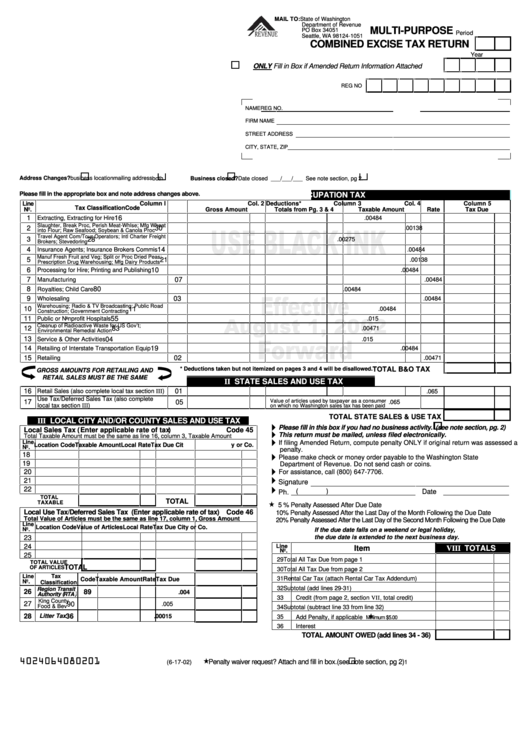

Multi-Purpose Combined Excise Tax Return Form - 2002

ADVERTISEMENT

MAIL TO: State of Washington

Department of Revenue

MULTI-PURPOSE

PO Box 34051

Period

Seattle, WA 98124-1051

COMBINED EXCISE TAX RETURN

Year

ONLY Fill in Box if Amended Return Information Attached

REG NO

NAME

REG NO.

FIRM NAME

STREET ADDRESS

CITY, STATE, ZIP

Address Changes?

business location

mailing address

both

Business closed?

Date closed ___/___/___ See note section, pg 2.

Please fill in the appropriate box and note address changes above.

I STATE BUSINESS AND OCCUPATION TAX

Line

Column I

Col. 2 Deductions*

Column 3

Col. 4

Column 5

Tax Classification

Code

No.

Gross Amount

Totals from Pg. 3 & 4

Taxable Amount

Rate

Tax Due

1

16

Extracting, Extracting for Hire

.00484

Slaughter, Break Proc, Perish Meat-Whlse; Mfg Wheat

2

30

.00138

into Flour; Raw Seafood; Soybean & Canola Proc

Travel Agent Com/Tour Operators; Intl Charter Freight

3

28

.00275

Brokers; Stevedoring

4

14

Insurance Agents; Insurance Brokers Commis

.00484

Manuf Fresh Fruit and Veg; Split or Proc Dried Peas;

5

21

.00138

Prescription Drug Warehousing; Mfg Dairy Products

6

Processing for Hire; Printing and Publishing

10

.00484

7

Manufacturing

07

.00484

8

80

Royalties; Child Care

.00484

9

03

Wholesaling

.00484

Warehousing; Radio & TV Broadcasting; Public Road

10

11

.00484

Construction; Government Contracting

11

Public or Nonprofit Hospitals

55

.015

Cleanup of Radioactive Waste for US Gov’t;

12

83

.00471

Environmental Remedial Action

13

04

Service & Other Activities

.015

14

19

Retailing of Interstate Transportation Equip

.00484

15

02

Retailing

.00471

* Deductions taken but not itemized on pages 3 and 4 will be disallowed.

TOTAL B&O TAX

GROSS AMOUNTS FOR RETAILING AND

RETAIL SALES MUST BE THE SAME

II STATE SALES AND USE TAX

16

01

Retail Sales (also complete local tax section III)

.065

Use Tax/Deferred Sales Tax (also complete

Value of articles used by taxpayer as a consumer

17

05

.065

local tax section III)

on which no Washington sales tax has been paid

TOTAL STATE SALES & USE TAX

III LOCAL CITY AND/OR COUNTY SALES AND USE TAX

Please fill in this box if you had no business activity.

(see note section, pg. 2)

Local Sales Tax (Enter applicable rate of tax)

Code 45

This return must be mailed, unless filed electronically.

Total Taxable Amount must be the same as line 16, column 3, Taxable Amount

Line

If filing Amended Return, compute penalty ONLY if original return was assessed a

Location Code

Taxable Amount

Local Rate

Tax Due City or Co.

No.

penalty.

18

Please make check or money order payable to the Washington State

19

Department of Revenue. Do not send cash or coins.

20

For assistance, call (800) 647-7706.

21

Signature

22

Ph. (

)

Date

TOTAL

TOTAL

TAXABLE

5 % Penalty Assessed After Due Date

Local Use Tax/Deferred Sales Tax (Enter applicable rate of tax) Code 46

10% Penalty Assessed After the Last Day of the Month Following the Due Date

Total Value of Articles must be the same as line 17, column 1, Gross Amount

20% Penalty Assessed After the Last Day of the Second Month Following the Due Date

Line

Location Code

Value of Articles

Local Rate Tax Due City or Co.

No.

If the due date falls on a weekend or legal holiday,

the due date is extended to the next business day.

23

24

Line

Item

VIII TOTALS

No.

25

29

Total All Tax Due from page 1

TOTAL VALUE

TOTAL

OF ARTICLES

30

Total All Tax Due from page 2

Tax

Line

Code

Taxable Amount

Rate

Tax Due

31

Rental Car Tax (attach Rental Car Tax Addendum)

No.

Classification

32

Subtotal (add lines 29-31)

Region Transit

26

89

.004

Authority (RTA)

33

Credit (from page 2, section VII, total credit)

King County

27

90

.005

Food & Bev

34

Subtotal (subtract line 33 from line 32)

28

Litter Tax

36

.00015

35

Add Penalty, if applicable

Minimum $5.00

36

Interest

TOTAL AMOUNT OWED (add lines 34 - 36)

Penalty waiver request? Attach and fill in box.

(see note section, pg 2)

(6-17-02)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5