Form 5500 Schedule A Instructions - Insurance Information - 2002

ADVERTISEMENT

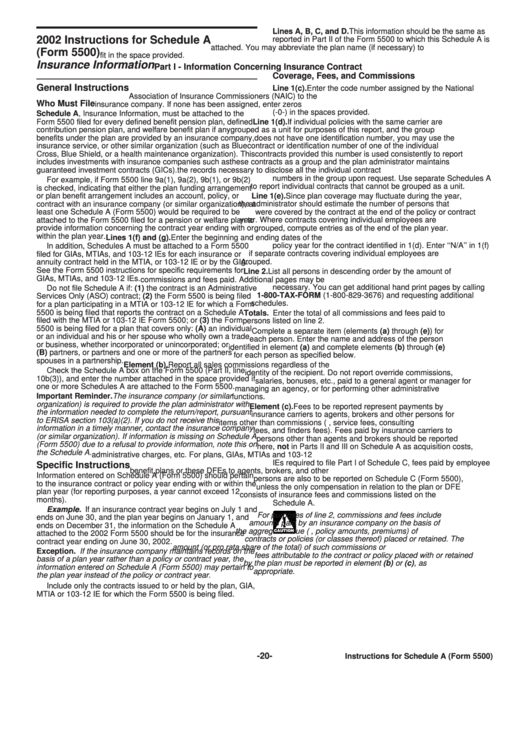

Lines A, B, C, and D. This information should be the same as

2002 Instructions for Schedule A

reported in Part II of the Form 5500 to which this Schedule A is

attached. You may abbreviate the plan name (if necessary) to

(Form 5500)

fit in the space provided.

Insurance Information

Part I - Information Concerning Insurance Contract

Coverage, Fees, and Commissions

General Instructions

Line 1(c). Enter the code number assigned by the National

Association of Insurance Commissioners (NAIC) to the

Who Must File

insurance company. If none has been assigned, enter zeros

(-0-) in the spaces provided.

Schedule A, Insurance Information, must be attached to the

Form 5500 filed for every defined benefit pension plan, defined

Line 1(d). If individual policies with the same carrier are

contribution pension plan, and welfare benefit plan if any

grouped as a unit for purposes of this report, and the group

benefits under the plan are provided by an insurance company,

does not have one identification number, you may use the

insurance service, or other similar organization (such as Blue

contract or identification number of one of the individual

Cross, Blue Shield, or a health maintenance organization). This

contracts provided this number is used consistently to report

includes investments with insurance companies such as

these contracts as a group and the plan administrator maintains

guaranteed investment contracts (GICs).

the records necessary to disclose all the individual contract

numbers in the group upon request. Use separate Schedules A

For example, if Form 5500 line 9a(1), 9a(2), 9b(1), or 9b(2)

to report individual contracts that cannot be grouped as a unit.

is checked, indicating that either the plan funding arrangement

or plan benefit arrangement includes an account, policy, or

Line 1(e). Since plan coverage may fluctuate during the year,

the administrator should estimate the number of persons that

contract with an insurance company (or similar organization), at

least one Schedule A (Form 5500) would be required to be

were covered by the contract at the end of the policy or contract

attached to the Form 5500 filed for a pension or welfare plan to

year. Where contracts covering individual employees are

grouped, compute entries as of the end of the plan year.

provide information concerning the contract year ending with or

within the plan year.

Lines 1(f) and (g). Enter the beginning and ending dates of the

policy year for the contract identified in 1(d). Enter ‘‘N/A’’ in 1(f)

In addition, Schedules A must be attached to a Form 5500

if separate contracts covering individual employees are

filed for GIAs, MTIAs, and 103-12 IEs for each insurance or

grouped.

annuity contract held in the MTIA, or 103-12 IE or by the GIA.

See the Form 5500 instructions for specific requirements for

Line 2. List all persons in descending order by the amount of

GIAs, MTIAs, and 103-12 IEs.

commissions and fees paid. Additional pages may be

necessary. You can get additional hand print pages by calling

Do not file Schedule A if: (1) the contract is an Administrative

1-800-TAX-FORM (1-800-829-3676) and requesting additional

Services Only (ASO) contract; (2) the Form 5500 is being filed

schedules.

for a plan participating in a MTIA or 103-12 IE for which a Form

5500 is being filed that reports the contract on a Schedule A

Totals. Enter the total of all commissions and fees paid to

filed with the MTIA or 103-12 IE Form 5500; or (3) the Form

persons listed on line 2.

5500 is being filed for a plan that covers only: (A) an individual

Complete a separate item (elements (a) through (e)) for

or an individual and his or her spouse who wholly own a trade

each person. Enter the name and address of the person

or business, whether incorporated or unincorporated; or

identified in element (a) and complete elements (b) through (e)

(B) partners, or partners and one or more of the partners’

for each person as specified below.

spouses in a partnership.

Element (b). Report all sales commissions regardless of the

Check the Schedule A box on the Form 5500 (Part II, line

identity of the recipient. Do not report override commissions,

10b(3)), and enter the number attached in the space provided if

salaries, bonuses, etc., paid to a general agent or manager for

one or more Schedules A are attached to the Form 5500.

managing an agency, or for performing other administrative

Important Reminder. The insurance company (or similar

functions.

organization) is required to provide the plan administrator with

Element (c). Fees to be reported represent payments by

the information needed to complete the return/report, pursuant

insurance carriers to agents, brokers and other persons for

to ERISA section 103(a)(2). If you do not receive this

items other than commissions (e.g., service fees, consulting

information in a timely manner, contact the insurance company

fees, and finders fees). Fees paid by insurance carriers to

(or similar organization). If information is missing on Schedule A

persons other than agents and brokers should be reported

(Form 5500) due to a refusal to provide information, note this on

here, not in Parts II and III on Schedule A as acquisition costs,

the Schedule A.

administrative charges, etc. For plans, GIAs, MTIAs and 103-12

IEs required to file Part I of Schedule C, fees paid by employee

Specific Instructions

benefit plans or these DFEs to agents, brokers, and other

Information entered on Schedule A (Form 5500) should pertain

persons are also to be reported on Schedule C (Form 5500),

to the insurance contract or policy year ending with or within the

unless the only compensation in relation to the plan or DFE

plan year (for reporting purposes, a year cannot exceed 12

consists of insurance fees and commissions listed on the

months).

Schedule A.

Example. If an insurance contract year begins on July 1 and

For purposes of line 2, commissions and fees include

ends on June 30, and the plan year begins on January 1, and

!

amounts paid by an insurance company on the basis of

ends on December 31, the information on the Schedule A

the aggregate value (e.g., policy amounts, premiums) of

CAUTION

attached to the 2002 Form 5500 should be for the insurance

contracts or policies (or classes thereof) placed or retained. The

contract year ending on June 30, 2002.

amount (or pro rata share of the total) of such commissions or

Exception. If the insurance company maintains records on the

fees attributable to the contract or policy placed with or retained

basis of a plan year rather than a policy or contract year, the

by the plan must be reported in element (b) or (c), as

information entered on Schedule A (Form 5500) may pertain to

appropriate.

the plan year instead of the policy or contract year.

Include only the contracts issued to or held by the plan, GIA,

MTIA or 103-12 IE for which the Form 5500 is being filed.

-20-

Instructions for Schedule A (Form 5500)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2