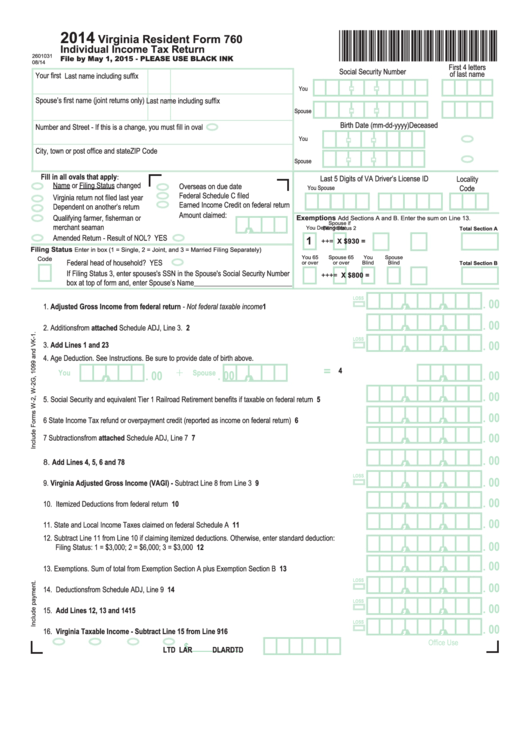

Form 760 - Virginia Resident Individual Income Tax Return - 2014

ADVERTISEMENT

2014

*VA0760114888*

Virginia Resident Form 760

Individual Income Tax Return

2601031

File by May 1, 2015 - PLEASE USE BLACK INK

08/14

First 4 letters

Social Security Number

of last name

Your first name

M.I.

Last name including suffix

-

-

You

Spouse’s first name (joint returns only) M.I.

Last name including suffix

-

-

Spouse

Birth Date (mm-dd-yyyy)

Deceased

Number and Street - If this is a change, you must fill in oval

-

-

You

City, town or post office and state

ZIP Code

-

-

Spouse

Fill in all ovals that apply:

Last 5 Digits of VA Driver’s License ID

Locality

Name or Filing Status changed

Overseas on due date

Code

You

Spouse

Federal Schedule C filed

Virginia return not filed last year

Earned Income Credit on federal return

Dependent on another’s return

Amount claimed:

Qualifying farmer, fisherman or

Exemptions

Add Sections A and B. Enter the sum on Line 13.

Spouse if

,

merchant seaman

Dependents

You

Filing Status 2

Total Section A

Amended Return - Result of NOL? YES

1

+

+

=

X $930 =

Filing Status

Enter in box (1 = Single, 2 = Joint, and 3 = Married Filing Separately)

You 65

Spouse 65

You

Spouse

Code

Federal head of household? YES

or over

or over

Blind

Blind

Total Section B

If Filing Status 3, enter spouses's SSN in the Spouse's Social Security Number

+

+

+

=

X $800 =

box at top of form and, enter Spouse’s Name

_______________________________

loss

00

,

,

.

1. Adjusted Gross Income from federal return - Not federal taxable income .......................................1

00

,

,

.

2. Additions from attached Schedule ADJ, Line 3. ...................................................................................2

loss

00

,

,

3. Add Lines 1 and 2 ................................................................................................................................3

.

4. Age Deduction. See Instructions. Be sure to provide date of birth above.

=

+

4

You

Spouse

00

00

00

,

,

,

.

.

.

00

,

,

.

5. Social Security and equivalent Tier 1 Railroad Retirement benefits if taxable on federal return ...........5

00

,

,

.

6

State Income Tax refund or overpayment credit (reported as income on federal return) ......................6

00

,

,

7

Subtractions from attached Schedule ADJ, Line 7 ...............................................................................7

.

00

,

,

.

8. Add Lines 4, 5, 6 and 7 ........................................................................................................................8

loss

00

,

,

.

9. Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3 ..............................................9

00

,

,

.

10. Itemized Deductions from federal return .............................................................................................10

00

,

,

.

11. State and Local Income Taxes claimed on federal Schedule A ........................................................... 11

12. Subtract Line 11 from Line 10 if claiming itemized deductions. Otherwise, enter standard deduction:

00

,

,

.

Filing Status: 1 = $3,000; 2 = $6,000; 3 = $3,000 ................................................................................12

00

,

,

.

13. Exemptions. Sum of total from Exemption Section A plus Exemption Section B .................................13

loss

00

,

,

.

14. Deductions from Schedule ADJ, Line 9 ...............................................................................................14

loss

00

,

,

.

15. Add Lines 12, 13 and 14 ....................................................................................................................15

loss

00

,

,

.

16. Virginia Taxable Income - Subtract Line 15 from Line 9 ................................................................16

Office Use

_________

$

LAR

DLAR

DTD

LTD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2