Form Dr-142es - Declaration/installment Payment Of Estimated Solid Mineral Severance Tax

ADVERTISEMENT

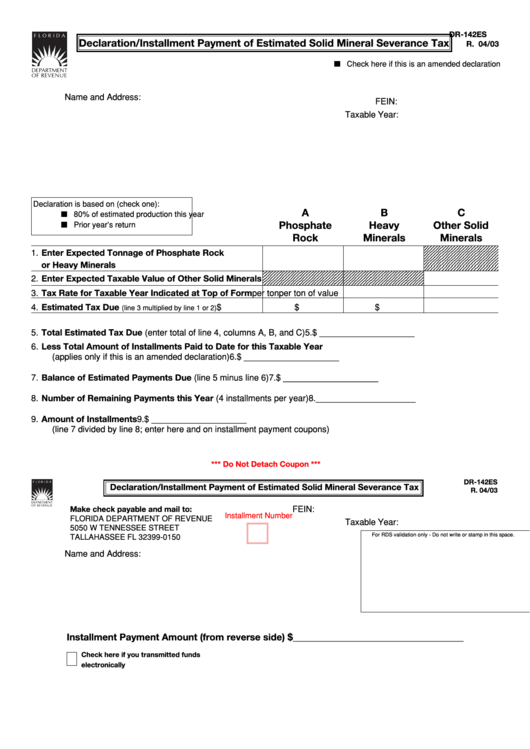

DR-142ES

Declaration/Installment Payment of Estimated Solid Mineral Severance Tax

R. 04/03

■ ■

Check here if this is an amended declaration

Name and Address:

FEIN:

Taxable Year:

Declaration is based on (check one):

A

B

C

■ ■

80% of estimated production this year

■ ■

Phosphate

Heavy

Other Solid

Prior year’s return

Rock

Minerals

Minerals

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1. Enter Expected Tonnage of Phosphate Rock

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

or Heavy Minerals

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

2. Enter Expected Taxable Value of Other Solid Minerals

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4

3. Tax Rate for Taxable Year Indicated at Top of Form

per ton

per ton

of value

4. Estimated Tax Due

$

$

$

(line 3 multiplied by line 1 or 2)

5. Total Estimated Tax Due (enter total of line 4, columns A, B, and C)

5. $ ____________________

6. Less Total Amount of Installments Paid to Date for this Taxable Year

(applies only if this is an amended declaration)

6. $ ____________________

7. Balance of Estimated Payments Due (line 5 minus line 6)

7. $ ____________________

8. Number of Remaining Payments this Year (4 installments per year)

8.

_____________________

9. Amount of Installments

9. $ ____________________

(line 7 divided by line 8; enter here and on installment payment coupons)

*** Do Not Detach Coupon ***

DR-142ES

Declaration/Installment Payment of Estimated Solid Mineral Severance Tax

R. 04/03

FEIN:

Make check payable and mail to:

Installment Number

FLORIDA DEPARTMENT OF REVENUE

Taxable Year:

5050 W TENNESSEE STREET

For RDS validation only - Do not write or stamp in this space.

TALLAHASSEE FL 32399-0150

Name and Address:

Installment Payment Amount (from reverse side) $ ____________________________________

Check here if you transmitted funds

electronically

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4