Instructions For Filing The Ia 1040a Short Form

ADVERTISEMENT

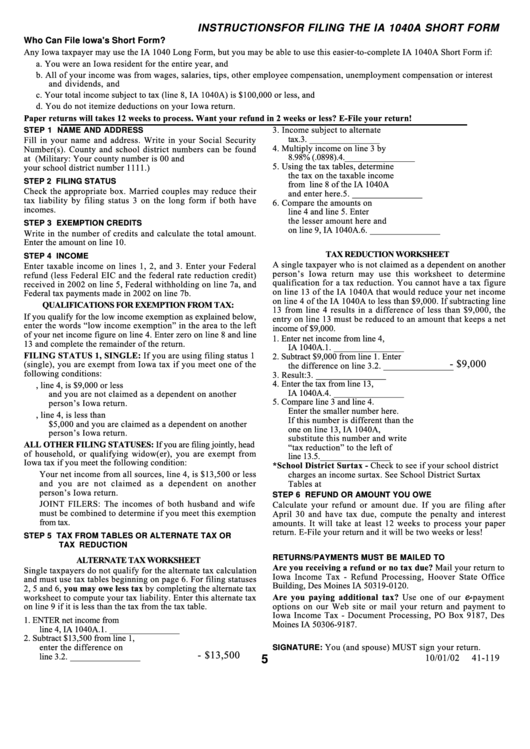

INSTRUCTIONS FOR FILING THE IA 1040A SHORT FORM

Who Can File Iowa's Short Form?

Any Iowa taxpayer may use the IA 1040 Long Form, but you may be able to use this easier-to-complete IA 1040A Short Form if:

a. You were an Iowa resident for the entire year, and

b. All of your income was from wages, salaries, tips, other employee compensation, unemployment compensation or interest

and dividends, and

c. Your total income subject to tax (line 8, IA 1040A) is $100,000 or less, and

d. You do not itemize deductions on your Iowa return.

Paper returns will takes 12 weeks to process. Want your refund in 2 weeks or less? E-File your return!

3. Income subject to alternate

STEP 1 NAME AND ADDRESS

tax.

3. ________________

Fill in your name and address. Write in your Social Security

4. Multiply income on line 3 by

Number(s). County and school district numbers can be found

8.98% (.0898).

4. ________________

at (Military: Your county number is 00 and

5. Using the tax tables, determine

your school district number 1111.)

the tax on the taxable income

STEP 2 FILING STATUS

from line 8 of the IA 1040A

Check the appropriate box. Married couples may reduce their

and enter here.

5. ________________

tax liability by filing status 3 on the long form if both have

6. Compare the amounts on

incomes.

line 4 and line 5. Enter

the lesser amount here and

STEP 3 EXEMPTION CREDITS

on line 9, IA 1040A.

6. ________________

Write in the number of credits and calculate the total amount.

Enter the amount on line 10.

TAX REDUCTION WORKSHEET

STEP 4 INCOME

A single taxpayer who is not claimed as a dependent on another

Enter taxable income on lines 1, 2, and 3. Enter your Federal

person’s Iowa return may use this worksheet to determine

refund (less Federal EIC and the federal rate reduction credit)

qualification for a tax reduction. You cannot have a tax figure

received in 2002 on line 5, Federal withholding on line 7a, and

on line 13 of the IA 1040A that would reduce your net income

Federal tax payments made in 2002 on line 7b.

on line 4 of the IA 1040A to less than $9,000. If subtracting line

QUALIFICATIONS FOR EXEMPTION FROM TAX:

13 from line 4 results in a difference of less than $9,000, the

If you qualify for the low income exemption as explained below,

entry on line 13 must be reduced to an amount that keeps a net

enter the words “low income exemption” in the area to the left

income of $9,000.

of your net income figure on line 4. Enter zero on line 8 and line

1. Enter net income from line 4,

13 and complete the remainder of the return.

IA 1040A.

1. ________________

FILING STATUS 1, SINGLE: If you are using filing status 1

2. Subtract $9,000 from line 1. Enter

- $9,000

(single), you are exempt from Iowa tax if you meet one of the

the difference on line 3.

2. ________________

following conditions:

3. Result:

3. ________________

4. Enter the tax from line 13,

a. Your net income from all sources, line 4, is $9,000 or less

IA 1040A.

4. ________________

and you are not claimed as a dependent on another

5. Compare line 3 and line 4.

person’s Iowa return.

Enter the smaller number here.

b. Your net income from all sources, line 4, is less than

If this number is different than the

$5,000 and you are claimed as a dependent on another

one on line 13, IA 1040A,

person’s Iowa return.

substitute this number and write

ALL OTHER FILING STATUSES: If you are filing jointly, head

“tax reduction” to the left of

of household, or qualifying widow(er), you are exempt from

line 13.

5. ________________

Iowa tax if you meet the following condition:

*School District Surtax - Check to see if your school district

Your net income from all sources, line 4, is $13,500 or less

charges an income surtax. See School District Surtax

and you are not claimed as a dependent on another

Tables at

person’s Iowa return.

STEP 6 REFUND OR AMOUNT YOU OWE

JOINT FILERS: The incomes of both husband and wife

Calculate your refund or amount due. If you are filing after

must be combined to determine if you meet this exemption

April 30 and have tax due, compute the penalty and interest

from tax.

amounts. It will take at least 12 weeks to process your paper

return. E-File your return and it will be two weeks or less!

STEP 5 TAX FROM TABLES OR ALTERNATE TAX OR

TAX REDUCTION

RETURNS/PAYMENTS MUST BE MAILED TO

ALTERNATE TAX WORKSHEET

Are you receiving a refund or no tax due? Mail your return to

Single taxpayers do not qualify for the alternate tax calculation

Iowa Income Tax - Refund Processing, Hoover State Office

and must use tax tables beginning on page 6. For filing statuses

Building, Des Moines IA 50319-0120.

2, 5 and 6, you may owe less tax by completing the alternate tax

Are you paying additional tax? Use one of our e-payment

worksheet to compute your tax liability. Enter this alternate tax

options on our Web site or mail your return and payment to

on line 9 if it is less than the tax from the tax table.

Iowa Income Tax - Document Processing, PO Box 9187, Des

1. ENTER net income from

Moines IA 50306-9187.

line 4, IA 1040A.

1. ________________

2. Subtract $13,500 from line 1,

You (and spouse) MUST sign your return.

enter the difference on

SIGNATURE:

- $13,500

line 3.

2. ________________

10/01/02

41-119

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9