Form Pr-1 - Montana Partnership Information Return - 2003

ADVERTISEMENT

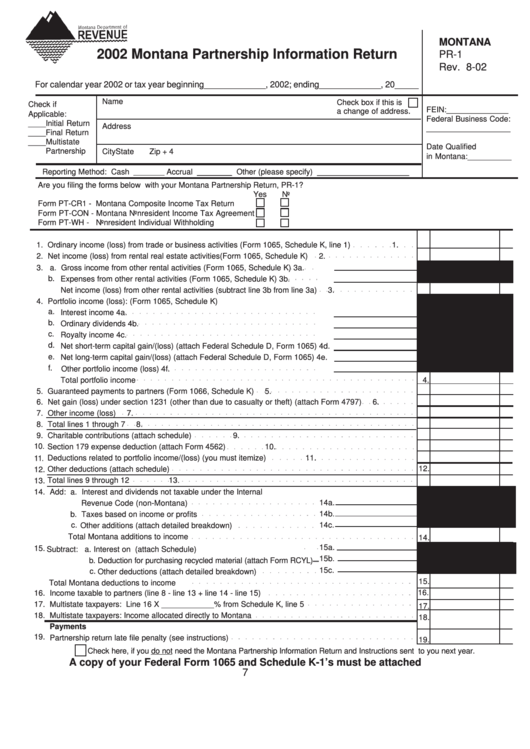

MONTANA

2002 Montana Partnership Information Return

PR-1

Rev. 8-02

For calendar year 2002 or tax year beginning_____________, 2002; ending_____________, 20_____

Name

Check box if this is

Check if

FEIN:______________

.

a change of address

Applicable:

Federal Business Code:

____Initial Return

Address

___________________

____Final Return

____Multistate

Date Qualified

Partnership

City

State

Zip + 4

in Montana:__________

Reporting Method: Cash

Accrual ________ Other (please specify) _____________________

Are you filing the forms below with your Montana Partnership Return, PR-1?

Yes

No

Form PT-CR1 - Montana Composite Income Tax Return

Form PT-CON - Montana Nonresident Income Tax Agreement

Form PT-WH - Nonresident Individual Withholding

1. Ordinary income (loss) from trade or business activities (Form 1065, Schedule K, line 1)

1.

2. Net income (loss) from rental real estate activities (Form 1065, Schedule K)

2.

3. a. Gross income from other rental activities (Form 1065, Schedule K)

3a.

b.

Expenses from other rental activities (Form 1065, Schedule K)

3b.

Net income (loss) from other rental activities (subtract line 3b from line 3a)

3.

4. Portfolio income (loss): (Form 1065, Schedule K)

a.

Interest income

4a.

b.

Ordinary dividends

4b.

c.

Royalty income

4c.

d.

Net short-term capital gain/(loss) (attach Federal Schedule D, Form 1065) 4d.

e.

Net long-term capital gain/(loss) (attach Federal Schedule D, Form 1065) 4e.

f.

Other portfolio income (loss)

4f.

Total portfolio income

4.

5. Guaranteed payments to partners (Form 1066, Schedule K)

5.

6. Net gain (loss) under section 1231 (other than due to casualty or theft) (attach Form 4797)

6.

7. Other income (loss)

7.

8. Total lines 1 through 7

8.

9. Charitable contributions (attach schedule)

9.

10.

Section 179 expense deduction (attach Form 4562)

10.

11.

Deductions related to portfolio income/(loss) (you must itemize)

11.

12.

12.

Other deductions (attach schedule)

Total lines 9 through 12

13.

13.

14.

Add: a. Interest and dividends not taxable under the Internal

14a.

Revenue Code (non-Montana)

14b.

b. Taxes based on income or profits

c.

14c.

Other additions (attach detailed breakdown)

Total Montana additions to income

14.

15a.

15.

Subtract: a. Interest on U.S. Government Obligations (attach Schedule)

15b.

b. Deduction for purchasing recycled material (attach Form RCYL)

15c.

c.

Other deductions (attach detailed breakdown)

15.

Total Montana deductions to income

16.

Income taxable to partners (line 8 - line 13 + line 14 - line 15)

16.

17.

Multistate taxpayers: Line 16 X ____________% from Schedule K, line 5

17.

18.

Multistate taxpayers: Income allocated directly to Montana

18.

Payments

19.

Partnership return late file penalty (see instructions)

19.

Check here, if you do not need the Montana Partnership Information Return and Instructions sent to you next year.

A copy of your Federal Form 1065 and Schedule K-1’s must be attached

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3