Form 1099-Sf - Statement Of Non-Employee Compensation - City Of Louisville Or Jefferson County Page 2

ADVERTISEMENT

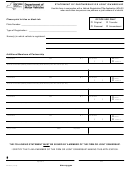

STATEMENT OF NON-EMPLOYEE COMPENSATION

FORM 1099-SF

FORM 1099-SF

CITY OF LOUISVILLE OR JEFFERSON COUNTY

Type or Print Payers Name and Address

Employers ID Number

SSN

Account #

Phone Number

CALENDAR YEAR

COL 1

COL 2

COL 3

COL 4

COL 5

COL 6

TOTAL NON-

AMOUNT OF COL 4

OCCUPATIO

NAME

STREET ADDRESS

RECIPIENT’S SS#

EMPLOYEE

EARNED IN

NAL

(TYPE OR PRINT)

CITY-STATE-ZIP CODE

COMPENSATION

JEFFERSON

TAX

PAID

COUNTY

WITHELD

(INCLUDING LOU.)

1.

2.

3.

4.

5.

Instructions for preparing City of Louisville or Jefferson County Form 1099-SF

GENERAL

-

Payee should report only those recipients who receive $600.00 or more for services performed in the City of Louisville or Jefferson County,

Kentucky. (Entry in Column 5 is greater than or equal to $600.00.)

COLUMN 1 -

Enter the name of the individual who received non-employee compensation. (Enter legal name, do not use D/B/A’s.)

COLUMN 2 -

Enter the mailing address of the recipient of the non-employee compensation. (Home address preferred.)

COLUMN 3 -

Enter the social security number or federal identification number of the recipient.

COLUMN 4 -

Enter the total amount of non-employee compensation paid to the recipient during the tax year.

COLUMN 5 -

Enter the amount of non-employee compensation which was paid to the recipient for services performed within Jefferson County including

Louisville. (Do not complete for any recipient under $600.00 in Jefferson County including Louisville.)

COLUMN 6 -

Enter the amount of occupational tax that was withheld and remitted to the Louisville Jefferson County Revenue Commission on behalf of

the recipient of the non-employee compensation. Local taxes should not be withheld from non-employee compensation. However, if you

did withhold in error, please record amount in Column 6.

Under penalties of perjury, I declare that I have examined this return, including accompanying documents and to the best of my knowledge and belief, it is

true, correct and complete.

SIGNATURE______________________________________________________________________

DATE___________________________

PRINT NAME________________________________________ TITLE________________________

We will not accept Federal Form 1099 MISC unless accompanied by a statement signed by you certifying that ALL monies reported were paid for work

performed 100% within the City of Louisville or Jefferson County Limits.

Additional 1099-SF forms are available upon request from this agency or you may submit the requested information on a separate sheet providing the same

indicated format is followed.

REPORTING NON-EMPLOYEE COMPENSATION PAYMENTS TO LOUISVILLE AND JEFFERSON COUNTY

DUE DATE FEBRUARY 28TH

Taxpayers making payments of $600.00 or more to persons other than

The Louisville/Jefferson County Revenue Commission will not accept reporting of this

employees, (i.e. non-employee compensation payments) for services performed

information on other forms unless all the information contained on 1099-SF is provided in

within Louisville and Jefferson County are responsible to maintain records of those

a similar format.

payments. The taxpayer making the payment will be responsible for completing

IMPORTANT

--

Persons receiving non-employee compensation payments for

Form 1099-SF.

Form 1099-SF is to be completed and submitted to the

services performed in Louisville and Jefferson County will be required to report and pay

Louisville/Jefferson County Revenue Commission, P.O. Box 35410, Louisville, KY

local tax on that income. Since many persons receiving this income are not aware of the

40232-5410 by February 28 of the year following the close of the calendar year in

local tax requirements, we ask that you advise them to contact the Louisville/Jefferson

which the non-employee compensation was paid.

County Revenue Commission to obtain a local tax reporting number and tax forms.

Businesses that make “non-employee compensation” payments to more

Recipient’s failure to obtain a tax number and file the proper tax forms can result in

substantial penalties, fines, and court costs.

than 100 individuals may comply with this reporting requirement by submitting

copies of Federal Form 1099 MISC for all payments over $600.00 made to

individuals with addresses in Jefferson County, Kentucky. Such businesses are not

NOTE: Federal and State Governments also have requirements regarding reporting of

required to identify services performed in Jefferson County.

non-employee compensation.

For information pertaining to Federal and State

requirements, please contact the Internal Revenue Service and the appropriate State

Authority.

Form 1099-SF is to be used exclusively for the purpose of reporting non-

employee compensation payments to the Louisville/Jefferson County Revenue

Your cooperation in this matter will be greatly appreciated.

Commission, tax collection agent for Louisville and Jefferson County, Kentucky.

REVISED: 10/20/1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2