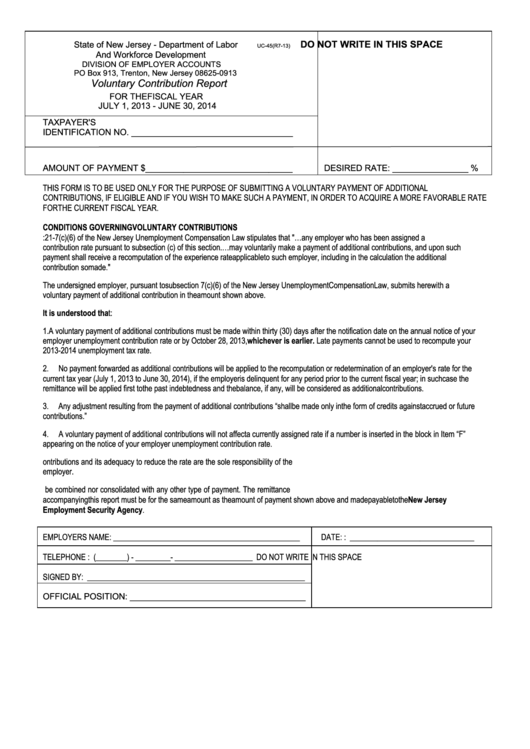

DO NOT WRITE IN THIS SPACE

State of New Jersey - Department of Labor

UC-45(R7-13)

And Workforce Development

DIVISION OF EMPLOYER ACCOUNTS

PO Box 913, Trenton, New Jersey 08625-0913

Voluntary Contribution Report

FOR THE FISCAL YEAR

JULY 1, 2013 - JUNE 30, 2014

TAXPAYER'S

IDENTIFICATION NO. __________________________________

AMOUNT OF PAYMENT $_______________________________

DESIRED RATE: ________________ %

THIS FORM IS TO BE USED ONLY FOR THE PURPOSE OF SUBMITTING A VOLUNTARY PAYMENT OF ADDITIONAL

CONTRIBUTIONS, IF ELIGIBLE AND IF YOU WISH TO MAKE SUCH A PAYMENT, IN ORDER TO ACQUIRE A MORE FAVORABLE RATE

FOR THE CURRENT FISCAL YEAR.

CONDITIONS GOVERNING VOLUNTARY CONTRIBUTIONS

R.S. 43:21-7(c)(6) of the New Jersey Unemployment Compensation Law stipulates that "…any employer who has been assigned a

contribution rate pursuant to subsection (c) of this section.…may voluntarily make a payment of additional contributions, and upon such

payment shall receive a recomputation of the experience rate applicable to such employer, including in the calculation the additional

contribution so made."

The undersigned employer, pursuant to subsection 7(c)(6) of the New Jersey Unemployment Compensation Law, submits herewith a

voluntary payment of additional contribution in the amount shown above.

It is understood that:

1.

A voluntary payment of additional contributions must be made within thirty (30) days after the notification date on the annual notice of your

employer unemployment contribution rate or by October 28, 2013, whichever is earlier. Late payments cannot be used to recompute your

2013-2014 unemployment tax rate.

2.

No payment forwarded as additional contributions will be applied to the recomputation or redetermination of an employer's rate for the

current tax year (July 1, 2013 to June 30, 2014), if the employer is delinquent for any period prior to the current fiscal year; in such case the

remittance will be applied first to the past indebtedness and the balance, if any, will be considered as additional contributions.

Any adjustment resulting from the payment of additional contributions “shall be made only in the form of credits against accrued or future

3.

contributions.”

4.

A voluntary payment of additional contributions will not affect a currently assigned rate if a number is inserted in the block in Item “F”

appearing on the notice of your employer unemployment contribution rate.

5.

The determinations of the above amount of additional contributions and its adequacy to reduce the rate are the sole responsibility of the

employer.

6.

Voluntary payments of additional contributions must not be combined nor consolidated with any other type of payment. The remittance

accompanying t his report must be for the same amount as the amount of payment shown above and made payable to the New Jersey

Employment Security Agency.

EMPLOYERS NAME: ________________________________________________

DATE: : ________________________________

TELEPHONE : (________) - _________- ____________________

DO NOT WRITE IN THIS SPACE

SIGNED BY: ________________________________________________________

OFFICIAL POSITION: _____________________________________

1

1