Contributions To Family Development Account Reserve Funds Tax Credit Worksheet - 2010

ADVERTISEMENT

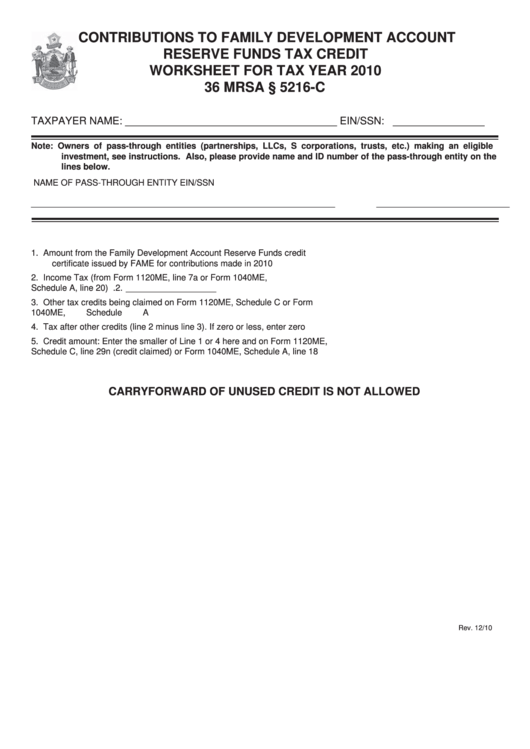

CONTRIBUTIONS TO FAMILY DEVELOPMENT ACCOUNT

RESERVE FUNDS TAX CREDIT

WORKSHEET FOR TAX YEAR 2010

36 MRSA § 5216-C

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Amount from the Family Development Account Reserve Funds credit

certifi cate issued by FAME for contributions made in 2010 .............................................. 1. ___________________

2.

Income Tax (from Form 1120ME, line 7a or Form 1040ME,

Schedule A, line 20) .......................................................................................................... 2. ___________________

3.

Other tax credits being claimed on Form 1120ME, Schedule C or Form

1040ME, Schedule A ........................................................................................................ 3. ___________________

4.

Tax after other credits (line 2 minus line 3). If zero or less, enter zero ............................. 4. ___________________

5.

Credit amount: Enter the smaller of Line 1 or 4 here and on Form 1120ME,

Schedule C, line 29n (credit claimed) or Form 1040ME, Schedule A, line 18 .................. 5. ___________________

CARRYFORWARD OF UNUSED CREDIT IS NOT ALLOWED

Rev. 12/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1