Instructions On How To Apply For A Certificate Of Discharge Of Property From Federal Tax Lien

ADVERTISEMENT

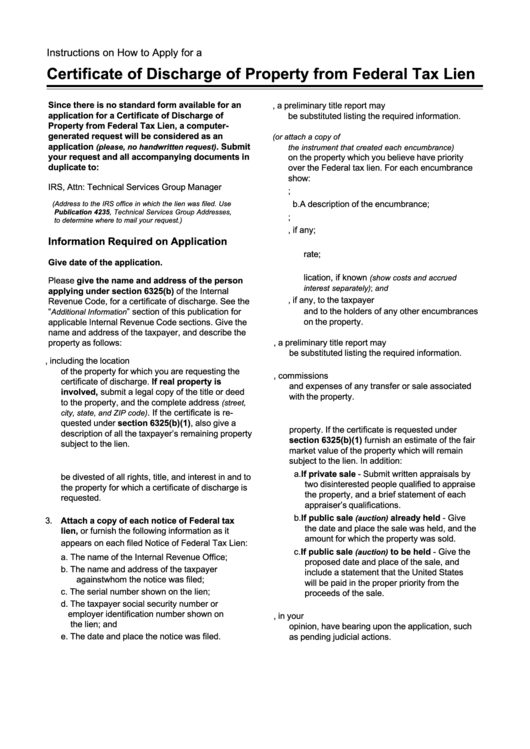

Instructions on How to Apply for a

Certificate of Discharge of Property from Federal Tax Lien

Since there is no standard form available for an

4. In lieu of the above, a preliminary title report may

application for a Certificate of Discharge of

be substituted listing the required information.

Property from Federal Tax Lien, a computer-

generated request will be considered as an

5. List the encumbrances

(or attach a copy of

application

. Submit

(please, no handwritten request)

the instrument that created each encumbrance)

your request and all accompanying documents in

on the property which you believe have priority

duplicate to:

over the Federal tax lien. For each encumbrance

show:

IRS, Attn: Technical Services Group Manager

a. The name and address of the holder;

b. A description of the encumbrance;

(Address to the IRS office in which the lien was filed. Use

Publication 4235, Technical Services Group Addresses,

c. The date of the agreement;

to determine where to mail your request.)

d. The date and place of the recording, if any;

Information Required on Application

e. The original principal amount and the interest

rate;

Give date of the application.

f. The amount due as of the date of the app-

lication, if known

(show costs and accrued

Please give the name and address of the person

interest separately); and

applying under section 6325(b) of the Internal

g. Your family relationship, if any, to the taxpayer

Revenue Code, for a certificate of discharge. See the

and to the holders of any other encumbrances

“

” section of this publication for

Additional Information

on the property.

applicable Internal Revenue Code sections. Give the

name and address of the taxpayer, and describe the

property as follows:

6. In lieu of the above, a preliminary title report may

be substituted listing the required information.

1. Give a detailed description, including the location

of the property for which you are requesting the

7. Itemize all proposed or actual costs, commissions

certificate of discharge. If real property is

and expenses of any transfer or sale associated

involved, submit a legal copy of the title or deed

with the property.

to the property, and the complete address

(street,

. If the certificate is re-

city, state, and ZIP code)

8. Furnish information to establish the value of the

quested under section 6325(b)(1), also give a

property. If the certificate is requested under

description of all the taxpayer’s remaining property

section 6325(b)(1) furnish an estimate of the fair

subject to the lien.

market value of the property which will remain

subject to the lien. In addition:

2. Show how and when the taxpayer has been or will

a. If private sale - Submit written appraisals by

be divested of all rights, title, and interest in and to

two disinterested people qualified to appraise

the property for which a certificate of discharge is

the property, and a brief statement of each

requested.

appraiser’s qualifications.

b. If public sale

already held - Give

(auction)

3. Attach a copy of each notice of Federal tax

the date and place the sale was held, and the

lien, or furnish the following information as it

amount for which the property was sold.

appears on each filed Notice of Federal Tax Lien:

c. If public sale

to be held - Give the

(auction)

a. The name of the Internal Revenue Office;

proposed date and place of the sale, and

b. The name and address of the taxpayer

include a statement that the United States

against whom the notice was filed;

will be paid in the proper priority from the

c. The serial number shown on the lien;

proceeds of the sale.

d. The taxpayer social security number or

employer identification number shown on

9. Give any other information that might, in your

the lien; and

opinion, have bearing upon the application, such

e. The date and place the notice was filed.

as pending judicial actions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3