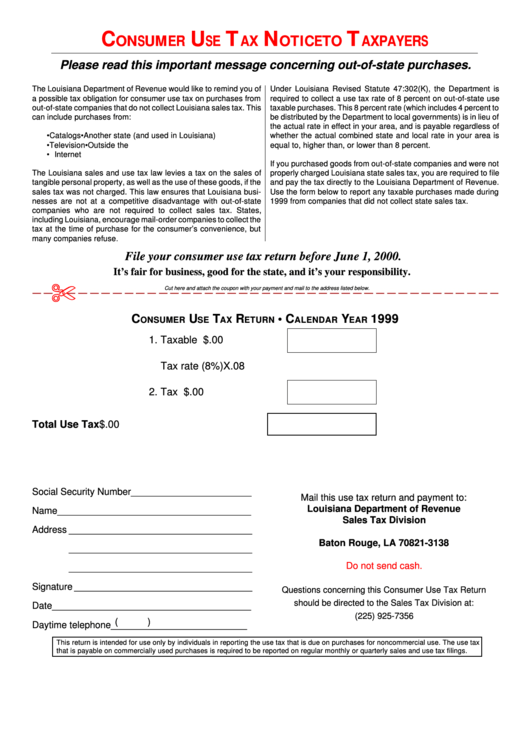

Coupon - 1999 Consumer Use Tax Return - - La Department Of Revenue

ADVERTISEMENT

C

U

T

N

T

ONSUMER

SE

AX

OTICE TO

AXPAYERS

Please read this important message concerning out-of-state purchases.

The Louisiana Department of Revenue would like to remind you of

Under Louisiana Revised Statute 47:302(K), the Department is

a possible tax obligation for consumer use tax on purchases from

required to collect a use tax rate of 8 percent on out-of-state use

out-of-state companies that do not collect Louisiana sales tax. This

taxable purchases. This 8 percent rate (which includes 4 percent to

can include purchases from:

be distributed by the Department to local governments) is in lieu of

the actual rate in effect in your area, and is payable regardless of

• Catalogs

• Another state (and used in Louisiana)

whether the actual combined state and local rate in your area is

• Television

• Outside the U.S.

equal to, higher than, or lower than 8 percent.

• Internet

If you purchased goods from out-of-state companies and were not

The Louisiana sales and use tax law levies a tax on the sales of

properly charged Louisiana state sales tax, you are required to file

tangible personal property, as well as the use of these goods, if the

and pay the tax directly to the Louisiana Department of Revenue.

sales tax was not charged. This law ensures that Louisiana busi-

Use the form below to report any taxable purchases made during

nesses are not at a competitive disadvantage with out-of-state

1999 from companies that did not collect state sales tax.

companies who are not required to collect sales tax. States,

including Louisiana, encourage mail-order companies to collect the

tax at the time of purchase for the consumer’s convenience, but

many companies refuse.

File your consumer use tax return before June 1, 2000.

It’s fair for business, good for the state, and it’s your responsibility.

Cut here and attach the coupon with your payment and mail to the address listed below.

C

U

T

R

• C

Y

1999

ONSUMER

SE

AX

ETURN

ALENDAR

EAR

1. Taxable purchases ........ 1 $

.00

Tax rate (8%)

X .08

2. Tax owed....................... 2 $

.00

Total Use Tax ......................................................... $

.00

Social Security Number _______________________

Mail this use tax return and payment to:

Louisiana Department of Revenue

Name _____________________________________

Sales Tax Division

Address ___________________________________

P.O. Box 3138

Baton Rouge, LA 70821-3138

Address

___________________________________

Do not send cash.

Address

___________________________________

Signature __________________________________

Questions concerning this Consumer Use Tax Return

should be directed to the Sales Tax Division at:

Date ______________________________________

(225) 925-7356

(

)

Daytime telephone __________________________

This return is intended for use only by individuals in reporting the use tax that is due on purchases for noncommercial use. The use tax

that is payable on commercially used purchases is required to be reported on regular monthly or quarterly sales and use tax filings.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1