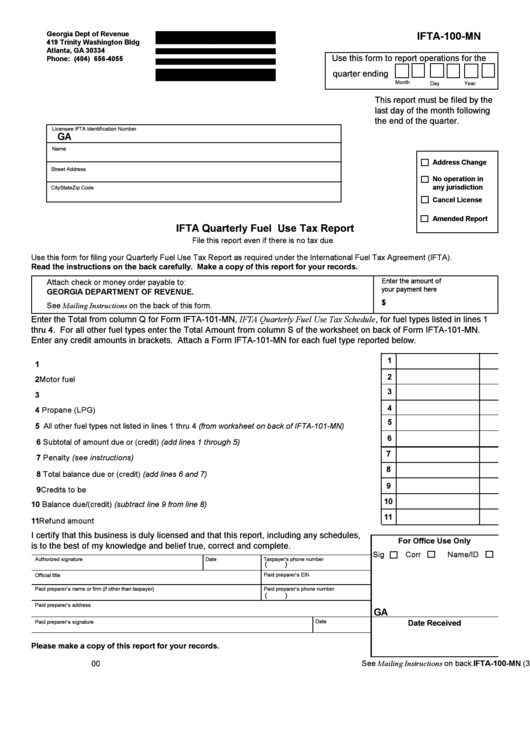

Form Ifta-100-Mn - Ifta Quarterly Fuel Use Tax Report - 2000

ADVERTISEMENT

Georgia Dept of Revenue

IFTA-100-MN

419 Trinity Washington Bldg

Atlanta, GA 30334

Use this form to report operations for the

Phone: (404) 656-4055

quarter ending

Month

Day

Year

This report must be filed by the

last day of the month following

the end of the quarter.

Licensee IFTA Identification Number

GA

Name

Address Change

Street Address

No operation in

any jurisdiction

City

State

Zip Code

Cancel License

Amended Report

IFTA Quarterly Fuel Use Tax Report

File this report even if there is no tax due.

Use this form for filing your Quarterly Fuel Use Tax Report as required under the International Fuel Tax Agreement (IFTA).

Read the instructions on the back carefully. Make a copy of this report for your records.

Enter the amount of

Attach check or money order payable to:

your payment here

GEORGIA DEPARTMENT OF REVENUE.

$

See Mailing Instructions on the back of this form.

Enter the Total from column Q for Form IFTA-101-MN, IFTA Quarterly Fuel Use Tax Schedule, for fuel types listed in lines 1

thru 4. For all other fuel types enter the Total Amount from column S of the worksheet on back of Form IFTA-101-MN.

Enter any credit amounts in brackets. Attach a Form IFTA-101-MN for each fuel type reported below.

1

1 Diesel..........................................................................................................................................

2

2 Motor fuel gasoline......................................................................................................................

3

3 Ethanol.......................................................................................................................................

4

4 Propane (LPG)............................................................................................................................

5

5 All other fuel types not listed in lines 1 thru 4 (from worksheet on back of IFTA-101-MN).............

6

6 Subtotal of amount due or (credit) (add lines 1 through 5)............................................................

7

7 Penalty (see instructions)............................................................................................................

8

8 Total balance due or (credit) (add lines 6 and 7)...........................................................................

9

9 Credits to be applied....................................................................................................................

10

10 Balance due/(credit) (subtract line 9 from line 8)...........................................................................

11

11 Refund amount requested............................................................................................................

I certify that this business is duly licensed and that this report, including any schedules,

For Office Use Only

is to the best of my knowledge and belief true, correct and complete.

Sig

Corr

Name/ID

Authorized signature

Date

Taxpayer’s phone number

(

)

Paid preparer’s EIN

Official title

Paid preparer’s name or firm (if other than taxpayer)

Paid preparer’s phone number

(

)

Paid preparer’s address

GA

Date

Paid preparer’s signature

Date Received

Please make a copy of this report for your records.

IFTA-100-MN (3/99) (rev. 12/00)

00

See Mailing Instructions on back.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1