For Office Use Only

Non-Resident

or

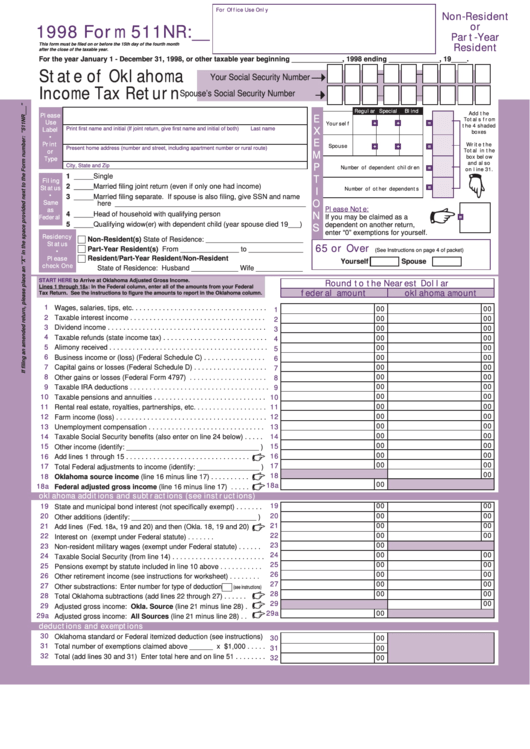

1998 Form 511NR:__

Part-Year

This form must be filed on or before the 15th day of the fourth month

Resident

after the close of the taxable year.

For the year January 1 - December 31, 1998, or other taxable year beginning _____________, 1998 ending _____________, 19____.

State of Oklahoma

Your Social Security Number

Income Tax Return

Spouse’s Social Security Number

Regular Special

Blind

Add the

Please

E

Totals from

+

+

=

Use

Yourself

the 4 shaded

Print first name and initial (If joint return, give first name and initial of both)

Last name

Label

X

boxes

•

E

Print

Write the

+

+

=

Spouse

Present home address (number and street, including apartment number or rural route)

Total in the

or

M

box below

Type

and also

City, State and Zip

P

=

Number of dependent children

on line 31.

1 _____ Single

T

Filing

2 _____ Married filing joint return (even if only one had income)

=

Status

Number of other dependents

I

•

3 _____ Married filing separate. If spouse is also filing, give SSN and name

here _________________________________________________

O

Same

Please Note:

as

4 _____ Head of household with qualifying person

N

If you may be claimed as a

=

Federal

5 _____ Qualifying widow(er) with dependent child (year spouse died 19___)

dependent on another return,

S

enter “0” exemptions for yourself.

E

Residency

Non-Resident(s) State of Residence: _________________________

Status

65 or Over

Part-Year Resident(s) From _______________ to ______________

(See Instructions on page 4 of packet)

•

Resident/Part-Year Resident/Non-Resident

Please

Yourself

Spouse

check One

State of Residence: Husband ____________ Wife ____________

START HERE

to Arrive at Oklahoma Adjusted Gross Income.

Round to the Nearest Dollar

Lines 1 through 18

: In the Federal column, enter all of the amounts from your Federal

A

federal amount

oklahoma amount

Tax Return. See the instructions to figure the amounts to report in the Oklahoma column.

Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

00

1

Taxable interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

00

2

Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

00

3

Taxable refunds (state income tax) . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

00

4

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

5

Business income or (loss) (Federal Schedule C) . . . . . . . . . . . . . . . .

6

00

00

6

Capital gains or losses (Federal Schedule D) . . . . . . . . . . . . . . . . . . .

7

00

00

7

Other gains or losses (Federal Form 4797) . . . . . . . . . . . . . . . . . . . .

8

00

00

8

Taxable IRA deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

00

9

Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

10

10

Rental real estate, royalties, partnerships, etc. . . . . . . . . . . . . . . . . . .

00

00

11

11

Farm income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

12

12

00

00

Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

Taxable Social Security benefits (also enter on line 24 below) . . . . .

00

00

14

14

00

00

Other income (identify: __________________________________ )

15

15

00

00

Add lines 1 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16

00

00

Total Federal adjustments to income (identify: ________________ )

17

17

00

18

Oklahoma source income (line 16 minus line 17) . . . . . . . . . .

18

00

18a

Federal adjusted gross income (line 16 minus line 17) . . . . .

18a

oklahoma additions and subtractions (see instructions)

19

State and municipal bond interest (not specifically exempt) . . . . . . .

19

00

00

20

00

00

20

Other additions (identify: ________________________________ )

21

00

00

21

Add lines (Fed. 18

, 19 and 20) and then (Okla. 18, 19 and 20)

A

22

00

00

22

Interest on U.S. obligations (exempt under Federal statute) . . . . . . .

23

00

23

Non-resident military wages (exempt under Federal statute) . . . . . .

24

00

00

24

Taxable Social Security (from line 14) . . . . . . . . . . . . . . . . . . . . . . . .

25

00

00

25

Pensions exempt by statute included in line 10 above . . . . . . . . . . .

26

00

00

26

Other retirement income (see instructions for worksheet) . . . . . . . .

27

00

00

27

Other substractions: Enter number for type of deduction

(see instructions)

28

00

00

28

Total Oklahoma subtractions (add lines 22 through 27) . . . . . .

29

00

29

Adjusted gross income: Okla. Source (line 21 minus line 28) .

29a

00

29a

Adjusted gross income: All Sources (line 21 minus line 28) . .

deductions and exemptions

30

Oklahoma standard or Federal itemized deduction (see instructions)

30

00

31

Total number of exemptions claimed above ______ x $1,000 . . . . .

31

00

32

Total (add lines 30 and 31) Enter total here and on line 51 . . . . . . . .

32

00

1

1 2

2