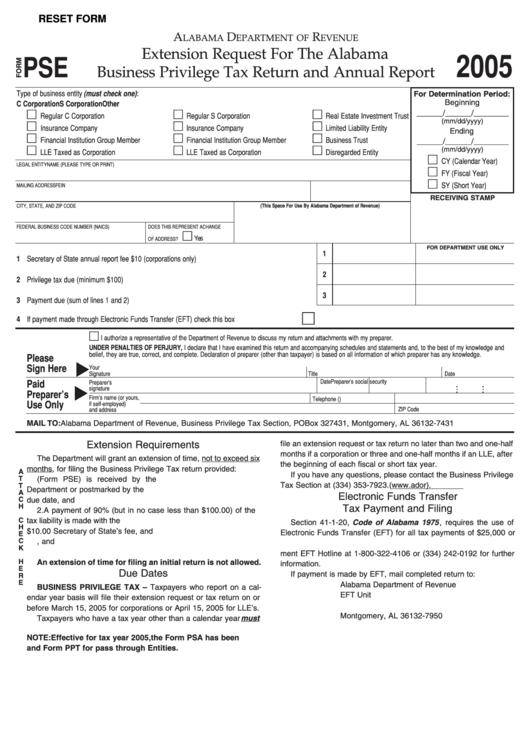

RESET FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Extension Request For The Alabama

2005

PSE

Business Privilege Tax Return and Annual Report

Type of business entity (must check one) :

For Determination Period:

Beginning

C Corporation

S Corporation

Other

______/______/________

Regular C Corporation

Regular S Corporation

Real Estate Investment Trust

(mm/dd/yyyy)

Insurance Company

Insurance Company

Limited Liability Entity

Ending

Financial Institution Group Member

Financial Institution Group Member

Business Trust

______/______/________

(mm/dd/yyyy)

LLE Taxed as Corporation

LLE Taxed as Corporation

Disregarded Entity

CY (Calendar Year)

LEGAL ENTITY NAME (PLEASE TYPE OR PRINT)

FY (Fiscal Year)

SY (Short Year)

MAILING ADDRESS

FEIN

RECEIVING STAMP

CITY, STATE, AND ZIP CODE

(This Space For Use By Alabama Department of Revenue)

FEDERAL BUSINESS CODE NUMBER (NAICS)

DOES THIS REPRESENT A CHANGE

Yes

OF ADDRESS?

FOR DEPARTMENT USE ONLY

1

1 Secretary of State annual report fee $10 (corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Privilege tax due (minimum $100). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Payment due (sum of lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 If payment made through Electronic Funds Transfer (EFT) check this box. . . . . . . . . . . . . . . . . . .

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

UNDER PENALTIES OF PERJURY, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign Here

Your

Signature

Title

Date

Date

Phone number

Preparer’s social security no.

Paid

Preparer’s

signature

Preparer’s

Firm’s name (or yours,

Telephone (

)

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

MAIL TO: Alabama Department of Revenue, Business Privilege Tax Section, PO Box 327431, Montgomery, AL 36132-7431

Extension Requirements

file an extension request or tax return no later than two and one-half

months if a corporation or three and one-half months if an LLE, after

The Department will grant an extension of time, not to exceed six

the beginning of each fiscal or short tax year.

months, for filing the Business Privilege Tax return provided:

A

If you have any questions, please contact the Business Privilege

T

1. The Extension Request (Form PSE) is received by the

Tax Section at (334) 353-7923. ( ).

T

Department or postmarked by the U.S. Post Office on or before the

A

Electronic Funds Transfer

C

due date, and

H

Tax Payment and Filing

2. A payment of 90% (but in no case less than $100.00) of the

C

tax liability is made with the request. Corporations must also pay the

Section 41-1-20, Code of Alabama 1975 , requires the use of

H

$10.00 Secretary of State’s fee, and

Electronic Funds Transfer (EFT) for all tax payments of $25,000 or

E

C

3. All sections of the Extension Request are completed, and

more. Taxpayers must register to use EFT. Call the Revenue Depart-

K

4. The Extension Request is signed.

ment EFT Hotline at 1-800-322-4106 or (334) 242-0192 for further

H

An extension of time for filing an initial return is not allowed.

information.

E

Due Dates

If payment is made by EFT, mail completed return to:

R

E

Alabama Department of Revenue

BUSINESS PRIVILEGE TAX – Taxpayers who report on a cal-

EFT Unit

endar year basis will file their extension request or tax return on or

P.O. Box 327950

before March 15, 2005 for corporations or April 15, 2005 for LLE’s.

Montgomery, AL 36132-7950

Taxpayers who have a tax year other than a calendar year must

NOTE: Effective for tax year 2005, the Form PSA has been discontinued. It has been replaced with Form CPT for C-corporations

and Form PPT for pass through Entities.

1

1