEST INFORMATION AVAILABLE.

LATE FILING PENALTY WILL BE ASSESSED TO EACH SCHEDULE NOT FILED OR POST MARKED BY MAY 1, 2000 (10% OF TAX ASSESSABLE, SEE REVERSE)

DECLARATION: I declare that the statements and figures herein given are true, full and correct to the best of my knowledge and belief.

REV. BY:

TAXPAYER'S SIGNATURE _____________________________________________________

TELEPHONE NO. _________________________________________

PLEASE PRINT NAME _____________________________________________________

FAX NO. _________________________________________________

MAIL

DATE _____________________________________________________

E-MAIL __________________________________________________

NOTE: IT IS A CLASS 1 MISDEMEANOR FOR ANY PERSON WILLFULLY TO SUBSCRIBE AN APPLICATION THAT HE DOES

OFFICE

NOT BELIEVE TO BE TRUE AND CORRECT AS TO EVERY MATERIAL MATTER. (CODE OF VA SEC. 58.1-11).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2