Print and Reset Form

Reset Form

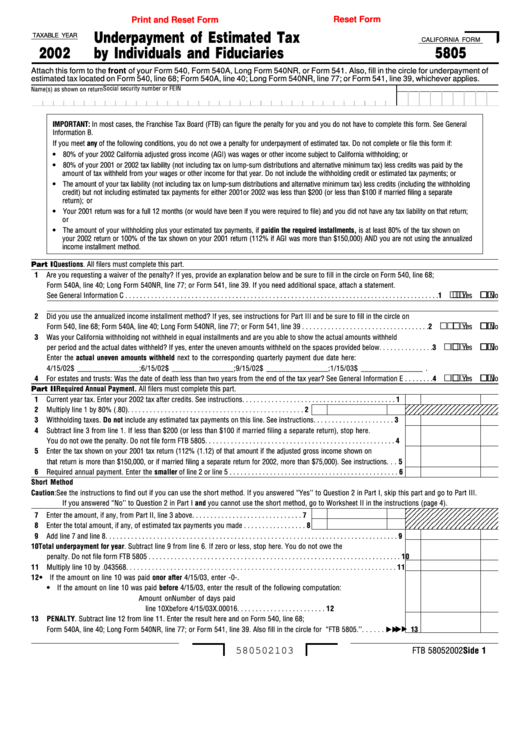

Underpayment of Estimated Tax

TAXABLE YEAR

CALIFORNIA FORM

2002

by Individuals and Fiduciaries

5805

Attach this form to the front of your Form 540, Form 540A, Long Form 540NR, or Form 541. Also, fill in the circle for underpayment of

estimated tax located on Form 540, line 68; Form 540A, line 40; Long Form 540NR, line 77; or Form 541, line 39, whichever applies.

Social security number or FEIN

Name(s) as shown on return

IMPORTANT: In most cases, the Franchise Tax Board (FTB) can figure the penalty for you and you do not have to complete this form. See General

Information B.

If you meet any of the following conditions, you do not owe a penalty for underpayment of estimated tax. Do not complete or file this form if:

• 80% of your 2002 California adjusted gross income (AGI) was wages or other income subject to California withholding; or

• 80% of your 2001 or 2002 tax liability (not including tax on lump-sum distributions and alternative minimum tax) less credits was paid by the

amount of tax withheld from your wages or other income for that year. Do not include the withholding credit or estimated tax payments; or

• The amount of your tax liability (not including tax on lump-sum distributions and alternative minimum tax) less credits (including the withholding

credit) but not including estimated tax payments for either 2001or 2002 was less than $200 (or less than $100 if married filing a separate

return); or

• Your 2001 return was for a full 12 months (or would have been if you were required to file) and you did not have any tax liability on that return;

or

• The amount of your withholding plus your estimated tax payments, if paid in the required installments, is at least 80% of the tax shown on

your 2002 return or 100% of the tax shown on your 2001 return (112% if AGI was more than $150,000) AND you are not using the annualized

income installment method.

Part I Questions. All filers must complete this part.

1

Are you requesting a waiver of the penalty? If yes, provide an explanation below and be sure to fill in the circle on Form 540, line 68;

Form 540A, line 40; Long Form 540NR, line 77; or Form 541, line 39. If you need additional space, attach a statement.

See General Information C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Yes

No

2

Did you use the annualized income installment method? If yes, see instructions for Part III and be sure to fill in the circle on

Form 540, line 68; Form 540A, line 40; Long Form 540NR, line 77; or Form 541, line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Yes

No

3

Was your California withholding not withheld in equal installments and are you able to show the actual amounts withheld

per period and the actual dates withheld? If yes, enter the uneven amounts withheld on the spaces provided below. . . . . . . . . . . . . . . 3

Yes

No

Enter the actual uneven amounts withheld next to the corresponding quarterly payment due date here:

4/15/02 $ ________________; 6/15/02 $ ________________; 9/15/02 $ ________________; 1/15/03 $ ________________ .

4

For estates and trusts: Was the date of death less than two years from the end of the tax year? See General Information E . . . . . . . . 4

Yes

No

Part II Required Annual Payment. All filers must complete this part.

1

Current year tax. Enter your 2002 tax after credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

2

Multiply line 1 by 80% (.80) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

3

Withholding taxes. Do not include any estimated tax payments on this line. See instructions . . . . . . . . . . . . . . . . . . . . . .

3

4

Subtract line 3 from line 1. If less than $200 (or less than $100 if married filing a separate return), stop here.

You do not owe the penalty. Do not file form FTB 5805 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Enter the tax shown on your 2001 tax return (112% (1.12) of that amount if the adjusted gross income shown on

that return is more than $150,000, or if married filing a separate return for 2002, more than $75,000). See instructions . . .

5

6

Required annual payment. Enter the smaller of line 2 or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Short Method

Caution: See the instructions to find out if you can use the short method. If you answered “Yes’’ to Question 2 in Part I, skip this part and go to Part III.

If you answered “No’’ to Question 2 in Part I and you cannot use the short method, go to Worksheet II in the instructions (page 4).

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

7

Enter the amount, if any, from Part II, line 3 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

8

Enter the total amount, if any, of estimated tax payments you made . . . . . . . . . . . . . . . . .

8

9

Add line 7 and line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10

Total underpayment for year. Subtract line 9 from line 6. If zero or less, stop here. You do not owe the

penalty. Do not file form FTB 5805 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Multiply line 10 by .043568 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

• If the amount on line 10 was paid on or after 4/15/03, enter -0-.

• If the amount on line 10 was paid before 4/15/03, enter the result of the following computation:

Amount on

Number of days paid

line 10

X

before 4/15/03

X

.00016 . . . . . . . . . . . . . . . . . . . . . . . .

12

13

PENALTY. Subtract line 12 from line 11. Enter the result here and on Form 540, line 68;

Form 540A, line 40; Long Form 540NR, line 77; or Form 541, line 39. Also fill in the circle for “FTB 5805.’’ . . . . . .

13

580502103

FTB 5805 2002 Side 1

1

1 2

2 3

3