Instructions For Completing Wage Detail Report (Uia 1017)

ADVERTISEMENT

UIA 1017 (Rev. 8-09)

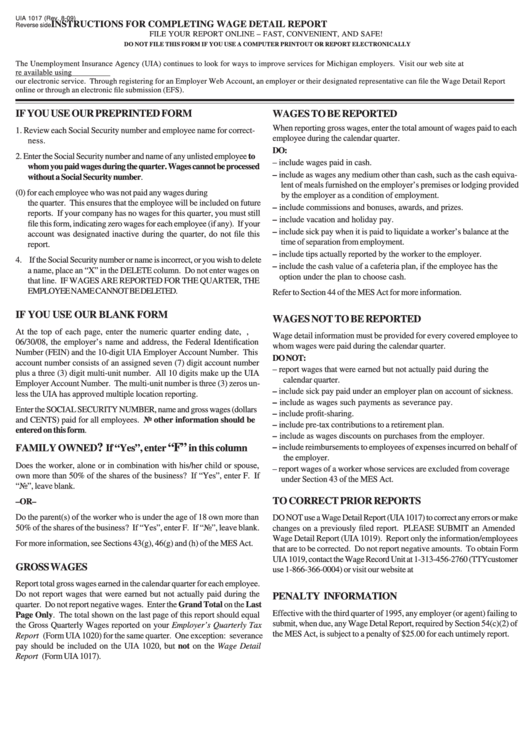

INSTRUCTIONS FOR COMPLETING WAGE DETAIL REPORT

Reverse side

FILE YOUR REPORT ONLINE – FAST, CONVENIENT, AND SAFE!

DO NOT FILE THIS FORM IF YOU USE A COMPUTER PRINTOUT OR REPORT ELECTRONICALLY

The Unemployment Insurance Agency (UIA) continues to look for ways to improve services for Michigan employers. Visit our web site at

to see how easy it is to reduce costs and paperwork by filing your Wage Detail Report online. Two options are available using

our electronic service. Through registering for an Employer Web Account, an employer or their designated representative can file the Wage Detail Report

online or through an electronic file submission (EFS).

IF YOU USE OUR PREPRINTED FORM

WAGES TO BE REPORTED

When reporting gross wages, enter the total amount of wages paid to each

1. Review each Social Security number and employee name for correct-

employee during the calendar quarter.

ness.

DO:

2. Enter the Social Security number and name of any unlisted employee to

– include wages paid in cash.

whom you paid wages during the quarter. Wages cannot be processed

– include as wages any medium other than cash, such as the cash equiva-

without a Social Security number.

lent of meals furnished on the employer’s premises or lodging provided

3. Enter a zero (0) for each employee who was not paid any wages during

by the employer as a condition of employment.

the quarter. This ensures that the employee will be included on future

– include commissions and bonuses, awards, and prizes.

reports. If your company has no wages for this quarter, you must still

– include vacation and holiday pay.

file this form, indicating zero wages for each employee (if any). If your

– include sick pay when it is paid to liquidate a worker’s balance at the

account was designated inactive during the quarter, do not file this

time of separation from employment.

report.

– include tips actually reported by the worker to the employer.

4. If the Social Security number or name is incorrect, or you wish to delete

– include the cash value of a cafeteria plan, if the employee has the

a name, place an “X” in the DELETE column. Do not enter wages on

option under the plan to choose cash.

that line. IF WAGES ARE REPORTED FOR THE QUARTER, THE

EMPLOYEE NAME CANNOT BE DELETED.

Refer to Section 44 of the MES Act for more information.

IF YOU USE OUR BLANK FORM

WAGES NOT TO BE REPORTED

At the top of each page, enter the numeric quarter ending date, e.g.,

Wage detail information must be provided for every covered employee to

06/30/08, the employer’s name and address, the Federal Identification

whom wages were paid during the calendar quarter.

Number (FEIN) and the 10-digit UIA Employer Account Number. This

DO NOT:

account number consists of an assigned seven (7) digit account number

– report wages that were earned but not actually paid during the

plus a three (3) digit multi-unit number. All 10 digits make up the UIA

calendar quarter.

Employer Account Number. The multi-unit number is three (3) zeros un-

– include sick pay paid under an employer plan on account of sickness.

less the UIA has approved multiple location reporting.

– include as wages such payments as severance pay.

Enter the SOCIAL SECURITY NUMBER, name and gross wages (dollars

– include profit-sharing.

and CENTS) paid for all employees. No other information should be

– include pre-tax contributions to a retirement plan.

entered on this form.

– include as wages discounts on purchases from the employer.

?

“F”

FAMILY OWNED

If “Yes”, enter

in this column

– include reimbursements to employees of expenses incurred on behalf of

the employer.

Does the worker, alone or in combination with his/her child or spouse,

– report wages of a worker whose services are excluded from coverage

own more than 50% of the shares of the business? If “Yes”, enter F. If

under Section 43 of the MES Act.

“No”, leave blank.

TO CORRECT PRIOR REPORTS

–OR–

Do the parent(s) of the worker who is under the age of 18 own more than

DO NOT use a Wage Detail Report (UIA 1017) to correct any errors or make

50% of the shares of the business? If “Yes”, enter F. If “No”, leave blank.

changes on a previously filed report. PLEASE SUBMIT an Amended

Wage Detail Report (UIA 1019). Report only the information/employees

For more information, see Sections 43(g), 46(g) and (h) of the MES Act.

that are to be corrected. Do not report negative amounts. To obtain Form

UIA 1019, contact the Wage Record Unit at 1-313-456-2760 (TTYcustomer

GROSS WAGES

use 1-866-366-0004) or visit our website at .

Report total gross wages earned in the calendar quarter for each employee.

Do not report wages that were earned but not actually paid during the

PENALTY INFORMATION

quarter. Do not report negative wages. Enter the Grand Total on the Last

Effective with the third quarter of 1995, any employer (or agent) failing to

Page Only. The total shown on the last page of this report should equal

submit, when due, any Wage Detal Report, required by Section 54(c)(2) of

the Gross Quarterly Wages reported on your Employer’s Quarterly Tax

the MES Act, is subject to a penalty of $25.00 for each untimely report.

Report (Form UIA 1020) for the same quarter. One exception: severance

pay should be included on the UIA 1020, but not on the Wage Detail

Report (Form UIA 1017).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1