Form Qba - Application For Designation As A Qualified Business For The Ar Year Application For Designation As A Qualified Business For The Form Qba Q

ADVERTISEMENT

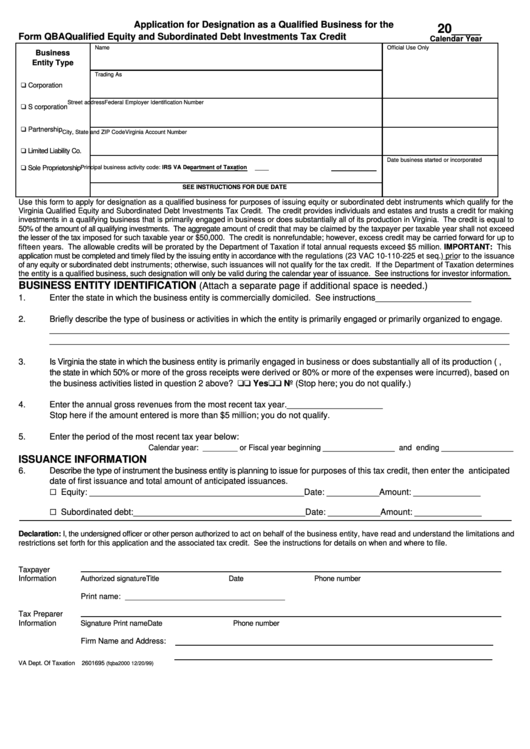

Application for Designation as a Qualified Business for the

20____

Form QBA

Qualified Equity and Subordinated Debt Investments Tax Credit

Calendar Year

Name

Official Use Only

Business

Entity Type

Trading As

“ Corporation

Street address

Federal Employer Identification Number

“ S corporation

“ Partnership

City, State and ZIP Code

Virginia Account Number

“ Limited Liability Co.

Date business started or incorporated

“ Sole Proprietorship

Principal business activity code: IRS

VA Department of Taxation

_

_____

SEE INSTRUCTIONS FOR DUE DATE

Use this form to apply for designation as a qualified business for purposes of issuing equity or subordinated debt instruments which qualify for the

Virginia Qualified Equity and Subordinated Debt Investments Tax Credit. The credit provides individuals and estates and trusts a credit for making

investments in a qualifying business that is primarily engaged in business or does substantially all of its production in Virginia. The credit is equal to

50% of the amount of all qualifying investments. The aggregate amount of credit that may be claimed by the taxpayer per taxable year shall not exceed

the lesser of the tax imposed for such taxable year or $50,000. The credit is nonrefundable; however, excess credit may be carried forward for up to

fifteen years. The allowable credits will be prorated by the Department of Taxation if total annual requests exceed $5 million. IMPORTANT: This

application must be completed and timely filed by the issuing entity in accordance with the regulations (23 VAC 10-110-225 et seq.) prior to the issuance

of any equity or subordinated debt instruments; otherwise, such issuances will not qualify for the tax credit. If the Department of Taxation determines

the entity is a qualified business, such designation will only be valid during the calendar year of issuance. See instructions for investor information.

BUSINESS ENTITY IDENTIFICATION

(Attach a separate page if additional space is needed.)

1.

Enter the state in which the business entity is commercially domiciled. See instructions . . . . . . . ____________________

2.

Briefly describe the type of business or activities in which the entity is primarily engaged or primarily organized to engage.

________________________________________________________________________________________________

________________________________________________________________________________________________

3.

Is Virginia the state in which the business entity is primarily engaged in business or does substantially all of its production (i.e.,

the state in which 50% or more of the gross receipts were derived or 80% or more of the expenses were incurred), based on

the business activities listed in question 2 above? . . . . . . . . . . . . . . . . . . . . . . “ “ Yes

“ “ No (Stop here; you do not qualify.)

4.

Enter the annual gross revenues from the most recent tax year. . . . . . . . . . . . . . . . . . . . . . . . . . . ____________________

Stop here if the amount entered is more than $5 million; you do not qualify.

5.

Enter the period of the most recent tax year below:

_______________

_______________

Calendar year: ________ or Fiscal year beginning

and ending

ISSUANCE INFORMATION

6.

Describe the type of instrument the business entity is planning to issue for purposes of this tax credit, then enter the anticipated

date of first issuance and total amount of anticipated issuances.

G Equity: _____________________________________________

Date: ___________

Amount: ______________

G Subordinated debt:____________________________________

Date: ___________

Amount: ______________

Declaration: I, the undersigned officer or other person authorized to act on behalf of the business entity, have read and understand the limitations and

restrictions set forth for this application and the associated tax credit. See the instructions for details on when and where to file.

Taxpayer

Information

Authorized signature

Title

Date

Phone number

Print name: ____________________________________

Tax Preparer

Information

Signature

Print name

Date

Phone number

Firm Name and Address:

VA Dept. Of Taxation

2601695

(fqba2000 12/20/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1