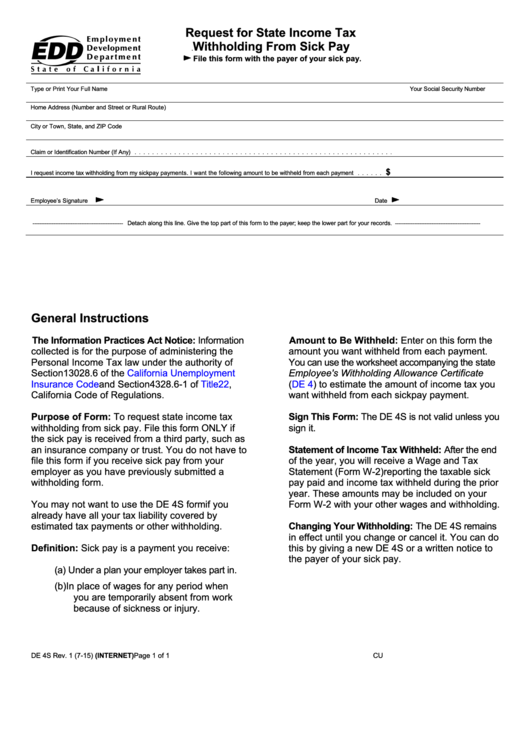

Request for State Income Tax

Withholding From Sick Pay

0B

File this form with the payer of your sick pay.

Type or Print Your Full Name

Your Social Security Number

Home Address (Number and Street or Rural Route)

City or Town, State, and ZIP Code

Claim or Identification Number (If Any)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

I request income tax withholding from my sick pay payments. I want the following amount to be withheld from each payment

. . . . . .

Employee’s Signature

Date

Detach along this line. Give the top part of this form to the payer; keep the lower part for your records

----------------------------------------------------

. -------------------------------------------------

General Instructions

The Information Practices Act Notice: Information

Amount to Be Withheld: Enter on this form the

collected is for the purpose of administering the

amount you want withheld from each payment.

Personal Income Tax law under the authority of

You can use the worksheet accompanying the state

Section 13028.6 of the

California Unemployment

Employee's Withholding Allowance Certificate

Insurance Code

and Section 4328.6-1 of

Title

22,

(DE

4) to estimate the amount of income tax you

California Code of Regulations.

want withheld from each sick pay payment.

Purpose of Form: To request state income tax

Sign This Form: The DE 4S is not valid unless you

withholding from sick pay. File this form ONLY if

sign it.

the sick pay is received from a third party, such as

an insurance company or trust. You do not have to

Statement of Income Tax Withheld: After the end

file this form if you receive sick pay from your

of the year, you will receive a Wage and Tax

employer as you have previously submitted a

Statement (Form W-2) reporting the taxable sick

withholding form.

pay paid and income tax withheld during the prior

year. These amounts may be included on your

You may not want to use the DE 4S form if you

Form W-2 with your other wages and withholding.

already have all your tax liability covered by

estimated tax payments or other withholding.

Changing Your Withholding: The DE 4S remains

in effect until you change or cancel it. You can do

Definition: Sick pay is a payment you receive:

this by giving a new DE 4S or a written notice to

the payer of your sick pay.

(a) Under a plan your employer takes part in.

(b) In place of wages for any period when

you are temporarily absent from work

because of sickness or injury.

DE 4S Rev. 1 (7-15) (INTERNET)

Page 1 of 1

CU

1

1