Form Op-300 - Tobacco Products Tax Return - Connecticut Department Of Revenue Services

ADVERTISEMENT

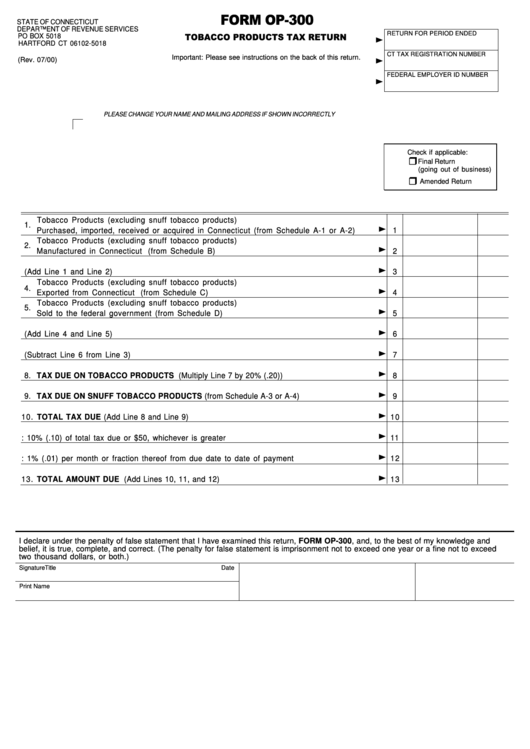

FORM OP-300

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

RETURN FOR PERIOD ENDED

TOBACCO PRODUCTS TAX RETURN

<

PO BOX 5018

HARTFORD CT 06102-5018

CT TAX REGISTRATION NUMBER

<

Important: Please see instructions on the back of this return.

(Rev. 07/00)

FEDERAL EMPLOYER ID NUMBER

<

PLEASE CHANGE YOUR NAME AND MAILING ADDRESS IF SHOWN INCORRECTLY

Check if applicable:

H

Final Return

(going out of business)

H

Amended Return

Tobacco Products (excluding snuff tobacco products)

<

1.

Purchased, imported, received or acquired in Connecticut (from Schedule A-1 or A-2)

1

Tobacco Products (excluding snuff tobacco products)

<

2.

Manufactured in Connecticut (from Schedule B)

2

<

3. Subtotal (Add Line 1 and Line 2)

3

Tobacco Products (excluding snuff tobacco products)

<

4.

Exported from Connecticut (from Schedule C)

4

Tobacco Products (excluding snuff tobacco products)

<

5.

Sold to the federal government (from Schedule D)

5

<

6. Subtotal (Add Line 4 and Line 5)

6

<

7. Amount subject to tax (Subtract Line 6 from Line 3)

7

<

8. TAX DUE ON TOBACCO PRODUCTS (Multiply Line 7 by 20% (.20))

8

<

9. TAX DUE ON SNUFF TOBACCO PRODUCTS (from Schedule A-3 or A-4)

9

<

10. TOTAL TAX DUE (Add Line 8 and Line 9)

10

<

11. PENALTY: 10% (.10) of total tax due or $50, whichever is greater

11

<

12. INTEREST: 1% (.01) per month or fraction thereof from due date to date of payment

12

<

13. TOTAL AMOUNT DUE (Add Lines 10, 11, and 12)

13

I declare under the penalty of false statement that I have examined this return, FORM OP-300, and, to the best of my knowledge and

belief, it is true, complete, and correct. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed

two thousand dollars, or both.)

Signature

Title

Date

Print Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1