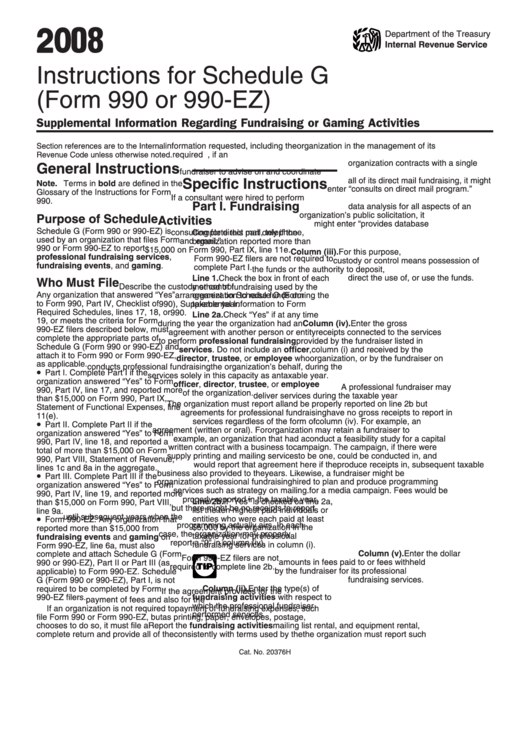

2008 Instructions For Schedule G (Form 990 Or 990-Ez)

ADVERTISEMENT

2 0 08

Department of the Treasury

Internal Revenue Service

Instructions for Schedule G

(Form 990 or 990-EZ)

Supplemental Information Regarding Fundraising or Gaming Activities

information requested, including the

organization in the management of its

Section references are to the Internal

required schedules.

fundraising program. For example, if an

Revenue Code unless otherwise noted.

organization contracts with a single

General Instructions

fundraiser to advise on and coordinate

all of its direct mail fundraising, it might

Specific Instructions

Note. Terms in bold are defined in the

enter “consults on direct mail program.”

Glossary of the Instructions for Form

If a consultant were hired to perform

990.

Part I. Fundraising

data analysis for all aspects of an

organization’s public solicitation, it

Purpose of Schedule

Activities

might enter “provides database

Schedule G (Form 990 or 990-EZ) is

consulting for direct mail, telephone,

Complete this part only if the

used by an organization that files Form

organization reported more than

and email.”

990 or Form 990-EZ to report

$15,000 on Form 990, Part IX, line 11e.

Column (iii). For this purpose,

professional fundraising services,

Form 990-EZ filers are not required to

custody or control means possession of

fundraising events, and gaming.

complete Part I.

the funds or the authority to deposit,

Line 1. Check the box in front of each

direct the use of, or use the funds.

Who Must File

method of fundraising used by the

Describe the custody or control

Any organization that answered “Yes”

organization to raise funds during the

arrangement on Schedule O (Form

to Form 990, Part IV, Checklist of

taxable year.

990), Supplemental Information to Form

Required Schedules, lines 17, 18, or

990.

Line 2a. Check “Yes” if at any time

19, or meets the criteria for Form

during the year the organization had an

Column (iv). Enter the gross

990-EZ filers described below, must

agreement with another person or entity

receipts connected to the services

complete the appropriate parts of

to perform professional fundraising

provided by the fundraiser listed in

Schedule G (Form 990 or 990-EZ) and

services. Do not include an officer,

column (i) and received by the

attach it to Form 990 or Form 990-EZ,

director, trustee, or employee who

organization, or by the fundraiser on

as applicable.

conducts professional fundraising

the organization’s behalf, during the

•

Part I. Complete Part I if the

services solely in this capacity as an

taxable year.

organization answered “Yes” to Form

officer, director, trustee, or employee

A professional fundraiser may

990, Part IV, line 17, and reported more

of the organization.

deliver services during the taxable year

than $15,000 on Form 990, Part IX,

The organization must report all

and be properly reported on line 2b but

Statement of Functional Expenses, line

agreements for professional fundraising

have no gross receipts to report in

11(e).

•

services regardless of the form of

column (iv). For example, an

Part II. Complete Part II if the

agreement (written or oral). For

organization may retain a fundraiser to

organization answered “Yes” to Form

example, an organization that had a

conduct a feasibility study for a capital

990, Part IV, line 18, and reported a

written contract with a business to

campaign. The campaign, if there were

total of more than $15,000 on Form

supply printing and mailing services

to be one, could be conducted in, and

990, Part VIII, Statement of Revenue,

would report that agreement here if the

produce receipts in, subsequent taxable

lines 1c and 8a in the aggregate.

•

business also provided to the

years. Likewise, a fundraiser might be

Part III. Complete Part III if the

organization professional fundraising

hired to plan and produce programming

organization answered “Yes” to Form

services such as strategy on mailing.

for a media campaign. Fees would be

990, Part IV, line 19, and reported more

properly reported in the taxable year,

Line 2b. If “Yes” is checked on line 2a,

than $15,000 on Form 990, Part VIII,

but there might be no receipts to report

list the ten highest paid individuals or

line 9a.

•

until subsequent years when the

entities who were each paid at least

Form 990-EZ. Any organization that

programming actually airs. In each

$5,000 by the organization in the

reported more than $15,000 from

case, the organization may properly

taxable year for professional

fundraising events and gaming on

report a “0” in column (iv).

fundraising services in column (i).

Form 990-EZ, line 6a, must also

Column (v). Enter the dollar

complete and attach Schedule G (Form

Form 990-EZ filers are not

amounts in fees paid to or fees withheld

990 or 990-EZ), Part II or Part III (as

TIP

required to complete line 2b.

by the fundraiser for its professional

applicable) to Form 990-EZ. Schedule

fundraising services.

G (Form 990 or 990-EZ), Part I, is not

Column (ii). Enter the type(s) of

required to be completed by Form

If the agreement provides for the

990-EZ filers.

fundraising activities with respect to

payment of fees and also for the

which the professional fundraiser

If an organization is not required to

payment of fundraising expenses, such

performed services.

file Form 990 or Form 990-EZ, but

as printing, paper, envelopes, postage,

chooses to do so, it must file a

Report the fundraising activities

mailing list rental, and equipment rental,

complete return and provide all of the

consistently with terms used by the

the organization must report such

Cat. No. 20376H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3