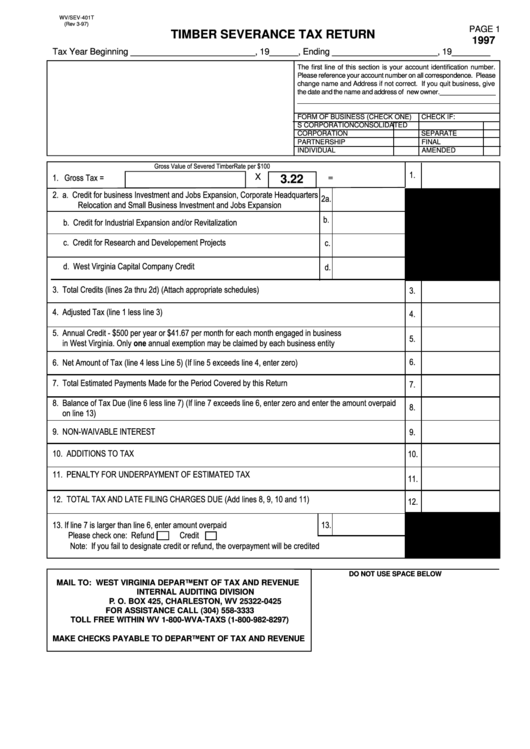

WV/SEV-401T

(Rev 3-97)

PAGE 1

TIMBER SEVERANCE TAX RETURN

1997

Tax Year Beginning __________________________, 19______, Ending ______________________, 19________

The first line of this section is your account identification number.

Please reference your account number on all correspondence. Please

change name and Address if not correct. If you quit business, give

the date and the name and address of new owner._______________

______________________________________________________

FORM OF BUSINESS (CHECK ONE)

CHECK IF:

S CORPORATION

CONSOLIDATED

CORPORATION

SEPARATE

PARTNERSHIP

FINAL

INDIVIDUAL

AMENDED

Gross Value of Severed Timber

Rate per $100

1.

1. Gross Tax =

X

=

3.22

2. a. Credit for business Investment and Jobs Expansion, Corporate Headquarters

2a.

Relocation and Small Business Investment and Jobs Expansion

b.

b. Credit for Industrial Expansion and/or Revitalization

c. Credit for Research and Developement Projects

c.

d. West Virginia Capital Company Credit

d.

3. Total Credits (lines 2a thru 2d) (Attach appropriate schedules)

3.

4. Adjusted Tax (line 1 less line 3)

4.

5. Annual Credit - $500 per year or $41.67 per month for each month engaged in business

5.

in West Virginia. Only one annual exemption may be claimed by each business entity

6.

6. Net Amount of Tax (line 4 less Line 5) (If line 5 exceeds line 4, enter zero)

7. Total Estimated Payments Made for the Period Covered by this Return

7.

8. Balance of Tax Due (line 6 less line 7) (If line 7 exceeds line 6, enter zero and enter the amount overpaid

8.

on line 13)

9. NON-WAIVABLE INTEREST

9.

10. ADDITIONS TO TAX

10.

11. PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

11.

12. TOTAL TAX AND LATE FILING CHARGES DUE (Add lines 8, 9, 10 and 11)

12.

13. If line 7 is larger than line 6, enter amount overpaid

13.

Please check one: Refund

Credit

Note: If you fail to designate credit or refund, the overpayment will be credited

DO NOT USE SPACE BELOW

MAIL TO: WEST VIRGINIA DEPARTMENT OF TAX AND REVENUE

INTERNAL AUDITING DIVISION

P. O. BOX 425, CHARLESTON, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333

TOLL FREE WITHIN WV 1-800-WVA-TAXS (1-800-982-8297)

MAKE CHECKS PAYABLE TO DEPARTMENT OF TAX AND REVENUE

1

1 2

2