Distributors Tobacco Products Tax Return - Maine Revenue Services

ADVERTISEMENT

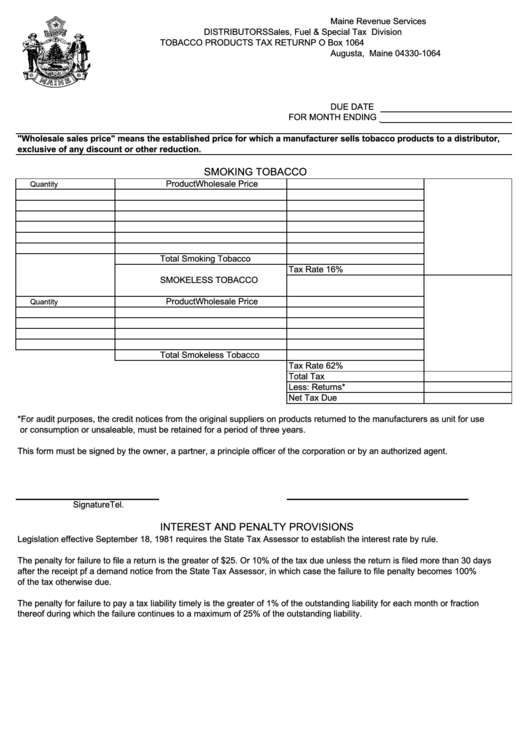

Maine Revenue Services

DISTRIBUTORS

Sales, Fuel & Special Tax Division

TOBACCO PRODUCTS TAX RETURN

P O Box 1064

Augusta, Maine 04330-1064

DUE DATE

FOR MONTH ENDING _

"Wholesale sales price" means the established price for which a manufacturer sells tobacco products to a distributor,

exclusive of any discount or other reduction.

SMOKING TOBACCO

Product

Wholesale Price

Quantity

Total Smoking Tobacco

Tax Rate 16%

SMOKELESS TOBACCO

Product

Wholesale Price

Quantity

Total Smokeless Tobacco

Tax Rate 62%

Total Tax

Less: Returns*

Net Tax Due

*For audit purposes, the credit notices from the original suppliers on products returned to the manufacturers as unit for use

or consumption or unsaleable, must be retained for a period of three years.

This form must be signed by the owner, a partner, a principle officer of the corporation or by an authorized agent.

Signature

Tel. No.

Title

INTEREST AND PENALTY PROVISIONS

Legislation effective September 18, 1981 requires the State Tax Assessor to establish the interest rate by rule.

The penalty for failure to file a return is the greater of $25. Or 10% of the tax due unless the return is filed more than 30 days

after the receipt pf a demand notice from the State Tax Assessor, in which case the failure to file penalty becomes 100%

of the tax otherwise due.

The penalty for failure to pay a tax liability timely is the greater of 1% of the outstanding liability for each month or fraction

thereof during which the failure continues to a maximum of 25% of the outstanding liability.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1