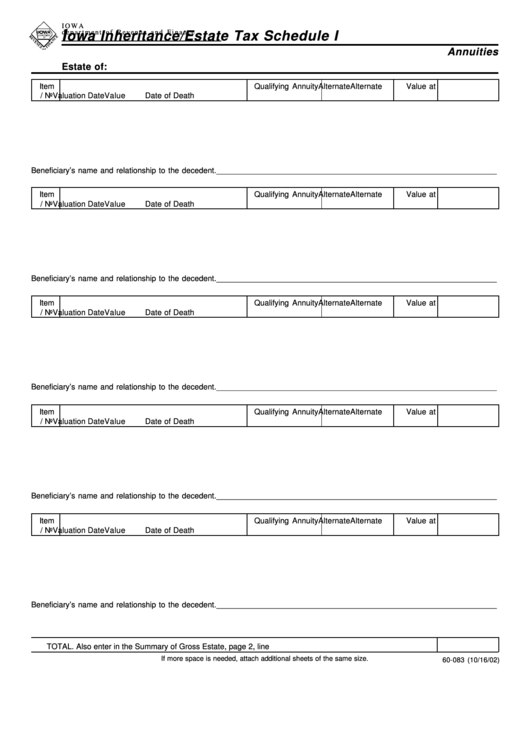

Form 60-083 - Iowa Inheritance/estate Tax Schedule I

ADVERTISEMENT

I O WA

d e p a r t m e n t o f R e ve n u e a n d F i n a n c e

I

owa Inheritance/Estate Tax Schedule I

Annuities

Estate of:

Item

Qualifying Annuity

Alternate

Alternate

Value at

No.

Description of Annuity

Yes / No

Valuation Date

Value

Date of Death

Beneficiary’s name and relationship to the decedent. ________________________________________________________________

Item

Qualifying Annuity

Alternate

Alternate

Value at

No.

Description of Annuity

Yes / No

Valuation Date

Value

Date of Death

Beneficiary’s name and relationship to the decedent. ________________________________________________________________

Item

Qualifying Annuity

Alternate

Alternate

Value at

No.

Description of Annuity

Yes / No

Valuation Date

Value

Date of Death

Beneficiary’s name and relationship to the decedent. ________________________________________________________________

Item

Qualifying Annuity

Alternate

Alternate

Value at

No.

Description of Annuity

Yes / No

Valuation Date

Value

Date of Death

Beneficiary’s name and relationship to the decedent. ________________________________________________________________

Item

Qualifying Annuity

Alternate

Alternate

Value at

No.

Description of Annuity

Yes / No

Valuation Date

Value

Date of Death

Beneficiary’s name and relationship to the decedent. ________________________________________________________________

TOTAL. Also enter in the Summary of Gross Estate, page 2, line 35. .....................................................................

If more space is needed, attach additional sheets of the same size.

60-083 (10/16/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1