Maine Revenue Services Certified Visual Media Production Residency Affidavit

ADVERTISEMENT

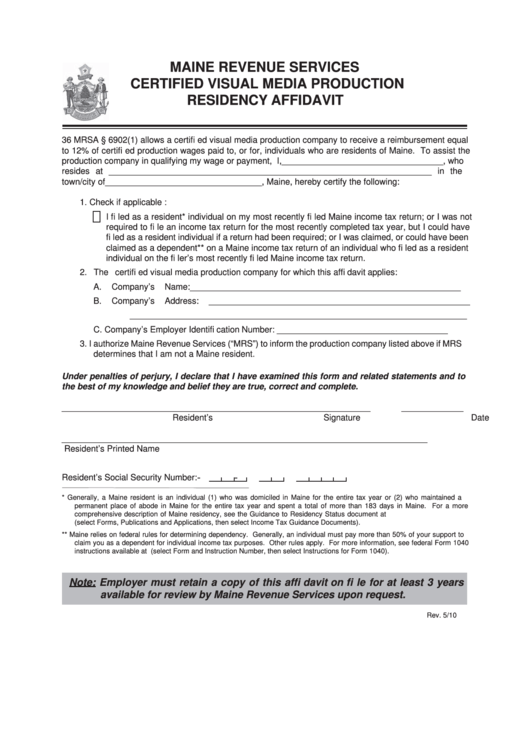

MAINE REVENUE SERVICES

CERTIFIED VISUAL MEDIA PRODUCTION

RESIDENCY AFFIDAVIT

36 MRSA § 6902(1) allows a certifi ed visual media production company to receive a reimbursement equal

to 12% of certifi ed production wages paid to, or for, individuals who are residents of Maine. To assist the

production company in qualifying my wage or payment, I,__________________________________, who

resides at ____________________________________________________________________ in the

town/city of_________________________________, Maine, hereby certify the following:

1. Check if applicable :

I fi led as a resident* individual on my most recently fi led Maine income tax return; or I was not

required to fi le an income tax return for the most recently completed tax year, but I could have

fi led as a resident individual if a return had been required; or I was claimed, or could have been

claimed as a dependent** on a Maine income tax return of an individual who fi led as a resident

individual on the fi ler’s most recently fi led Maine income tax return.

2. The certifi ed visual media production company for which this affi davit applies:

A.

Company’s Name:_________________________________________________________

B.

Company’s Address: _______________________________________________________

_______________________________________________________________________

C.

Company’s Employer Identifi cation Number: ____________________________________

3. I authorize Maine Revenue Services (“MRS”) to inform the production company listed above if MRS

determines that I am not a Maine resident.

Under penalties of perjury, I declare that I have examined this form and related statements and to

the best of my knowledge and belief they are true, correct and complete.

_________________________________________________________________

_____________

Resident’s Signature

Date

_____________________________________________________________________________

Resident’s Printed Name

-

-

Resident’s Social Security Number:

*

Generally, a Maine resident is an individual (1) who was domiciled in Maine for the entire tax year or (2) who maintained a

permanent place of abode in Maine for the entire tax year and spent a total of more than 183 days in Maine. For a more

comprehensive description of Maine residency, see the Guidance to Residency Status document at

(select Forms, Publications and Applications, then select Income Tax Guidance Documents).

**

Maine relies on federal rules for determining dependency. Generally, an individual must pay more than 50% of your support to

claim you as a dependent for individual income tax purposes. Other rules apply. For more information, see federal Form 1040

instructions available at (select Form and Instruction Number, then select Instructions for Form 1040).

Note: Employer must retain a copy of this affi davit on fi le for at least 3 years

available for review by Maine Revenue Services upon request.

Rev. 5/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1