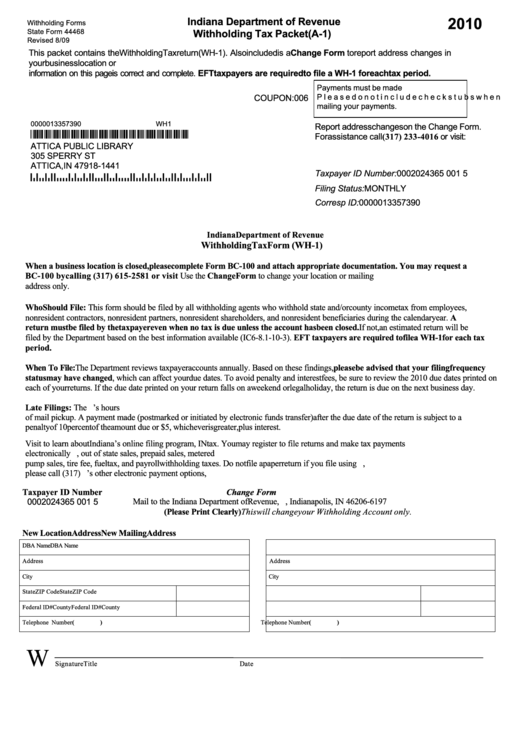

2010

Indiana Department of Revenue

W ithholding Forms

State Form 44468

Withholding Tax Packet (A-1)

Revised 8/09

This packet contains the Withholding Tax return (WH-1). Also included is a Change Form to report address changes in

your business location or mailing address. Your withholding tax return is due on the date printed on the form. Make sure the

information on this page is correct and complete. EFT taxpayers are required to file a WH-1 for each tax period.

Payments must be made with U.S. funds.

Please do not include check stubs when

COUPON:006

mailing your payments.

0000013357390

WH1

Report address changes on the Change Form.

*970000013357390*

For assistance call (317) 233-4016 or visit:

ATTICA PUBLIC LIBRARY

305 S PERRY ST

ATTICA,IN 47918-1441

/462278124374/

Taxpayer ID Number: 0002024365 001 5

Filing Status: MONTHLY

Corresp ID: 0000013357390

Indiana Department of Revenue

Withholding Tax Form (WH-1)

When a business location is closed, please complete Form BC-100 and attach appropriate documentation. You may request a

BC-100 by calling (317) 615-2581 or visit

Change Form

Who Should File:

A

return must be filed by the taxpayer even when no tax is due unless the account has been closed.

EFT taxpayers are required to file a WH-1 for each tax

period.

When To File:

please be advised that your filing frequency

status may have changed

Late Filings:

Taxpayer ID Number

Change Form

0002024365 001 5

(Please Print Clearly) This will change your Withholding Account only.

New Location Address

New Mailing Address

(

)

(

)

1

1 2

2 3

3