Form 150-310-020 - Application For Cancellation Of Assessment On Commercial Facilities Under Construction

ADVERTISEMENT

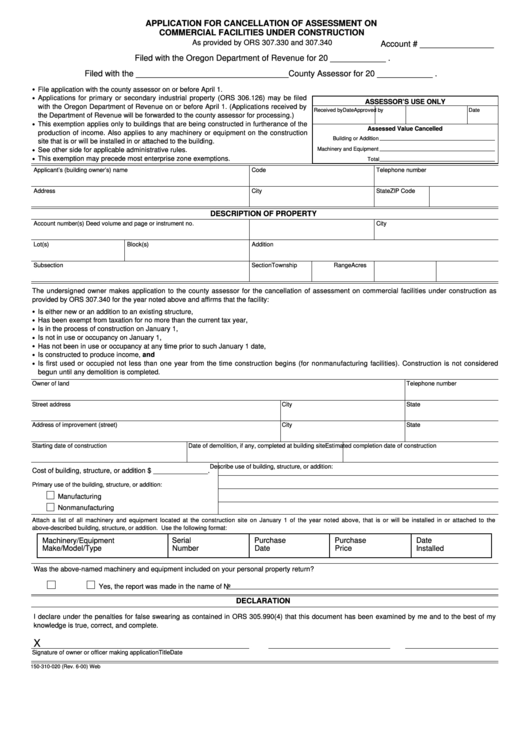

APPLICATION FOR CANCELLATION OF ASSESSMENT ON

COMMERCIAL FACILITIES UNDER CONSTRUCTION

As provided by ORS 307.330 and 307.340

Account # ________________

Filed with the Oregon Department of Revenue for 20 ____________ .

Filed with the _________________________________County Assessor for 20 ____________ .

•

File application with the county assessor on or before April 1.

•

Applications for primary or secondary industrial property (ORS 306.126) may be filed

ASSESSOR’S USE ONLY

with the Oregon Department of Revenue on or before April 1. (Applications received by

Received by

Date

Approved by

Date

the Department of Revenue will be forwarded to the county assessor for processing.)

•

This exemption applies only to buildings that are being constructed in furtherance of the

Assessed Value Cancelled

production of income. Also applies to any machinery or equipment on the construction

Building or Addition

site that is or will be installed in or attached to the building.

Machinery and Equipment

•

See other side for applicable administrative rules.

•

This exemption may precede most enterprise zone exemptions.

Total

Applicant’s (building owner’s) name

Code

Telephone number

Address

City

State

ZIP Code

DESCRIPTION OF PROPERTY

Account number(s)

Deed volume and page or instrument no.

City

Lot(s)

Block(s)

Addition

Subsection

Section

Township

Range

Acres

The undersigned owner makes application to the county assessor for the cancellation of assessment on commercial facilities under construction as

provided by ORS 307.340 for the year noted above and affirms that the facility:

•

Is either new or an addition to an existing structure,

•

Has been exempt from taxation for no more than the current tax year,

•

Is in the process of construction on January 1,

•

Is not in use or occupancy on January 1,

•

Has not been in use or occupancy at any time prior to such January 1 date,

•

Is constructed to produce income, and

•

Is first used or occupied not less than one year from the time construction begins (for nonmanufacturing facilities). Construction is not considered

begun until any demolition is completed.

Owner of land

Telephone number

Street address

City

State

Address of improvement (street)

City

State

Starting date of construction

Date of demolition, if any, completed at building site

Estimated completion date of construction

Describe use of building, structure, or addition:

Cost of building, structure, or addition $ ______________.

Primary use of the building, structure, or addition:

Manufacturing

Nonmanufacturing

Attach a list of all machinery and equipment located at the construction site on January 1 of the year noted above, that is or will be installed in or attached to the

above-described building, structure, or addition. Use the following format:

Machinery/Equipment

Serial

Purchase

Purchase

Date

Make/Model/Type

Number

Date

Price

Installed

Was the above-named machinery and equipment included on your personal property return?

No

Yes, the report was made in the name of

DECLARATION

I declare under the penalties for false swearing as contained in ORS 305.990(4) that this document has been examined by me and to the best of my

knowledge is true, correct, and complete.

X

Signature of owner or officer making application

Title

Date

150-310-020 (Rev. 6-00) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1