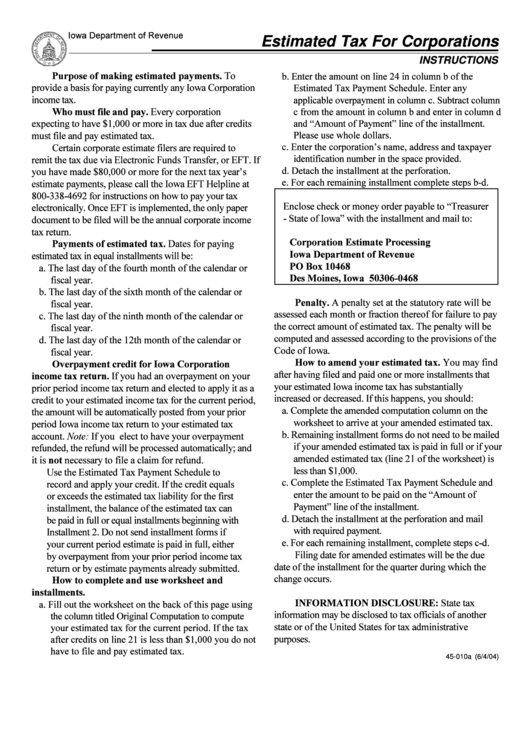

Instructions And Worksheet For Estimated Tax For Corporation - Iowa Department Of Revenue

ADVERTISEMENT

Iowa Department of Revenue

Estimated Tax For Corporations

INSTRUCTIONS

Purpose of making estimated payments.

b. Enter the amount on line 24 in column b of the

Estimated Tax Payment Schedule. Enter any

applicable overpayment in column c. Subtract column

Who must file and pay.

c from the amount in column b and enter in column d

and “Amount of Payment” line of the installment.

Please use whole dollars.

c. Enter the corporation’s name, address and taxpayer

identification number in the space provided.

d. Detach the installment at the perforation.

e. For each remaining installment complete steps b-d.

Corporation Estimate Processing

Payments of estimated tax.

Iowa Department of Revenue

PO Box 10468

Des Moines, Iowa 50306-0468

Penalty.

How to amend your estimated tax.

Overpayment credit for Iowa Corporation

income tax return.

Note:

not

How to complete and use worksheet and

installments.

INFORMATION DISCLOSURE:

a. Fill out the worksheet on the back of this page using

the column titled Original Computation to compute

your estimated tax for the current period. If the tax

after credits on line 21 is less than $1,000 you do not

have to file and pay estimated tax.

45-010a (6/4/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2