Instructions For Form 8038-Cp (April 2009)- Return For Credit Payments To Issuers Of Qualified Bonds

ADVERTISEMENT

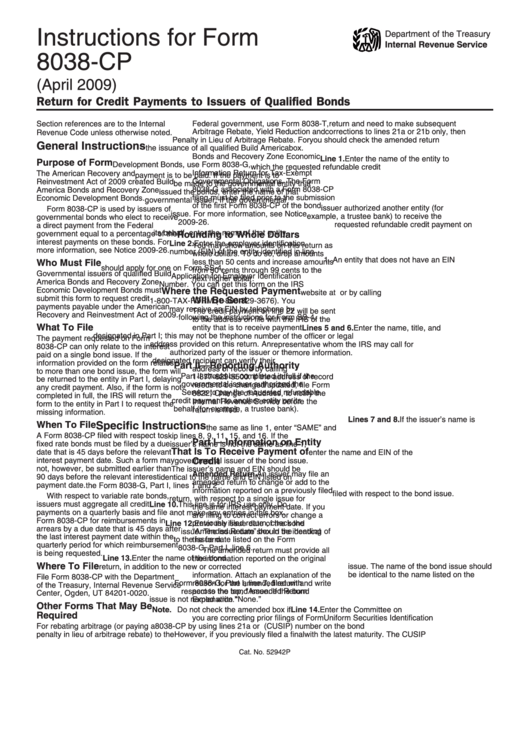

Instructions for Form

Department of the Treasury

Internal Revenue Service

8038-CP

(April 2009)

Return for Credit Payments to Issuers of Qualified Bonds

Federal government, use Form 8038-T,

return and need to make subsequent

Section references are to the Internal

Arbitrage Rebate, Yield Reduction and

corrections to lines 21a or 21b only, then

Revenue Code unless otherwise noted.

Penalty in Lieu of Arbitrage Rebate. For

you should check the amended return

General Instructions

the issuance of all qualified Build America

box.

Bonds and Recovery Zone Economic

Line 1. Enter the name of the entity to

Purpose of Form

Development Bonds, use Form 8038-G,

which the requested refundable credit

Information Return for Tax-Exempt

The American Recovery and

payment is to be paid. If the payment is to

Governmental Obligations. The Form

Reinvestment Act of 2009 created Build

be made to the governmental entity that

8038-G associated with a Form 8038-CP

America Bonds and Recovery Zone

issued the bonds, enter the name of that

filing must be filed prior to the submission

Economic Development Bonds.

governmental issuer. If the governmental

of the first Form 8038-CP of the bond

issuer authorized another entity (for

Form 8038-CP is used by issuers of

issue. For more information, see Notice

example, a trustee bank) to receive the

governmental bonds who elect to receive

2009-26.

requested refundable credit payment on

a direct payment from the Federal

its behalf, enter the name of that entity.

government equal to a percentage of the

Rounding to Whole Dollars

interest payments on these bonds. For

Line 2. Enter the employer identification

You may show amounts on this return as

more information, see Notice 2009-26.

number (EIN) of the entity identified in line

whole dollars. To do so, drop amounts

1. An entity that does not have an EIN

less than 50 cents and increase amounts

Who Must File

should apply for one on Form SS-4,

from 50 cents through 99 cents to the

Governmental issuers of qualified Build

Application for Employer Identification

next higher dollar.

America Bonds and Recovery Zone

Number. You can get this form on the IRS

Economic Development Bonds must

Where the Requested Payment

website at or by calling

submit this form to request credit

Will Be Sent

1-800-TAX-FORM (1-800-829-3676). You

payments payable under the American

may receive an EIN by telephone by

The credit payment on line 22 will be sent

Recovery and Reinvestment Act of 2009.

following the instructions for Form SS-4.

to the address on file with the IRS of the

What To File

entity that is to receive payment

Lines 5 and 6. Enter the name, title, and

designated in Part I; this may not be the

phone number of the officer or legal

The payment requested on Form

address provided on this return. An

representative whom the IRS may call for

8038-CP can only relate to the interest

authorized party of the issuer or the

more information.

paid on a single bond issue. If the

designated recipient can verify their

information provided on the form relates

Part II—Reporting Authority

address of record by calling

to more than one bond issue, the form will

Part II should be completed in full if the

1-877-829-5500. If the address of record

be returned to the entity in Part I, delaying

governmental issuer authorized the

needs to be changed/updated, file Form

any credit payment. Also, if the form is not

Service to pay the requested refundable

8822, Change of Address, to notify the

completed in full, the IRS will return the

credit payment to another entity on its

Internal Revenue Service before the

form to the entity in Part I to request the

behalf (for example, a trustee bank).

return is filed.

missing information.

Lines 7 and 8. If the issuer’s name is

When To File

Specific Instructions

the same as line 1, enter “SAME” and

A Form 8038-CP filed with respect to

skip lines 8, 9, 11, 15, and 16. If the

Part I—Information on Entity

fixed rate bonds must be filed by a due

issuer’s name is not the same as line 1,

That Is To Receive Payment of

date that is 45 days before the relevant

enter the name and EIN of the

interest payment date. Such a form may

Credit

governmental issuer of the bond issue.

not, however, be submitted earlier than

The issuer’s name and EIN should be

Amended Return. An issuer may file an

90 days before the relevant interest

identical to the name and EIN listed on

amended return to change or add to the

payment date.

the Form 8038-G, Part I, lines 1 and 2

information reported on a previously filed

filed with respect to the bond issue.

With respect to variable rate bonds,

return, with respect to a single issue for

issuers must aggregate all credit

Line 10. This line is for IRS use only. Do

the same interest payment date. If you

payments on a quarterly basis and file a

not make any entries in this box.

are filing to correct errors or change a

Form 8038-CP for reimbursements in

Line 12. Enter the issue date of the bond

previously filed return, check the

arrears by a due date that is 45 days after

“Amended Return” box in the heading of

issue. The issue date should be identical

the last interest payment date within the

the form.

to the issue date listed on the Form

quarterly period for which reimbursement

8038-G, Part I, line 6.

The amended return must provide all

is being requested.

Line 13. Enter the name of the bond

the information reported on the original

Where To File

return, in addition to the new or corrected

issue. The name of the bond issue should

be identical to the name listed on the

information. Attach an explanation of the

File Form 8038-CP with the Department

reason for the amended return and write

Form 8038-G, Part I, line 7, filed with

of the Treasury, Internal Revenue Service

across the top, “Amended Return

respect to the bond issue. If the bond

Center, Ogden, UT 84201-0020.

issue is not named write “None.”

Explanation.”

Other Forms That May Be

Note. Do not check the amended box if

Line 14. Enter the Committee on

Required

you are correcting prior filings of Form

Uniform Securities Identification

For rebating arbitrage (or paying a

8038-CP by using lines 21a or 21b.

Procedures (CUSIP) number on the bond

penalty in lieu of arbitrage rebate) to the

However, if you previously filed a final

with the latest maturity. The CUSIP

Cat. No. 52942P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2