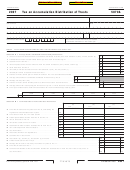

California Form 5870a - Tax On Accumulation Distribution Of Trusts - 2002 Page 2

ADVERTISEMENT

Part II Tax on Distributions of previously untaxed trust income under R&TC Section 17745 (b) and (d):

• If the income was accumulated over a period of five years or more, complete Section A.

• If the income was accumulated over a period of four years or less, complete Section B.

Section A — See instructions.

1 Income accumulated over five years or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 _________________

2 Divide line 1 by 6. Enter here and on Schedule CA (540 or 540NR), line 21f, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 _________________

(a)

(b)

(c)

(d)

(e)

2001

2000

1999

1998

1997

3 Were you a resident or part-year resident? Enter “Yes” or “No” for each year

3

(Answer “No” for nonresident years.)

4 Enter your taxable income before this distribution for the five immediately

preceding years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Enter the amount from line 2 in column (a) through column (e) . . . . . . . .

5

6 Recomputed taxable income. Add line 4 and line 5 . . . . . . . . . . . . . . . . . . .

6

7 Tax on amounts on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Tax before credits on line 4 income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Additional tax before credits. Subtract line 8 from line 7 . . . . . . . . . . . . . .

9

10 Tax credit adjustment. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Subtract line 10 from line 9. See instructions . . . . . . . . . . . . . . . . . . . . . . .

11

12 Alternative minimum tax adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Add line 11 and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Add line 13, column (a) through column (e) for all years that you entered “Yes” on line 3. Enter here and on Form 540, line 23;

Long Form 540NR, line 26; or Form 541, line 21b. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

Section B — See instructions.

1 Income accumulated over four years or less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 _________________

2 Averaging factor:

a Enter the number of years the trust accumulated the amount on line 1 . . . . . . . . . . . . . . . . . . . . . . . .

2a_________________

1

b Distribution year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b_________________

3 Add line 2a and line 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _________________

4 Divide line 1 by line 3. Enter here and on Schedule CA (540 or 540NR), line 21f, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 _________________

(a)

(b)

(c)

(d)

2001

2000

1999

1998

5

Were you a resident or part-year resident? Enter “Yes” or “No” for each year . . .

5

(Answer “No” for nonresident years.)

6 Enter your taxable income before this distribution for the number of

preceding years entered on line 2a. See instructions . . . . . . . . . . . . . . . . .

6

7 Enter the amount from line 4 in column (a) through column (d) . . . . . . . .

7

8 Recomputed taxable income. Add line 6 and line 7 . . . . . . . . . . . . . . . . . . .

8

9 Tax on amounts on line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Tax before credits on line 6 income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Additional tax before credits. Subtract line 10 from line 9 . . . . . . . . . . . . .

11

12 Tax credit adjustment. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Subtract line 12 from line 11. See instructions . . . . . . . . . . . . . . . . . . . . . .

13

14 Alternative minimum tax adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Add line 15, column (a) through column (d) for all years that you entered “Yes” on line 5. Enter here and on Form 540, line 23;

Long Form 540NR, line 26; or Form 541, line 21b. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Side 2 FTB 5870A 2002

5870A02204

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2