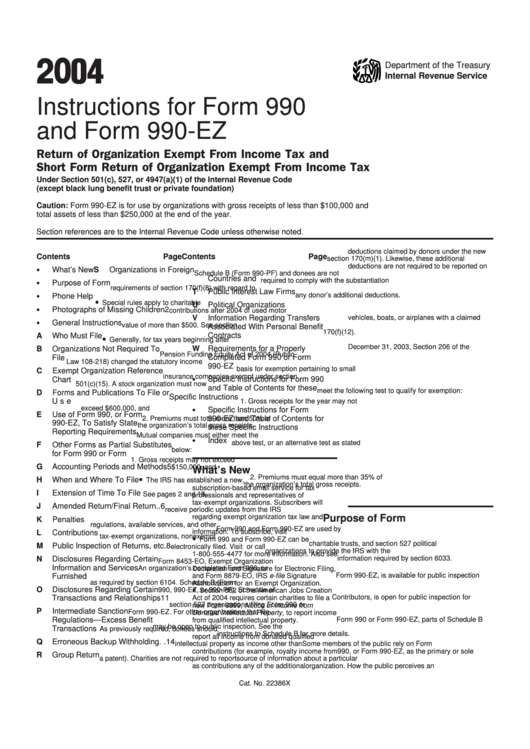

Instructions For Form 990 And Form 990-Ez - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 990

and Form 990-EZ

Return of Organization Exempt From Income Tax and

Short Form Return of Organization Exempt From Income Tax

Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except black lung benefit trust or private foundation)

Caution: Form 990-EZ is for use by organizations with gross receipts of less than $100,000 and

total assets of less than $250,000 at the end of the year.

Section references are to the Internal Revenue Code unless otherwise noted.

deductions claimed by donors under the new

Contents

Page

Contents

Page

section 170(m)(1). Likewise, these additional

deductions are not required to be reported on

•

What’s New . . . . . . . . . . . . . . .

1

S

Organizations in Foreign

Schedule B (Form 990-PF) and donees are not

Countries and U.S. Possessions

14

required to comply with the substantiation

•

Purpose of Form . . . . . . . . . . . .

1

requirements of section 170(f)(8) with regard to

T

Public Interest Law Firms . . . . . . 14

•

any donor’s additional deductions.

Phone Help . . . . . . . . . . . . . . . .

2

•

Special rules apply to charitable

U

Political Organizations . . . . . . . . 14

•

Photographs of Missing Children

2

contributions after 2004 of used motor

V

Information Regarding Transfers

vehicles, boats, or airplanes with a claimed

•

General Instructions . . . . . . . . . .

2

value of more than $500. See section

Associated With Personal Benefit

170(f)(12).

A

Who Must File . . . . . . . . . . . . . .

2

Contracts . . . . . . . . . . . . . . . . . 14

•

Generally, for tax years beginning after

December 31, 2003, Section 206 of the

B

Organizations Not Required To

W

Requirements for a Properly

Pension Funding Equity Act of 2004 (Public

File . . . . . . . . . . . . . . . . . . . . . .

3

Completed Form 990 or Form

Law 108-218) changed the statutory income

990-EZ . . . . . . . . . . . . . . . . . . . 14

basis for exemption pertaining to small

C

Exempt Organization Reference

insurance companies exempt under section

•

Chart . . . . . . . . . . . . . . . . . . . .

3

Specific Instructions for Form 990

501(c)(15). A stock organization must now

and Table of Contents for these

meet the following test to qualify for exemption:

D

Forms and Publications To File or

Specific Instructions . . . . . . . . . . 17

Use . . . . . . . . . . . . . . . . . . . . .

4

1. Gross receipts for the year may not

•

exceed $600,000, and

Specific Instructions for Form

E

Use of Form 990, or Form

990-EZ and Table of Contents for

2. Premiums must total more than 50% of

990-EZ, To Satisfy State

the organization’s total gross receipts.

these Specific Instructions . . . . . 36

Reporting Requirements . . . . . .

5

Mutual companies must either meet the

•

Index . . . . . . . . . . . . . . . . . . . . 45

above test, or an alternative test as stated

F

Other Forms as Partial Substitutes

below:

for Form 990 or Form 990-EZ . . .

5

1. Gross receipts may not exceed

G

Accounting Periods and Methods

5

$150,000, and

What’s New

•

2. Premiums must equal more than 35% of

H

When and Where To File . . . . . .

6

The IRS has established a new,

the organization’s total gross receipts.

subscription-based email service for tax

I

Extension of Time To File . . . . . .

6

See pages 2 and 19.

professionals and representatives of

tax-exempt organizations. Subscribers will

J

Amended Return/Final Return . .

6

receive periodic updates from the IRS

Purpose of Form

regarding exempt organization tax law and

K

Penalties . . . . . . . . . . . . . . . . .

6

regulations, available services, and other

Form 990 and Form 990-EZ are used by

information. To subscribe, visit

L

Contributions . . . . . . . . . . . . . . .

7

•

tax-exempt organizations, nonexempt

Form 990 and Form 990-EZ can be

charitable trusts, and section 527 political

M

Public Inspection of Returns, etc.

8

electronically filed. Visit or call

organizations to provide the IRS with the

1-800-555-4477 for more information. Also see

information required by section 6033.

N

Disclosures Regarding Certain

Form 8453-EO, Exempt Organization

Information and Services

An organization’s completed Form 990, or

Declaration and Signature for Electronic Filing,

Form 990-EZ, is available for public inspection

Furnished . . . . . . . . . . . . . . . . . 11

and Form 8879-EO, IRS e-file Signature

as required by section 6104. Schedule B (Form

Authorization for an Exempt Organization.

•

O

Disclosures Regarding Certain

990, 990-EZ, or 990-PF), Schedule of

Section 882 of the American Jobs Creation

Contributors, is open for public inspection for

Transactions and Relationships

11

Act of 2004 requires certain charities to file a

section 527 organizations filing Form 990 or

new Form 8899, Notice of Income from

P

Intermediate Sanction

Form 990-EZ. For other organizations that file

Donated Intellectual Property, to report income

Form 990 or Form 990-EZ, parts of Schedule B

Regulations — Excess Benefit

from qualified intellectual property.

may be open to public inspection. See the

Transactions . . . . . . . . . . . . . . . 11

As previously required, donees should

instructions to Schedule B for more details.

report all income from donated qualified

Q

Erroneous Backup Withholding . . 14

intellectual property as income other than

Some members of the public rely on Form

contributions (for example, royalty income from

990, or Form 990-EZ, as the primary or sole

R

Group Return . . . . . . . . . . . . . . 14

a patent). Charities are not required to report

source of information about a particular

as contributions any of the additional

organization. How the public perceives an

Cat. No. 22386X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46