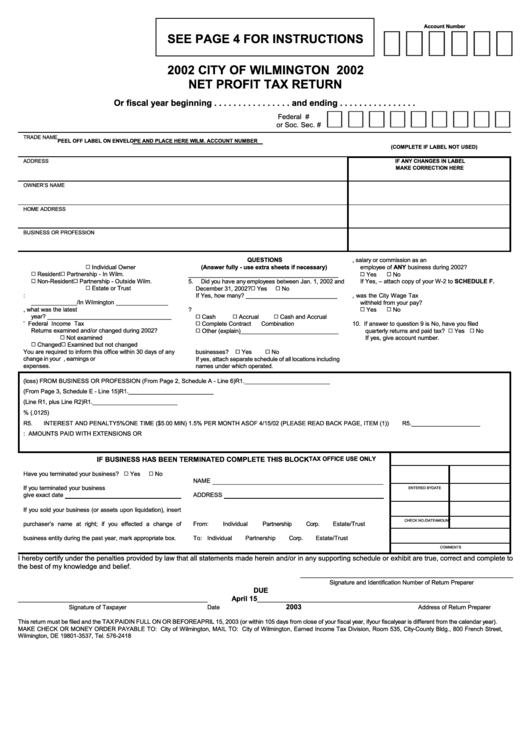

Net Profit Tax Return - City Of Wilmington - 2002

ADVERTISEMENT

Account Number

SEE PAGE 4 FOR INSTRUCTIONS

2002 CITY OF WILMINGTON 2002

NET PROFIT TAX RETURN

Or fiscal year beginning . . . . . . . . . . . . . . . . and ending . . . . . . . . . . . . . . . .

Federal I.D. #

or Soc. Sec. #

TRADE NAME

PEEL OFF LABEL ON ENVELOPE AND PLACE HERE

WILM. ACCOUNT NUMBER

(COMPLETE IF LABEL NOT USED)

ADDRESS

IF ANY CHANGES IN LABEL

MAKE CORRECTION HERE

OWNER’S NAME

HOME ADDRESS

BUSINESS OR PROFESSION

QUESTIONS

1. Please check all applicable blocks.

8. Did you receive any wages, salary or commission as an

Individual Owner

(Answer fully - use extra sheets if necessary)

employee of ANY business during 2002?

Q

Resident

Partnership - In Wilm.

______________________________________________

Yes

No

Q

Q

Q

Q

Non-Resident

Partnership - Outside Wilm.

5. Did you have any employees between Jan. 1, 2002 and

If Yes, – attach copy of your W-2 to SCHEDULE F.

Q

Q

Estate or Trust

December 31, 2002?

Yes

No

Q

Q

Q

2. Date business started or trust created:

If Yes, how many? ____________________________

9. if answer to question 8 is Yes, was the City Wage Tax

______________/ In Wilmington ________________

withheld from your pay?

3. If you filed a Return for a prior year, what was the latest

6. On which basis are your records kept?

Yes

No

Q

Q

year? ______________________________________

Cash

Accrual

Cash and Accrual

Q

Q

Q

4. Were any of your prior years’ Federal Income Tax

Complete Contract

Combination

10. If answer to question 9 is No, have you filed

Q

Returns examined and/or changed during 2002?

Other (explain)______________________________

quarterly returns and paid tax?

Yes

No

Q

Q

Q

Not examined

If yes, give account number.

Q

Changed

Examined but not changed

7. Do you maintain any bona fide branches or other

Q

Q

You are required to inform this office within 30 days of any

businesses?

Yes

No

Q

Q

change in your U.S. Tax Return affecting profits, earnings or

If yes, attach separate schedule of all locations including

expenses.

names under which operated.

R1.

TAXABLE PROFIT (loss) FROM BUSINESS OR PROFESSION (From Page 2, Schedule A - Line 6)

R1.__________________________

R2. TAXABLE INCOME FROM ALL OTHER SOURCES (From Page 3, Schedule E - Line 15)

R1.__________________________

R3. TOTAL AMOUNT ON WHICH TAX IS DUE (Line R1, plus Line R2)

R1.__________________________

R4. TAX AT 1¼% (.0125) ..................................................................................................................................................................................................

R4._____________________

R5. INTEREST AND PENALTY 5% ONE TIME ($5.00 MIN) 1.5% PER MONTH AS OF 4/15/02 (PLEASE READ BACK PAGE, ITEM (1)) ..............

R5._____________________

R6. LESS: AMOUNTS PAID WITH EXTENSIONS OR ESTIMATES..............................................................................................................................

R6._____________________

R7. TOTAL DUE.................................................................................................................................................................................................................

R7._____________________

IF BUSINESS HAS BEEN TERMINATED COMPLETE THIS BLOCK

TAX OFFICE USE ONLY

Have you terminated your business?

Yes

No

Q

Q

NAME

If you terminated your business

ENTERED BY

DATE

give exact date

ADDRESS

If you sold your business (or assets upon liquidation), insert

CHECK NO./DATE

AMOUNT

purchaser’s name at right; if you effected a change of

From:

Individual

Partnership

Corp.

Estate/Trust

business entity during the past year, mark appropriate box.

To:

Individual

Partnership

Corp.

Estate/Trust

COMMENTS

I hereby certify under the penalties provided by law that all statements made herein and/or in any supporting schedule or exhibit are true, correct and complete to

the best of my knowledge and belief.

_______________________________________________________

Signature and Identification Number of Return Preparer

DUE

____________________________________

_____________

April 15

_______________________________________________________

2003

Signature of Taxpayer

Date

Address of Return Preparer

This return must be filed and the TAX PAID IN FULL ON OR BEFORE APRIL 15, 2003 (or within 105 days from close of your fiscal year, if your fiscal year is different from the calendar year).

MAKE CHECK OR MONEY ORDER PAYABLE TO: City of Wilmington, MAIL TO: City of Wilmington, Earned Income Tax Division, Room 535, City-County Bldg., 800 French Street,

Wilmington, DE 19801-3537, Tel. 576-2418

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3