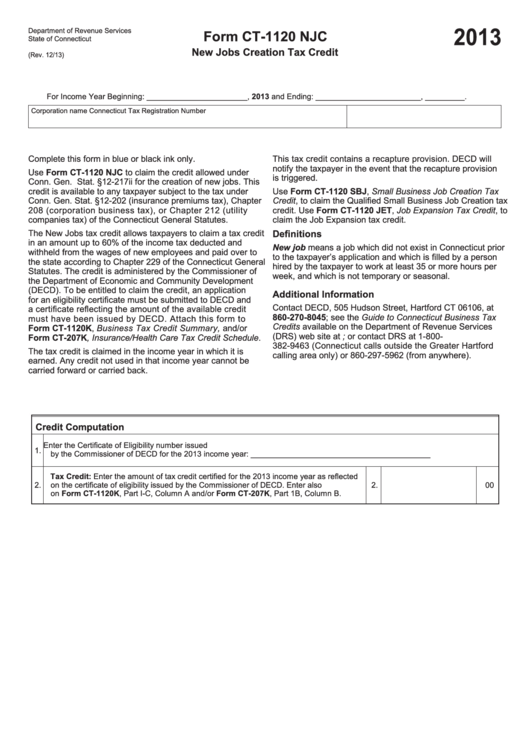

Form Ct-1120 Njc - New Jobs Creation Tax Credit - 2013

ADVERTISEMENT

2013

Department of Revenue Services

Form CT-1120 NJC

State of Connecticut

New Jobs Creation Tax Credit

(Rev. 12/13)

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

This tax credit contains a recapture provision. DECD will

notify the taxpayer in the event that the recapture provision

Use Form CT-1120 NJC to claim the credit allowed under

is triggered.

Conn. Gen. Stat. §12-217ii for the creation of new jobs. This

credit is available to any taxpayer subject to the tax under

Use Form CT-1120 SBJ, Small Business Job Creation Tax

Conn. Gen. Stat. §12-202 (insurance premiums tax), Chapter

Credit, to claim the Qualified Small Business Job Creation tax

208 (corporation business tax), or Chapter 212 (utility

credit. Use Form CT-1120 JET, Job Expansion Tax Credit, to

companies tax) of the Connecticut General Statutes.

claim the Job Expansion tax credit.

The New Jobs tax credit allows taxpayers to claim a tax credit

Definitions

in an amount up to 60% of the income tax deducted and

New job means a job which did not exist in Connecticut prior

withheld from the wages of new employees and paid over to

to the taxpayer’s application and which is filled by a person

the state according to Chapter 229 of the Connecticut General

hired by the taxpayer to work at least 35 or more hours per

Statutes. The credit is administered by the Commissioner of

week, and which is not temporary or seasonal.

the Department of Economic and Community Development

(DECD). To be entitled to claim the credit, an application

Additional Information

for an eligibility certificate must be submitted to DECD and

Contact DECD, 505 Hudson Street, Hartford CT 06106, at

a certificate reflecting the amount of the available credit

860-270-8045; see the Guide to Connecticut Business Tax

must have been issued by DECD. Attach this form to

Credits available on the Department of Revenue Services

Form CT-1120K, Business Tax Credit Summary, and/or

(DRS) web site at or contact DRS at 1-800-

Form CT-207K, Insurance/Health Care Tax Credit Schedule.

382-9463 (Connecticut calls outside the Greater Hartford

The tax credit is claimed in the income year in which it is

calling area only) or 860-297-5962 (from anywhere).

earned. Any credit not used in that income year cannot be

carried forward or carried back.

Credit Computation

Enter the Certificate of Eligibility number issued

1.

by the Commissioner of DECD for the 2013 income year: _________________________________________

Tax Credit: Enter the amount of tax credit certified for the 2013 income year as reflected

2.

on the certificate of eligibility issued by the Commissioner of DECD. Enter also

2.

00

on Form CT-1120K, Part I-C, Column A and/or Form CT-207K, Part 1B, Column B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1