Instructions For Preparation Of Form Ui-28, Employer'S Claim For Adjustment / Refund

ADVERTISEMENT

INFORMATION AND GENERAL INSTRUCTIONS

INFORMATION AND GENERAL INSTRUCTIONS

An employer may file a claim for adjustment/refund not later than three years after the date upon which any contributions,

An employer may file a claim for adjustment/refund not later than three years after the date upon which any contributions,

interest or penalties were paid erroneously.

interest or penalties were paid erroneously.

A separate Form UI-28, Employer's Claim for Adjustment / Refund, must be submitted for each calendar year with respect

A separate Form UI-28, Employer's Claim for Adjustment / Refund, must be submitted for each calendar year with respect

to which a claim is filed. If you are adjusting individual worker's wages not previously corrected, you must complete Form

to which a claim is filed. If you are adjusting individual worker's wages not previously corrected, you must complete Form

UI-28B, Employer's Correction Report of Wages Paid to Workers, and submit it with Form UI-28.

All claims for adjustment/refund are subject to field investigation and audit at the discretion of the Director. Claims

involving contributions paid on overstated wages may affect an employer's contribution rate for any year with

respect to which such wages were included in the computation of the rate.

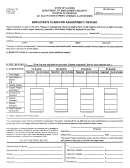

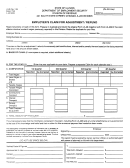

INSTRUCTIONS FOR PREPARATION OF

FORM UI-28, EMPLOYER'S CLAIM FOR ADJUSTMENT / REFUND

Enter your name and account number exactly as it appears on your contribution report. Enter your current address.

ITEM A.

BASIS OF CLAIM

Explain in detail the nature of the overpayment. State fully the facts which you believe entitle you to an

adjustment/refund. If more space is required, continue on your own letterhead, which will then become a part of

this claim. FAILURE TO GIVE COMPLETE INFORMATION WILL DELAY THE PROCESSING OF YOUR

CLAIM AND MAY RESULT IN A DENIAL.

ITEM B.

FOR THE YEAR _____________

Enter the year applicable to your claim.

ITEM C.

COMPUTATION

NOTE: If you are correcting the amount of total wages, wages in excess (See 2 below) or taxable wages originally

reported by you, be sure to complete EACH item under "COMPUTATION." However, if the SOLE basis of your claim is

an error in computing the amount of your quarterly contribution (such as an error in multiplication or the use of an

incorrect contribution rate), Item 1, 2, 3 and 4 need not to be filled in.

1. Total Wages - For each quarter involved, enter the amount of total wages as originally reported and the amount as

corrected. If you are correcting the amount of total wages reported, you must also prepare Form UI-28B, Employer's

Correction Report of Wages Previously Reported. The difference between the total wages reported and the total wages

as corrected on Form UI-28 must agree with the quarterly difference on Form UI-28B.

2. Less: Wages in Excess - For each quarter involved, enter the amount originally reported and the corrected amount of

excess wages. (For calendar year 2010, the taxable wages are the first $12,520 of wages paid to each worker for the

calendar year. For calendar year 2009, the taxable wages are the first $12,300 of wages paid to each worker for the

calendar year. For calendar year 2008, the taxable wages are the first $12,000 of wages paid to each worker for the

calendar year. For calendar year 2007, the taxable wages are the first $11,500 of wages paid to each worker for the

calendar year. For calendar year 2006, taxable wages are the first $11,000 of wages paid to each worker for the calendar

year. For calendar year 2005, the tax does not apply to wages in excess of $10,500 paid to a worker by an employer in

the calendar year. For calendar year 2004, the tax does not apply to wages in excess of $9,800 paid to a worker by an

employer in a calendar year. If you are correcting the amount of taxable wages reported, you must also complete Form

UI-28B for each revised quarter and any preceding quarter within the same calendar year.

3. Taxable Wages - For each quarter involved, enter the amount of taxable wages as originally reported and the

amount as corrected. If you are correcting the amount of taxable wages reported, you must also prepare Form

UI-28B,Employer's Correction Report of Wages Previously Reported.

4. Taxable Wages Overstated - Enter the amount of taxable wages overstated for each quarter.

5. Contribution Overpaid

}

6. Interest Overpaid

Enter the amount of contributions, interest and penalty overpaid for each quarter

7. Penalty Overpaid

8. Total Overpaid (by Quarter) - For each quarter, enter the total of 5, 6, and 7.

9. Total Amount of This Claim - Enter the total amount of claim for the calendar year. Amount shown in this item must

equal the sum of the quarterly totals on line 8.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1