PO BOX 942879

(916) 322-9669

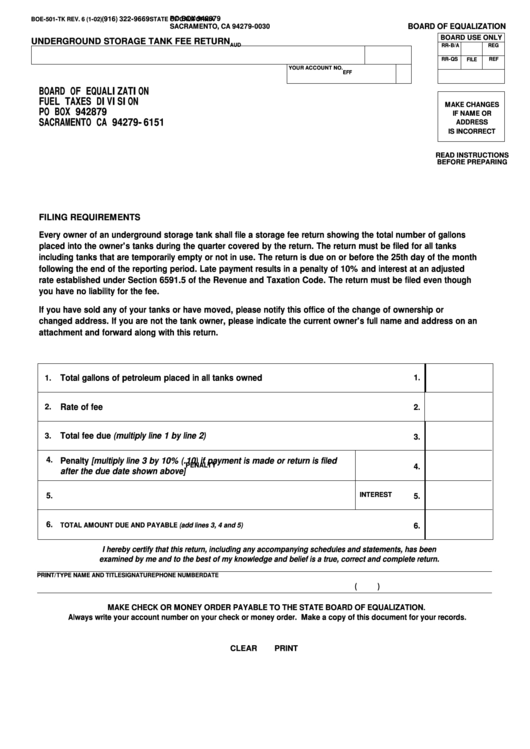

BOE-501-TK REV. 6 (1-02)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SACRAMENTO, CA 94279-0030

BOARD USE ONLY

UNDERGROUND STORAGE TANK FEE RETURN

RR-B/A

AUD

REG

RR-QS

REF

FILE

YOUR ACCOUNT NO.

EFF

BOARD OF EQUALIZATION

FUEL TAXES DIVISION

MAKE CHANGES

PO BOX 942879

IF NAME OR

ADDRESS

SACRAMENTO CA 94279-6151

IS INCORRECT

READ INSTRUCTIONS

BEFORE PREPARING

FILING REQUIREMENTS

Every owner of an underground storage tank shall file a storage fee return showing the total number of gallons

placed into the owner's tanks during the quarter covered by the return. The return must be filed for all tanks

including tanks that are temporarily empty or not in use. The return is due on or before the 25th day of the month

following the end of the reporting period. Late payment results in a penalty of 10% and interest at an adjusted

rate established under Section 6591.5 of the Revenue and Taxation Code. The return must be filed even though

you have no liability for the fee.

If you have sold any of your tanks or have moved, please notify this office of the change of ownership or

changed address. If you are not the tank owner, please indicate the current owner's full name and address on an

attachment and forward along with this return.

Total gallons of petroleum placed in all tanks owned

1.

1.

Rate of fee

2.

2.

Total fee due (multiply line 1 by line 2)

3.

3.

4.

Penalty [multiply line 3 by 10% (.10) if payment is made or return is filed

PENALTY

4.

after the due date shown above]

INTEREST

5.

5.

6.

TOTAL AMOUNT DUE AND PAYABLE (add lines 3, 4 and 5)

6.

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct and complete return.

PRINT/TYPE NAME AND TITLE

SIGNATURE

PHONE NUMBER

DATE

(

)

MAKE CHECK OR MONEY ORDER PAYABLE TO THE STATE BOARD OF EQUALIZATION.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1