Form 1040me-El - Maine Individual Income Tax Declaration For Electronic Filing

ADVERTISEMENT

*000210A00*

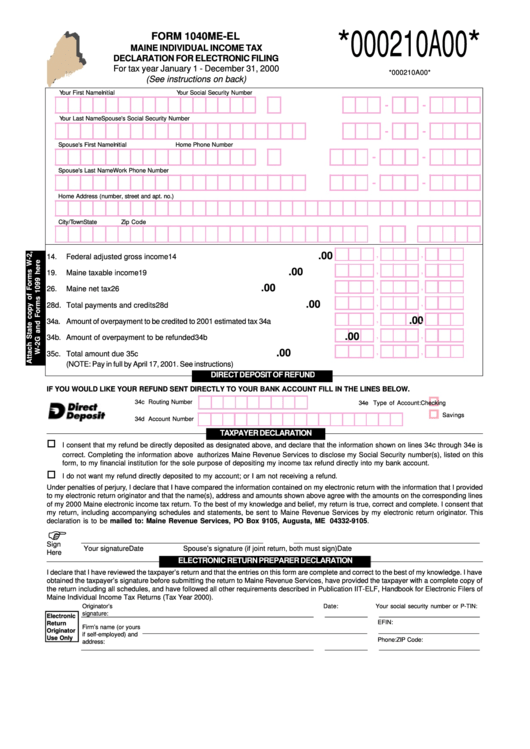

FORM 1040ME-EL

MAINE INDIVIDUAL INCOME TAX

DECLARATION FOR ELECTRONIC FILING

For tax year January 1 - December 31, 2000

*000210A00*

(See instructions on back)

Your First Name

Initial

Your Social Security Number

-

-

Your Last Name

Spouse's Social Security Number

-

-

Spouse's First Name

Initial

Home Phone Number

-

-

Spouse's Last Name

Work Phone Number

-

-

Home Address (number, street and apt. no.)

City/Town

State

Zip Code

,

,

.00

14.

Federal adjusted gross income ..................................................................... 14

,

,

.00

19.

Maine taxable income ................................................................................... 19

,

,

.00

26.

Maine net tax ................................................................................................ 26

,

,

.00

28d. Total payments and credits ........................................................................... 28d

,

,

.00

34a. Amount of overpayment to be credited to 2001 estimated tax ........................... 34a

,

,

.00

34b. Amount of overpayment to be refunded ........................................................ 34b

,

,

.00

35c. Total amount due .......................................................................................... 35c

(NOTE: Pay in full by April 17, 2001. See instructions)

DIRECT DEPOSIT OF REFUND

IF YOU WOULD LIKE YOUR REFUND SENT DIRECTLY TO YOUR BANK ACCOUNT FILL IN THE LINES BELOW.

34c Routing Number

34e Type of Account:

Checking

Savings

34d Account Number

TAXPAYER DECLARATION

o

I consent that my refund be directly deposited as designated above, and declare that the information shown on lines 34c through 34e is

correct. Completing the information above authorizes Maine Revenue Services to disclose my Social Security number(s), listed on this

form, to my financial institution for the sole purpose of depositing my income tax refund directly into my bank account.

o

I do not want my refund directly deposited to my account; or I am not receiving a refund.

Under penalties of perjury, I declare that I have compared the information contained on my electronic return with the information that I provided

to my electronic return originator and that the name(s), address and amounts shown above agree with the amounts on the corresponding lines

of my 2000 Maine electronic income tax return. To the best of my knowledge and belief, my return is true, correct and complete. I consent that

my return, including accompanying schedules and statements, be sent to Maine Revenue Services by my electronic return originator. This

declaration is to be mailed to: Maine Revenue Services, PO Box 9105, Augusta, ME 04332-9105.

F

_______________________________________________

________________________________________________

S ign

Your signature

Date

Spouse’s signature (if joint return, both must sign)

Date

Here

ELECTRONIC RETURN PREPARER DECLARATION

I declare that I have reviewed the taxpayer’s return and that the entries on this form are complete and correct to the best of my knowledge. I have

obtained the taxpayer’s signature before submitting the return to Maine Revenue Services, have provided the taxpayer with a complete copy of

the return including all schedules, and have followed all other requirements described in Publication IIT-ELF, Handbook for Electronic Filers of

Maine Individual Income Tax Returns (Tax Year 2000).

Originator’s

Date:

Your social security number or P-TIN:

____________________________________________________________

signature:

___________

__________________________

Electronic

EFIN:

Return

Firm’s name (or yours

__________________________________________________________

__________________________

Originator

if self-employed) and

Use Only

ZIP Code:

Phone:

address:

____________________________________________________________

___________

__________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1